This was a fun M&A update with Andrew Dittmar, Director, Enverus. You have heard the old phrase: “Friends don let friends make decisions without data”. I have added on the phrase “If you need data in the energy market talk to Enverus.” Last year there was 66 billion in M&A activity, with 9 billion of that in Q4. Andrew has a real grip on the market and is a true resource for Enverus.

It will be fun to have Andrew back next quarter, and even see if my prediction of $120 oil has come to pass by then. In the meantime enjoy listening to an expert. (him not me).

Please connect with Andrew on his LinkedIn Here

The following is an automatic transcription, and we disavow any errors unless they make us seem funnier or smarter.

Stu Turley, CEO, Sandstone Group [00:00:04] Hello, everybody, today, welcome to the Energy News podcast, and we got a fun schedule today. Today is Andrew Dettmer and I’ll tell you, Andrew, this is about our fourth I think podcast together, and I just am so appreciative of everything that you do over it and various, and thank you for stopping by today.

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Stuart Turley: [00:00:03] Hello, everybody. Today, welcome to the Energy News Beat Podcast and we’ve got a really fun schedule today. [00:00:11][7.0]

Stuart Turley: [00:00:11] Today is Andrew Marr. And I’ll tell you, Andrew, this is about our fourth I think podcast together and I just am so appreciative of everything that you do over it and Enverus and thank you for stopping by today. [00:00:25][13.1]

Andrew DIttmar: [00:00:26] Yeah, no, absolutely. We’ve been able to keep this going for as long as we have and always look forward to this a lot of my favorite talks we do after this report goes out. [00:00:34][8.6]

Stuart Turley: [00:00:35] Oh, I’ll tell you, you know, what’s kind of fun is it looks like you just got up there promoted to director. So congratulations. I think that’s very good. It means that somebody is actually paying attention to your good work. So, you know. [00:00:50][14.9]

Andrew DIttmar: [00:00:51] I always wonder, as an analyst, you know, you send out your notes and you hope somebody is looking. He says, Oh. [00:00:55][3.9]

Stuart Turley: [00:00:56] Absolutely. And for those that don’t understand and Enverus means data, you just want to give us a real brief idea of what Enverus is. [00:01:05][9.1]

Andrew DIttmar: [00:01:06] Sure. So, yeah, we’re a data focused oil and gas, I guess, technology company and provide a really broad range of tech driven solutions to various issues in oil and gas, anything from accounts and payroll management to what I do, which is more analysis of the business side,. [00:01:24][18.3]

Andrew DIttmar: [00:01:25] A focus on geology, well results, stock performance, and then my particular area of expertise, mergers and acquisitions we put out reports to go to clients as well as providing databases that people can use to access their information. [00:01:39][13.3]

Stuart Turley: [00:01:40] And so one of the things that we’re talking about today is you guys put out a really cool quarterly report and I mean, there is speaking of data, holy smokes, I was doing through it and it’s like lots of data in here. [00:01:56][15.4]

Stuart Turley: [00:01:56] And when you take a look, it looks like you guys came up with in Q4, we had $9 billion in M&A and for the year was 6 billion. Can you talk a little bit about where those numbers come from? [00:02:12][15.3]

Andrew DIttmar: [00:02:13] Sure. So, yeah, transaction about 9 billion in Q4, which brought our total to I think about 66 billion for the year. [00:02:20][6.8]

Stuart Turley: [00:02:21] Right. [00:02:21][0.0]

Andrew DIttmar: [00:02:21] So we’re up about 25% year over year versus what we did in 2020, which was the first year of our COVID influence market. But we’re still off of the average that we had from 2015 to 2019, which was running about 72 billion. [00:02:33][11.5]

Andrew DIttmar: [00:02:34] And we had a lot of big deals. So it feels like an extremely busy M&A market, but activity is variable. You know, just within 2021, we went, I think from a high of 34 billion in Q2 down to about 18 billion in Q3, and then they go into Q4. So that halved activity each quarter. [00:02:51][17.5]

Stuart Turley: [00:02:52] Yeah. [00:02:52][0.0]

Andrew DIttmar: [00:02:53] So I’m sure we’ll get into this more in the talk but basically what we’ve seen is the selection of large multibillion dollar deals and I think the number of billion plus dollar deals transacted is pretty much back to its pre-COVID average. [00:03:05][12.3]

Andrew DIttmar: [00:03:06] I haven’t seen the sort of bread and butter, say 100 to 500 million EMV type market that we had before COVID so that’s maybe adding a little bit of variability to the M&A market and keeping the number of total deals transacted the total value down a bit, even though when you read the headlines and you see the amount that oil and gas is brought up in sort of the broader media, if you like, in this exceedingly busy, busy environment. [00:03:29][22.2]

Stuart Turley: [00:03:30] When we talk about the five biggest deals you get at nine outlined on Nice, you got Continental, Southwestern Energy, Earth, stone polymer and diversified and taps down Goodrich, Goodrich, good people over there. [00:03:46][15.8]

Stuart Turley: [00:03:47] So you want to go through just some of the bigger deals and it looks like the Haynesville, Delaware, and those were the really big ones in there you know, so tell us a little bit about the big boys in all of these and also the plays, because, you know, the Haynesville is big natural gas. So we got about 19 questions for you in there. [00:04:09][21.6]

Andrew DIttmar: [00:04:10] Yeah, Delaware in Haynesville is definitely where the activity was both in Q4 and really throughout 2021. And so you can see those plays, each representing one commodity. I think Delaware has been your go to spot for oil deals and Haynesville obviously, like you said, the gas place. What’s been your go to spot for gas deals? [00:04:25][15.1]

Andrew DIttmar: [00:04:27] And I think that speaks to public companies really wanting to go out and add some inventory. They’re generating great cash flow right now, and that’s being reflected in their stock prices. It’s strange on a day like today for an energy analyst that this for a few years to see energy in the green and the rest of the market red has been I felt like my entire career watching that in the other direction. [00:04:44][17.5]

Andrew DIttmar: [00:04:46] But so they’re doing great. I mean, generating cash flow. But we were still somewhat in agreement. And I’m. [00:04:51][4.8]

Stuart Turley: [00:04:52] Sorry, I’m not ignoring you. I’m just looking that oil’s at 84, 78 and net gas is that 430 And Brant looks like it’s at 8425. Wow. Is WTI over Brant? [00:05:11][19.6]

Andrew DIttmar: [00:05:13] I haven’t looked today. [00:05:14][0.7]

Stuart Turley: [00:05:15] Oh, yeah, that’s weird. Anyway, I’m probably cross-eyed and looking at it wrong, but. [00:05:19][4.6]

Andrew DIttmar: [00:05:21] I do the same thing. I get the chance to get my eyes checked and the numbers that it felt like we weren’t ever going to see again we all remember the sell off in 2014 hitting me on the way down and no big deal. We’ll be back here someday. And then years. Like what? We’re never going to get back there. [00:05:36][14.9]

Andrew DIttmar: [00:05:37] So it’s been a good time to be an Energy Companies they’re doing well and they want to keep keep the good times rolling. And that’s going to require having plenty of high quality inventory. [00:05:45][8.0]

Stuart Turley: [00:05:46] Right. [00:05:46][0.0]

Andrew DIttmar: [00:05:46] Where the question marks for the industry in shale is, okay, we’re doing great by drilling our best locations. How many of these locations do we have and can we sustain this for the next 5 to 10 years? [00:05:55][9.1]

Stuart Turley: [00:05:56] Right. [00:05:56][0.0]

Andrew DIttmar: [00:05:57] The companies that’s no problem if you’re a pioneer, Diamondback, one of the guys that’s big in the Permian, you have lots of tier one stuff. You’ve got 20 years of inventory or more companies and other players don’t have that luxury and so Continental would be one example of that they’re big in the Bakken, which is great play fantastic rock,. [00:06:15][17.5]

Stuart Turley: [00:06:15] Right? [00:06:15][0.0]

Andrew DIttmar: [00:06:16] Doesn’t have this the inventory stack that the Permian say would and it’s been drilled really heavily for the last ten years in some of these core locations were have companies. [00:06:24][7.8]

Stuart Turley: [00:06:25] Right. [00:06:25][0.0]

Andrew DIttmar: [00:06:26] Those lean years that we had in 2015, 2016, 27th as you go out and hike core and drill your best locations,. [00:06:31][5.4]

Stuart Turley: [00:06:32] Right,. [00:06:32][0.0]

Andrew DIttmar: [00:06:33] That’s a finite resource and as you work through that, you need to go out and look at, okay, what are some other areas we can add back in Eagle Ford doesn’t have the resource stack a little more mature drilled up. [00:06:44][10.2]

Andrew DIttmar: [00:06:44] Midland is great rock, but people don’t want to part with it,. [00:06:47][2.5]

Stuart Turley: [00:06:47] Right [00:06:47][0.0]

Andrew DIttmar: [00:06:48] That by a few big public and private companies and so you go, okay, we’re in high quality locations available on the oil side of the Delaware is a big answer to that. [00:06:57][9.0]

Stuart Turley: [00:06:58] Yep. [00:06:58][0.0]

Andrew DIttmar: [00:06:59] That’s where you see companies like Continental that wasn’t previously in the Basin want to go out and find a position, a find a position of scale, and that’s what they were able to do with the Pioneer Deal. [00:07:08][9.1]

Andrew DIttmar: [00:07:09] Pioneers, one of those companies and the other campus inventory rich. So they acquired these Delaware assets in their purchase of parsley back in late 2020. [00:07:17][7.8]

Stuart Turley: [00:07:18] Yep. [00:07:18][0.0]

Andrew DIttmar: [00:07:18] Good assets stack up great. And the overall North American resource stack, but maybe not competitive with the best of the best the Pioneer is sitting on in the Midland. [00:07:26][7.6]

Stuart Turley: [00:07:27] Right? [00:07:27][0.0]

Andrew DIttmar: [00:07:27] They were interested in monetizing but look really good if you’re a continental and looking to go out and build that inventory runway. So that was our headliner from Q4. And a pretty natural follow on whenever you see a big wave of corporate consolidation like we had, you expect there’s going to be some follow on non-core assets sales as companies sort of dig through these portfolios and figure out what they don’t need anymore or what they’ve newly acquired that they don’t particularly want and so Continental obviously took advantage of that to move in. And,. [00:07:55][27.4]

Andrew DIttmar: [00:07:56] You know, Southern Delaware maybe is a little more challenging in the northern part of the basin but again, still great Rock Continental is a great operator. It’s done really good things, good engineering team and so it’ll be exciting to see what they can do with this asset. Boom. [00:08:08][12.1]

Stuart Turley: [00:08:09] And so when you talk about free cash flow and you talk about it, so it’s easier for the oil companies to come in and say, we’re going to buy these assets because they’re either already producing. [00:08:21][11.3]

Stuart Turley: [00:08:22] And it’s not going to just be coming in and they can then drill the offset wells in and all of those kind of things. So it makes it easier for the investors to say, yeah, go ahead. You know, they’re not going to get penalized anymore like they did before, right? [00:08:36][14.4]

Andrew DIttmar: [00:08:37] Sure. Yeah. No, we got a lot of questions floating around that we’re missing out on but to tackle what you’re talking about there,. [00:08:42][5.2]

Andrew DIttmar: [00:08:43] One of the things that makes buying attractive is the prices are still pretty reasonable and I think that’s being driven by exactly what you said. [00:08:48][5.5]

Andrew DIttmar: [00:08:50] These deals need to be accretive on free cash flow they need to be producing and the old days of running out and buying three wells and a big chunk of land with great plans for the future and paying cash where they never even saw 20, 30, 40,000 acre in the Permian a few years back and pretty much. [00:09:04][14.3]

Andrew DIttmar: [00:09:06] So on deals like the Continental Pioneer you know, I think after running our numbers and doing the math, we saw that somewhere around 10,000 acres, maybe 800,000 per location. [00:09:14][8.5]

Andrew DIttmar: [00:09:15] So still pretty modest pricing relative to our to what you saw a few years back and a big PDP component on that and so when you look at what these are trading at on a cash flow multiple, they’re mostly trading around, you know, say 3.5 times cash flow under four even for assets that have quite a bit of inventory. [00:09:36][20.7]

Andrew DIttmar: [00:09:37] So that’s necessary, I think, to get that investor support that you need to show that, hey, these are going to be out of the gate, we’re going to build our will, our cash flow base and at the same time, that’s an inventory that’s going to be helpful down the road. [00:09:50][13.4]

Stuart Turley: [00:09:52] Also, you know, we always talk about how good the Marcellus is up there, and it didn’t seem like there was a lot of activity in the Marcellus this time. [00:10:00][8.2]

Stuart Turley: [00:10:02] Can you tell us a little bit of what’s going on up over there or why it wasn’t any hit on what you think? [00:10:08][6.0]

Andrew DIttmar: [00:10:09] Sure. So a couple of different issues going on in the Marcellus and one that affects the M&A market but is it primarily an M&A issue? Is the takeaway capacity in the play that’s been a big issue in the industry that. [00:10:22][13.1]

Andrew DIttmar: [00:10:23] As you look to grow volumes, the pipe isn’t really there to get it to market and you’re dealing with pretty unfriendly, I guess might be too strong of a word. Political regimes in the states that you need across the building anywhere, it’s particularly difficult. [00:10:40][17.7]

Andrew DIttmar: [00:10:41] And if you’re looking at building in New York versus Texas and Louisiana or Oklahoma, not that those are the only states with anti-pipeline, right in the small town that drive taking advantage of the remote work situation to be in there in a pipeline not too far away from town and there was a bunch of stuff, the pipeline signs around. [00:10:58][17.3]

Andrew DIttmar: [00:11:00] The pipelines in the ground, some of the stuff, the pipeline signs are still up, but so not not unique to the Marcellus, but definitely more difficult to get infrastructure in the Northeast versus some of the other place. [00:11:10][9.7]

Stuart Turley: [00:11:11] I got tickled when I saw a Bloomberg article the other day and they said that they are importing LNG from the Arctic, from Russia instead of just going from a day, you know, from the Marcellus and putting a pipeline in, it’d be a cheaper and why are we giving Putin any money? I don’t know. I just think I got kind of tickled at that one. [00:11:36][25.3]

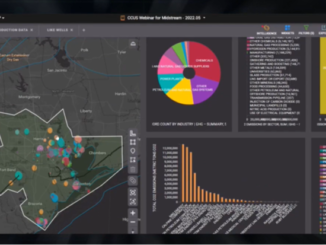

Stuart Turley: [00:11:38] So when you take a look at this on your team and you I’m sorry, I just you have so much in here. One of the charts that I found that was very interesting on this was the production versus acreage in value allocations. [00:11:56][18.5]

Stuart Turley: [00:11:57] So if you I mean, so we’re going to take a look at this chart, as we put it, into the the area. What does that mean? I mean, as you sit there and say production versus acreage versus allocations, does it make sense? [00:12:12][14.5]

Andrew DIttmar: [00:12:13] Yeah, sure. So anytime in Enverus has a deal come up, the primary responsibility for myself and my team is to figure out, okay, what’s the split in value in these assets? What are they paying for the existing wells or production and where are they paying for the upside if it’s there either expressed in terms of dollar per acre. [00:12:30][17.6]

Andrew DIttmar: [00:12:31] What we like to run now is actually dollar per location quite a bit. [00:12:33][2.2]

Stuart Turley: [00:12:34] Okay,. [00:12:34][0.0]

Andrew DIttmar: [00:12:35] You’re a little bit clearer picture what they’re actually acquiring. And so that chart is just taking all these individual deals that we’ve analyzed over the course of the quarter or the year and then summing up, okay, here’s how much cumulatively buyers spend on existing wells or production PDP value versus what they paid for upside. [00:12:52][17.4]

Andrew DIttmar: [00:12:54] And so that gets back, I think, to what we were just talking about a couple of minutes ago, where we still see most of the value flowing in to the production or PDP side of these assets because investors want these to be accretive out of the gate because they’re keeping a lid on acreage crisis. [00:13:07][13.6]

Stuart Turley: [00:13:09] Yep. [00:13:09][0.0]

Andrew DIttmar: [00:13:10] You still see that being being the largest component of value and I believe it’s about 70% of value to PDP for this quarter. You’ll see a pretty, pretty broad jumps from quarter to quarter you know, in Q2, I think we saw a little bit more flat acreage, which is just the nature of the deals that were lots of private equity exits in there and they were getting paid a little bit more upside. [00:13:28][18.2]

Andrew DIttmar: [00:13:29] But overall definitely have not reverted, say, maybe a 5050 type split that we would have seen back in the in the pre-COVID sort of go go man buying years, 2016, 2017, 2018. [00:13:41][11.3]

Stuart Turley: [00:13:42] Right. But also when we sit back and think the number of pads, you know, proven but undeveloped, those have really gone down as everybody’s been kind of taking those out. [00:13:54][12.4]

Stuart Turley: [00:13:55] So drilling going to go up in in pricings as we get rid of those silly, you know, the the ones that were just kind of sitting there so our our drilling is going to go up. [00:14:05][10.9]

Stuart Turley: [00:14:07] But with this on the PDP, it’s actually very well proven turf you know, when you’re sitting there drilling a PDP, it’s really I mean, they’ve already got other ones working there, right? So, I mean, it’s it’s the investors are not it’s not wildcat it. [00:14:25][18.8]

Andrew DIttmar: [00:14:27] No. Yeah. These. These are fairly well-established fields. Which is why you have people like Mike Shale so much and sometimes. We got frustrated by Shell’s inability to generate free cash flow and you want to look back at conventional the Gulf of Mexico, and then you go out and you drill a $333 million dry home. [00:14:49][22.0]

Andrew DIttmar: [00:14:50] The shale fields are actually pretty nice you’re pretty consistent on what you’re going to get. So, yeah, I mean, the big questions now are more around spacing, completion design. [00:14:59][9.4]

Andrew DIttmar: [00:15:00] You know, the wells are going to be productive. It’s just a matter of how do you maximize the economics relative to the cost of the well and the exploratory phase and shale, like you said, is really done. I mean, I don’t think there’s any big undiscovered shale fields out there. [00:15:13][13.1]

Andrew DIttmar: [00:15:14] You know, you revisit some of the other intervals and some of the existing fields, sometimes successfully, sometimes not. You know, I think Austin Chalk in the Eagle Ford has been one of the more successful redevelopments or returns here lately we’ve seen some strong well results sort of up and down the trend. [00:15:28][14.4]

Andrew DIttmar: [00:15:30] Obviously in the Permian there’s there’s a great resource stack there and you see people simply doing well in the Wolfcamp beach we go drill the Wolfcamp AB or at least track that but yeah,. [00:15:40][10.9]

Andrew DIttmar: [00:15:41] There’s not really not really much in the way of Wildcat we’re not going to go out and find a new shell. People are really not even going to stay expand the productive margins of the existing shale fields too much. I don’t think. You know, that was a big thing again a few years ago and private equity sort of led the charge on,. [00:15:54][13.3]

Andrew DIttmar: [00:15:54] Okay, the well results are good on this pasture can we move one ranch over at least some acreage and drill a well? Let’s see how it is. I think we’ve pretty much figured out where it dies off, at least at the prices that we’re likely to see right now. [00:16:07][13.1]

Stuart Turley: [00:16:08] Do you see the P firms getting more involved or do you see them going more public? [00:16:13][5.6]

Stuart Turley: [00:16:14] I mean, because you do have some good information in here and then even the IPO later on. So where do you see this is going? P getting bigger publics doing more. [00:16:25][11.5]

Stuart Turley: [00:16:26] I mean, you’re on a tough Wenatchee here because the crystal, the you know, the Andrew Crystal ball is going to be a little tough here for you on that one. [00:16:33][7.0]

Andrew DIttmar: [00:16:34] Yeah yeah it’s always fun to try to read the tea leaves on this and what’s going to happen. [00:16:38][4.6]

Andrew DIttmar: [00:16:40] In private equity you know there’s there’s so great about disclosure. It’s just really that really a clear industry that we have all the information we could possibly want to own. So it’s it’s really hard to know which ones guys are active to. [00:16:49][9.0]

Andrew DIttmar: [00:16:50] One of the key parts of their business is being secretive and they’re sometimes a bit paranoid they don’t want to let their competitors know what they’re up to. [00:16:56][6.4]

Andrew DIttmar: [00:16:56] So we generally know when they sell because it goes to a public company and obviously with a public company you get great disclosures and so PE sales are relatively easy to track and we’ve seen a lot of those this year that’s been a primary driver of activity. [00:17:08][11.8]

Stuart Turley: [00:17:09] Right [00:17:09][0.0]

Andrew DIttmar: [00:17:10] A lot of investments that have been outstanding for, say, 3 to 5 years, which is sort of the timeframe that these firms generally commit to on a capital deployment. [00:17:17][7.5]

Stuart Turley: [00:17:18] Right. [00:17:18][0.0]

Andrew DIttmar: [00:17:19] I think some of them were getting slightly concerned about how easy it was going to be to unwind some of these investments and then sort of public buyers step back in an active market and they were able to able to monetize some of those. [00:17:31][11.5]

Andrew DIttmar: [00:17:32] I think the willingness of PE firms themselves to take equity, also facilitating that deal market quite a bit. In prior years we’d seen mostly cash paid to PE sellers, but this year we saw a pretty high willingness on these bigger deals, especially early in the year, to take equity, which ended up being a great decision for them some of them were able to sell their assets at them. [00:17:49][17.2]

Andrew DIttmar: [00:17:49] A pretty nice headline price and then you look at how the stock of the buyer performed in the next six months and added another 30, 40, 50% to the deal value because the equity they took went up in value. So that worked out well. [00:18:00][10.8]

Andrew DIttmar: [00:18:03] Net seller. But that doesn’t mean that they’re leaving the industry, you know, they’re coming back in as well. We’ve seen some the deal you call that near the start and Paloma picking up Goodrich was one of the bigger entries we saw, which was really interesting. [00:18:17][14.1]

Andrew DIttmar: [00:18:18] Because the Haynesville otherwise has been pretty well dominated by this private to public shift site, indigo exit, GEP, Haynesville, Buy and Sell, which sold as a public company, but it only been public for about six weeks. Blackstone still owned most of the stocks we’ll call that acquisitive exit. [00:18:33][15.7]

Andrew DIttmar: [00:18:35] But Paloma and get back company with the other direction and bought in took out Goodrich which didn’t really have the scale to be competitive was sort of treading water in the public markets so. [00:18:44][9.3]

Stuart Turley: [00:18:45] Right. [00:18:45][0.0]

Andrew DIttmar: [00:18:46] And then interestingly the team that bought them from in CAP is a pretty traditional, I guess, P.E Style team or they tend to buy an asset, enhance it, improve it and then look to sell it down the road. [00:18:57][11.3]

Andrew DIttmar: [00:18:58] So you’re seeing some PE firms recently shift more towards this distribution model versus the sale model where we’re not going to rely on a liquidation event to get money back to our sponsors we’re going to go out and buy a PDP heavy cash flowing asset. [00:19:11][13.1]

Andrew DIttmar: [00:19:12] And we’re not as concerned about the sale as how much revenue we can generate and then we’re going to get that back to our LPs in the form of distributions. [00:19:19][7.2]

Stuart Turley: [00:19:20] Right? [00:19:20][0.0]

Andrew DIttmar: [00:19:21] But this Haynesville investment looks a little bit more old school in terms of going out and buying an asset and emerging we’ll look to flip that back into the public markets at some point in the next five, five years or so,. [00:19:31][10.1]

Andrew DIttmar: [00:19:32] If they are definitely still active in the space some plays that aren’t as attractive to public companies, plays like back in the Eagle Ford legacy areas that I think are where they’re going to be shopping they’re always looking for value in the market where there may be a little mismatch in pricing. [00:19:47][15.8]

Stuart Turley: [00:19:48] Right. [00:19:48][0.0]

Andrew DIttmar: [00:19:50] I think the challenge for private equity firms at this point not to steer the conversation too far out of the core, but it’s probably more around fundraising. If you’ve got a lot of dry powder already sitting there in the firms, I think it has quite a bit. You’re in good shape and there’s some opportunities to deploy that. [00:20:07][16.9]

Andrew DIttmar: [00:20:07] If you’re going out and looking to raise new funds. It’s not impossible, but it’s more challenging than it has been in prior years, both because of a combination of oil and gas sort of getting a bit of a stigma around the returns it was able to generate in prior years,. [00:20:21][13.5]

Andrew DIttmar: [00:20:21] Which we’ve been able to fix, and then sort of, I guess, social distaste in oil and gas investments, which we’re working on fixing by being more responsible in addressing these issues and showing how energy can be a be a key and is a key part of. Energy. Really, that’s the key part of the energy stack going forward. [00:20:41][20.1]

Stuart Turley: [00:20:42] It’s kind of you’ve kind of entered into my next questions here and I’m the. [00:20:47][5.1]

Stuart Turley: [00:20:48] The thing I got really tickled with is the CLP 26 they actually announced, you know, the the thing in Europe and they said, Oh, by the way, natural gas is now renewable. You know, they’re kind of doing the all switch of the roo here. [00:21:03][15.0]

Stuart Turley: [00:21:04] And then with the Biden administration, with the infrastructure bill, they now said natural gas is renewable because they can’t get to renewable, you know, carbon net zero without natural gas. [00:21:17][12.9]

Stuart Turley: [00:21:17] So ESG, you know, how cool is that that natural gas is now considered, you know, renewable and in ESG, they’ll figure this out,. [00:21:26][8.5]

Andrew DIttmar: [00:21:27] Right. [00:21:27][0.0]

Stuart Turley: [00:21:28] In your deal buy commodity in this chart here, this report is fabulous everybody needs to go to the in Enverus site register and get the get the report. Not that you know I’m not going to give in various another plug, but holy smokes, they’re great, great data and everything else. [00:21:46][17.6]

Stuart Turley: [00:21:48] You’re seeing gas versus oil and gas. Which kind are you seeing? The deal value buying commodity even though you may get a lot of gas, you know, oil with a higher price seems to be getting a better price on that but natural gas is now greener, you know, So go,. [00:22:07][19.2]

Andrew DIttmar: [00:22:07] Right? [00:22:07][0.0]

Stuart Turley: [00:22:08] Yeah, go figure that one out. Which one do you think is coming around the corner For more, What’s available? Do you think that the the market is going to bear oil or gas on the M&A type stuff. [00:22:19][11.2]

Andrew DIttmar: [00:22:20] Or, you know, we see both, obviously. Traditionally, U.S. M&A markets are going to have a higher deal value percentage in oil. [00:22:28][7.3]

Stuart Turley: [00:22:29] Right. [00:22:29][0.0]

Andrew DIttmar: [00:22:29] More oil plays a bigger for the U.S. independents, which are the ones who do most of the wheeling and dealing here. Oil is still a primary focus and there are plenty gas companies out there. [00:22:39][10.4]

Andrew DIttmar: [00:22:40] And if you like Totara, which is the combination of Cimarex and Cabot, which actually like what they did that they hated. Sometimes one commodity is going to outperform the other we don’t think it makes sense to be purely gas or purely oil and gas company and great oil company Marry them together and we can allocate capital wherever it makes the most sense. [00:22:59][19.0]

Andrew DIttmar: [00:23:00] Mercury is a little bit cool to that one when it first got announced, but they were able to close it and I think it makes reasonable sense from a business perspective. So just, yeah, the focus of U.S. independence,. [00:23:10][10.1]

Andrew DIttmar: [00:23:11] The level of oil plays and scale that are out there relative to gas, oil generally predominates on the commodity mix. [00:23:18][7.1]

Andrew DIttmar: [00:23:19] I was actually a little bit surprised we didn’t see more gas deals in 2021, just given how strong prices were. The tailwind from what you said, that it’s sort of working its way into these ESG goals, [00:23:31][11.2]

Andrew DIttmar: [00:23:32] There are so many long term secular bull indicators for U.S. gas I mean, you have a real domestic consumption that the administration seems to be fairly supportive of gas as a key feedstock in Peckham. [00:23:43][11.9]

Andrew DIttmar: [00:23:44] And we’ve all seen the inflation numbers and how high raw material prices are typical prices are high, too so big pet cam development and I gosh, it seems like every few months I see another big, big development and now out somewhere between Louisiana in Corpus Christi, here in Texas,. [00:24:00][16.0]

Andrew DIttmar: [00:24:01] And then also LNG exports. And you look at U.S. gas prices, they seem high and you see what’s going on in Europe. And oh, my gosh, our gas is practically free. So,. [00:24:09][7.4]

Stuart Turley: [00:24:10] Yeah,. [00:24:10][0.0]

Andrew DIttmar: [00:24:11] It’s big global. So but the only area we really saw much demand for gas assets was in the Haynesville, which we talked about. One of our our key ways,. [00:24:19][7.9]

Andrew DIttmar: [00:24:20] Marcellus, you can see, you know, maybe where people are a little bit less inclined to do deals there and just to revisit that, you know, besides the pipelines, I think some of the issues are maybe that there’s just not that many ready sellers in the Marcellus most of it’s owned by public companies. [00:24:34][14.5]

Andrew DIttmar: [00:24:36] I think consolidation within those public companies makes some sense but public public corporate deals are always that easy to put together. You have to have. [00:24:42][6.4]

Stuart Turley: [00:24:42] In the Marcellus, they’re probably they’re probably waiting for pipelines. You know, they don’t want to sell till they get it. [00:24:47][4.5]

Andrew DIttmar: [00:24:47] Right. [00:24:47][0.0]

Stuart Turley: [00:24:48] Yeah, I’m in a smart ALEC, but in the Haynesville they’ve got great take away they got great take away for Cheniere or any of those others. [00:24:57][9.4]

Stuart Turley: [00:24:59] Cheniere is stock price just hit a good all time high because what you just mentioned all the export going to Europe. [00:25:05][6.4]

Stuart Turley: [00:25:06] Was it a couple of weeks ago they just had 20 tankers of LNG go and they got shuttled over to Europe?. They need some LNG, don’t they.? [00:25:16][10.0]

Andrew DIttmar: [00:25:18] Buy from us or buy from Putin? [00:25:19][0.8]

Stuart Turley: [00:25:19] And then I’d rather him buy from us. [00:25:23][3.2]

Stuart Turley: [00:25:25] You know, when you sit back and you take a look at strip pricing in your deals and everything else, you know, it’s like $65. What I’m not sure what the the number is right now, but when folks are doing their financial analysis on strip rate, is that what you use when you’re taking a look at your forward modeling and those things? Tell us a little bit about how you do your modeling. [00:25:48][22.4]

Andrew DIttmar: [00:25:49] Yeah. So strip pricing is, I think, the the industry standard dynamic strip and I think in our own analysis, we tend to use strip for 24 months and then flat, whatever we think the future price is going to be. [00:26:04][14.1]

Andrew DIttmar: [00:26:04] And we tend to be pretty conservative on that, as are most analysts right now we’re using like flat 63 after two years. You know, a buyer obviously is going to stress test assets and so they’re going to say, okay, it makes sense at strip pricing, but a strip goes to X, Y, Z is is still going to make financial decision sense for us. [00:26:22][18.6]

Andrew DIttmar: [00:26:23] So those Navy are the numbers that are that are published. But from an internal perspective, that’s key is is stress testing. Look, what’s the what’s the minimum price where you where you see this work. [00:26:31][8.5]

Andrew DIttmar: [00:26:32] And I think the oil and gas industry overall has become extremely cautious because of the bad years that we had and so you don’t see companies buying assets that have to have current strip even to where they’re going to work if prices go down quite a bit,. They want them to break even. [00:26:46][14.5]

Andrew DIttmar: [00:26:47] Actually, it’s interesting, we ran an analysis on what break even prices companies are willing to pay for upside out. So this is the price you need to break even on your inventory. [00:26:55][8.3]

Andrew DIttmar: [00:26:56] And what we found is that pretty consistently in oil plays, future drilling locations need to break even at $45 to to get allocated value in an M&A deal in. [00:27:07][10.2]

Stuart Turley: [00:27:07] U.S. shale. [00:27:08][0.8]

Andrew DIttmar: [00:27:09] In U.S. shale. Right. [00:27:09][0.7]

Stuart Turley: [00:27:09] Cool. [00:27:09][0.0]

Andrew DIttmar: [00:27:12] If your inventory is over that generally you’re just buying the assets for PDP and allocating zero to there in the pivot when gas seems to be about to 25 an MCF so price is pretty far beneath where current strip is. They’re definitely taking a good bit of wiggle room to the downside into these deals for themselves. [00:27:28][16.1]

Stuart Turley: [00:27:31] That’s a pretty interesting number when you say just as a ballpark, $45 and when you consider Saudi Arabia, it’s what, $0.50? I’m kidding. I mean, whatever the number is there, you know, in order for them, it just kind of falls out of the ground, kind of like, what was it Jed Clampett when he shot? Never mind the Beverly Hillbillies that you probably don’t even remember. [00:27:52][21.7]

Andrew DIttmar: [00:27:53] But my parents loved the royal television show. [00:27:55][2.3]

Stuart Turley: [00:27:59] When a shot of the ground and come from the ground, the bubbling crude that just shows you how old I am. [00:28:05][6.6]

Stuart Turley: [00:28:06] In fact, most people call me Jethro because I’m that stupid. [00:28:09][2.5]

Stuart Turley: [00:28:10] But what do you see coming around for Q2? Do you see the M&A stuff picking up? What do you kind of guess and on the horizon here? [00:28:19][9.3]

Andrew DIttmar: [00:28:20] Sure. So, you know, futures always easy to read so clearly I’d be 100% here, as always. [00:28:25][4.8]

Andrew DIttmar: [00:28:26] And if I had to guess, I think that we’re we’re going to get back to hopefully a more of a normal pre-COVID type M&A market. I mentioned at the beginning that what we really missed or these sort of bread and butter, 100 to $500 million asset deals that companies did all the time back before 2020. [00:28:42][16.2]

Andrew DIttmar: [00:28:43] They adjusted their portfolios with strong commodity prices plus all of these big corporate deals we’ve seen that drive non-core divestments. I think there should be a good backlog of these assets to be put on the market, and I think there’s going to be a willing buyer pool both on the public and private side to fill them up. [00:28:59][15.7]

Andrew DIttmar: [00:28:59] And so I think and hope we see more regular deal flow this year to smooth out that boom or bust type cycle that we’ve had the last two years where it’s big deals or nothing. [00:29:08][8.3]

Andrew DIttmar: [00:29:09] On the other hand, we may get slightly less of these big multibillion dollar corporate tie ups or PE exits, and that’s mostly just a function that we’ve had so many of them the last two years that companies that were really anxious to transact either as a seller or buyer for the most part, found a deal at this point. [00:29:24][14.9]

Andrew DIttmar: [00:29:25] And so the potential pool of a deal partners out there has shrunk and along with that, these mid-cap publics were really under quite a bit of investor pressure they’re having a hard time. [00:29:36][10.3]

Andrew DIttmar: [00:29:37] It was solid commodity prices, better cash flow generation, share prices are up they’re feeling a lot better about their futures. So there’s probably a little bit less of a of an impetus to sell there than what we had maybe in 2020. [00:29:47][10.3]

Andrew DIttmar: [00:29:49] From macro perspective, it makes sense to have further consolidation in the shale patch. There’s quite a few redundant companies you could get down a list and where these both independent publics, they should merge and that would really cut the cost structure. [00:29:58][9.3]

Andrew DIttmar: [00:30:00] But I don’t know that they’re going to be in a hurry to do that. We’ll probably get a few. But but timing a piece on public company big time in the news is always notoriously difficult to call. [00:30:09][8.9]

Stuart Turley: [00:30:11] I’ll tell you, you know, it’s kind of exciting time like you say to be in energy and one thing I’ve really enjoyed about all of our podcasts that you and I have been on together is your love of your job. [00:30:23][12.0]

Stuart Turley: [00:30:24] Andrew is really kind of fun when you work for a great company, like in Envarus and then you really like your job. I just like to commend you for such a great report, you and your team putting this all together, and I’m looking forward to seeing your report next and next quarter because there’s a ton of stuff going on over there and congratulations on being a director over there now. [00:30:48][24.2]

Andrew DIttmar: [00:30:50] Well, thank you. Yeah. And I love it. Like you said, it’s a really exciting time to be in energy. There’s always something new and it makes it tough to call the future because the future is constantly changing but that’s that’s what makes our job so exciting and keeps us employed. Always. Information on new trends. [00:31:06][16.7]

Stuart Turley: [00:31:07] So one last question. One last question. Goldman Sachs came out this morning and said $100 oil by Q3. And I’ve been extremely bullish I’ve been calling for over 120 in Q2 and even higher because of all of this kind of stuff. [00:31:27][20.4]

Stuart Turley: [00:31:28] I’m going to throw you on the Andrew Crystal Ball. If Goldman Sachs is saying 100 and I’m saying even more, what are your thoughts? And I’m not going to hold you to it, you know, we’re not going to have you be buying anything but what are your thoughts on the path? [00:31:43][15.7]

Andrew DIttmar: [00:31:45] Fortunately, the various future predictions that have to make oil prices and gas prices are one of them. And we have a team that does that one more than I am of all kinds of degrees I never would have attempted and I really enjoy hearing them talk to and run through the numbers on this type of thing. [00:32:00][14.8]

Andrew DIttmar: [00:32:00] I think relative to the market, we’re actually as a firm, maybe slightly bearish on oil, not high level pricing, but we’re coming in beneath where Goldman and some of these other predictions are so. [00:32:12][11.6]

Andrew DIttmar: [00:32:12] And personally, I really I look at the deals within the prices and I think what we talked about when you tend to use strip and then even take a little bit of a conservative look past that. So. Right. A bullish on deals at these commodity prices and so I think that’s that’s. My take going forward. [00:32:30][17.7]

Stuart Turley: [00:32:31] I’ll tell you, that’s a. Andrew, you’re going to be running for office next year because that was an excellent political, political answer and by the way, you know, the folks over it in Enverus I’m going to give them a shout out again. Great, great job again. Thank you. We’ll see you next quarter, Andrew. I do. [00:32:49][17.7]

Andrew DIttmar: [00:32:49] Appreciate. Great. You always look forward to this and great questions. Enjoy the chat. Thanks so much for having me on. [00:32:53][4.4]

Stuart Turley: [00:32:54] Sounds great. Thanks. [00:32:54][0.0]

[1793.2]