Federal Reserve Chair Jerome Powell said on Friday it is still unclear if US interest rates will need to rise further, as central bank officials balance uncertainty about the effect of past hikes in borrowing costs and recent bank credit tightening with the fact that inflation is proving hard to control.

In carefully scripted remarks at a Fed research conference in which Powell was interviewed by a top US central bank staffer, the Fed chief reiterated that the central bank would now make decisions “meeting by meeting,” but also flagged that after a year of aggressive rate increases, officials “can afford to look at the data and the evolving outlook to make careful assessments”.

“We face uncertainty about the lagged effects of our tightening so far, and about the extent of credit tightening from recent banking stresses,” Powell said during a panel session at the conference in Washington. “So today, our guidance is limited to identifying the factors we’ll be monitoring as we assess the extent to which additional policy firming may be appropriate to return inflation to 2 percent.”

“The risks of doing too much or doing too little are becoming more balanced and our policy adjusted to reflect that,” Powell said. In advance of a June 13-14 policy meeting, he said that “we haven’t made any decisions about the extent to which additional policy firming will be appropriate.”

US policymakers have remained on the fence about their upcoming policy decision, and will review important jobs and inflation data that is due in coming weeks that could sway the debate within the central bank’s rate-setting Federal Open Market Committee.

Powell said he felt that data so far “support the committee’s view that bringing inflation down will take some time.” He noted, for example, that some of the factors that may keep inflation elevated, such as the tight labour market, have yet to ease – particularly in the service industries where inflation is proving more persistent.

Policymakers are facing other constraints, as well, in offering clear guidance on the next meeting. Regardless of the data, the Fed is unlikely to raise interest rates if a down-to-the-wire political standoff over the US federal debt ceiling remains unresolved. If an actual US debt default is the result, the central bank may even be pushed towards emergency steps to ease the burden on the economy.

Powell’s comments overall “were consistent with our takeaway from the May post-meeting press conference, which was that, while the (FOMC) wasn’t sure whether further tightening would be necessary at some point, the committee’s base case was a June pause,” LHMeyer senior economist Kevin Burgett wrote.

This week has indeed seen some Fed policymakers call for a pause to further rate hikes. But others have pushed for more increases, while vice chair nominee Philip Jefferson made remarks that walked a middle path, citing risks on either side with no clear recommendation.

Atlanta Fed President Raphael Bostic captured the mood earlier this week when he said that while he was “inclined” to keep interest rates steady at the June meeting, even that decision would not say much about the future.

“I would say it was a pause, but a pause could be a ‘skip,’ or it could be a hold,” Bostic said. “There’s a lot of uncertainty in the world. We will just have to see how things play out and get a sense of what’s true signal and what’s noise, and that is going to be a week-to-week thing.”

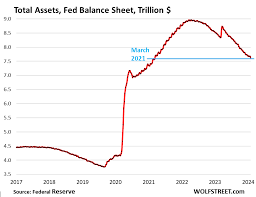

The quarter-of-a-percentage-point rate increase approved by the Fed earlier this month was the 10th in a row since March of 2022, and raised the benchmark policy rate to the 5 percent to 5.25 percent range, the level most policymakers had penciled in as the likely stopping point for rate hikes.

The Fed’s policy statement at that meeting opened the door to a pause, though Powell in his post-meeting news conference said, “It’s not possible to say that with confidence now … We’re going to have to see data accumulating” before deciding whether the door was closed on further rate hikes.

Data on inflation, jobs, and the banking industry since then have done little to clarify the situation, with nothing seeming to change very fast. Job growth seems to be cooling but remains strong; inflation appears to be falling but is still high; overall demand, bank credit and the economy look to be slowing but also are holding up better than anticipated.

The result has been “a frustrating inconsistency” in the arguments offered by policymakers since the last meeting, said Tim Duy, chief US economist at SGH Macro Advisors. Dovish officials have argued the need to keep the options for more rate hikes open, while hawkish officials have noted the risks of tightening credit, and some have tried to have it both ways.

Duy said it was getting to be time for a decision that either that the economy needs time to adjust to the aggressive rate hikes over the past year, or “stick with … waiting for inflation data to roll over” and continue raising rates until then.

The Fed chief reiterated that the central bank would now make decisions ‘meeting by meeting’.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack