HIGHLIGHTS

US Q1 lithium imports jump to 13,560 mt

EV market drives greater demand

The US imported 13,560 mt of processed and refined lithium materials in the first quarter, 69% more than in Q1 2021 and 21.9% more than Q4, according to S&P Global Market Intelligence data.

Much of the lithium imported into the US goes toward making industrial products, such as glass or lubricants, but an increasing proportion is being used to build rechargeable batteries installed in electric vehicles. US battery manufacturing capacity is expected to increase tenfold between 2021 and 2025 as the country becomes a top EV market, according to an MI analysis. By 2030, US battery capacity is forecast to hit 620 GWh, up from just 38 GWh in 2021.

Several companies plan to expand battery capacity this decade in the US and increase domestic battery production for EV product lines, including automakers General Motors, Ford, Tesla, and Toyota Motor North America, as well as battery manufacturers SK Innovation and LG Energy Solutions.

A long supply chain

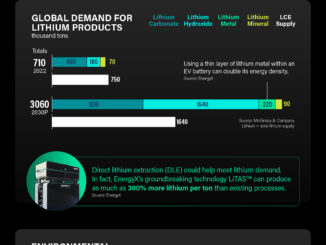

Lithium is processed along a lengthy global supply chain before it can become a battery. Companies first extract lithium ores or brine concentrates and process them into lithium compounds. This processed material is then converted into lithium chemicals. Refined lithium includes products such as lithium metal and lithium chloride. Processed lithium includes the lithium carbonate and lithium hydroxide used in EV batteries.

Global lithium demand is forecast to reach 620,000 mt lithium carbonate-equivalent in 2022, 21.3% more than in 2021, according to MI data forecasts. A 2,000 mt LCE deficit is expected to emerge in 2024 and balloon to an estimated 50,000 mt by 2026. The US produces little of its own lithium, although some projects are in development.

Domestic lithium mining projects have been slow to come online, largely because of permitting hurdles. Canadian developer Lithium Americas plans to produce 60,000 mt of battery-grade lithium carbonate at its Lithium Nevada lithium project, once commissioned. The company has obtained state environmental permits for the project and is awaiting a ruling on a federal permit as of May 5. Australian company ioneer also has its sights on Nevada, where it is planning its Rhyolite Ridge lithium-boron project. The company expects the project to come online in 2024, although it too is pending full regulatory approval.

The limited lithium mining and processing capacity in the US forces companies to import raw materials. In Q1, 98.8% of processed lithium imported into the country came from Chile and Argentina, while the majority of refined lithium, 30.7%, came from China, followed by Germany and Japan.

Source: Spglobal.com