By Simon White, Bloomberg Markets Live reporter and commentator

A signal based on the manufacturing indices compiled by the regional Fed banks indicates a recession next year. However, positive cyclical equity data suggests one is not imminent, while stock indices are not yet fully pricing one in.

Next year is set to be dominated by when the US will go into a recession, thus the more ways this question can be answered, the better.

Several of the regional Fed banks produce manufacturing and business outlook surveys for their region. Their releases are followed by the market to help build a more timely picture of what is happening at a national level, but they suffer from being very volatile, so are less reliable on a month-to-month basis.

However, we can increase the information content if we look at the surveys together. I built a simple recession model based on the percentage of the regional Fed surveys in contraction. The signal triggers when 100% of the indices are in that state.

As we can see it does a pretty good job. It triggered for every recession going back to 1970, but it also gave two false positives, in the mid-1990s and 2015. It also suffers from triggering a little too late sometimes, although it did go off prior to the 1981 and 1990 recessions.

It triggered in October, so we will find out in the coming months if this is another correct signal. Still, this is only one signal, and the best way to gauge recession risk is by combining several different indicators that approach the question from different angles.

One such other reliable signal is the Philadelphia Fed State Diffusion Indicator. It measures the net number of states whose coincident data are rising. After rebounding back to +68% in September, the recently-released October reading slumped to -4%. Every time it has hit that level, the US has subsequently gone into a recession.

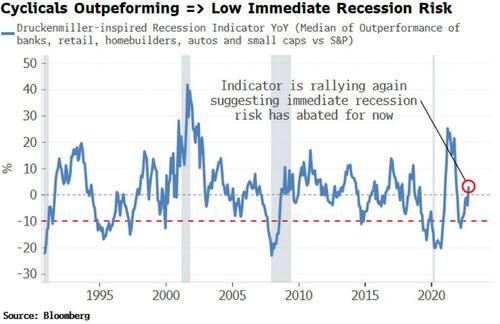

Nevertheless, a recession is not imminent, based on the behavior of cyclical stocks (the “Druckenmiller Indicator”), along with other data, but one is looking very likely by the second half of next year.

It’s a case of when, not if, for a recession in 2023. Either way, though, equities have yet to fully price in this reality.