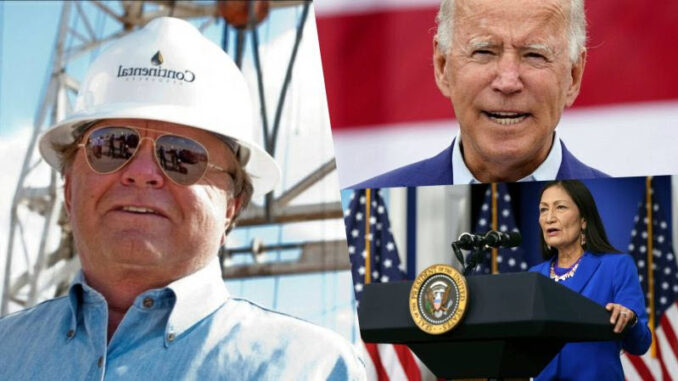

The FT writes, shale pioneer Harold Hamm has hit out at the US’s oil deal with Venezuela, saying it marked a new sign of “desperation” from the administration of Joe Biden as it tries to beat back fuel inflation.

The US last week said it would allow Chevron to restart some operations in Venezuela, more than three years after the Trump admin imposed sanctions on the country’s oil sector. The move could help free up more global crude supplies amid an energy crunch triggered by Russia’s invasion of Ukraine.

Battling a surge in domestic fuel prices that have fanned rampant inflation across the US economy, the Biden admin has released oil from the emergency federal stockpile, implored Saudi Arabia to supply more crude, and called on shale producers to increase drilling.

But in the US Hamm said Biden’s earlier pledge to transition from oil and end fracking on federal lands had stymied the once-prolific shale patch. Biden previously said that US operators were still sitting on as many as 9,000 leases on federal lands, and in October lashed out at the companies for not drilling more to lower domestic pump prices, saying their bumper profits were a “windfall of war.”

But Hamm said the admin was still doing “everything it can from a regulatory standpoint to block the industry. ” Federal agencies had blocked Continental Resources from drilling, he said.

While other executives have blamed Biden for the slow shale recovery, Wall Street investors have also demanded that producers use a windfall from higher prices to return capital rather than reinvest the cash in more drilling.

Hamm last month completed a move to take Continental Resources private again, meaning it is less beholden to asset managers holding its stock. Hamm said, “We don’t want somebody telling us what to do and how to do it. I can gauge the market about as good as the next guy.”

To Sum It Up: The shale tycoon expects further inflation as long as shale production, rich in the so-called middle distillates needed to make diesel—a crucial input in US industry and transport—remained depressed.

Our Take 1: So, in the bizarro world of the Biden admin’s energy policy, the release of hundreds of millions of barrels of oil from America’s strategic reserves to lower gasoline prices in advance of midterm elections is fine, but the production of similar barrels by the domestic oil and gas industry is an activity that must be left to die on the vine. It’s totally bananas.

Our Take 2: Good on Hamm for speaking out. Amazing what throwing off the restraints off short-term investors can do for one’s ability to speak out. Hope he and his partners make (another) fortune.

Source: LinkedIn Doug Sheridan -Please follow him HERE