Well, one of the phrases I hated during covid was “We live in unprecedented times.” Now I think that 2022 makes 2020 look like “Hold my beer.” The pandemic and supply chain failure was devastating, now mix that with our geopolitical disasters and we have a very unhealthy mix.

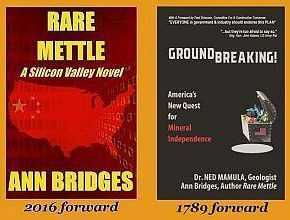

I sat down with Ann Bridges, a Silicon Valley Author, Editor, Marketing/Publishing Business Mentor, and most importantly, an absolutely fun interview. Ann has written many books and has two that are impactful on the rare earth minerals market and its impact on the migration to renewable energy, United States national security, and how tough the market is going to get for the minerals we need. Ann’s two books the Rare Mettle and the Ground Breaking were the two that I read and were worth the time.

Please follow Ann, read her books, and enjoy this fun talk. Thank you Ann for stopping by the Energy News Beat podcast, and hope to see you soon!

Please connect with Ann on her LinkedIn

Buy Ann’s books at:

Ann’s Helpful Resources:

Balancing America’s environment, mining and the Green New Deal – The Hill

- Praseodymium, used in permanent magnets, batteries, aerospace alloys, ceramics, and colorants

- Rhodium, is used in catalytic converters, electrical components, and as a catalyst

- Rubidium, used for research and development in electronics

- Ruthenium, used as catalysts, as well as electrical contacts and chip resistors in computers

- Samarium, used in permanent magnets, as an absorber in nuclear reactors, and in cancer treatments

- Scandium, used for alloys, ceramics, and fuel cells

- Tantalum, used in electronic components, mostly capacitors and in superalloys

- Tellurium, used in solar cells, thermoelectric devices, and as alloying additive

- Terbium, used in permanent magnets, fiber optics, lasers, and solid-state devices

- Thulium, used in various metal alloys and in lasers

- Tin, used as protective coatings and alloys for steel

- Titanium, used as a white pigment or metal alloys

- Tungsten, primarily used to make wear-resistant metals

- Vanadium, primarily used as alloying agent for iron and steel

- Ytterbium, used for catalysts, scintillometers, lasers, and metallurgy

- Yttrium, used for ceramic, catalysts, lasers, metallurgy, and phosphors

- Zinc, primarily used in metallurgy to produce galvanized steel

- Zirconium, used in the high-temperature ceramics and corrosion-resistant alloys.

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Stuart Turley [00:00:03] Hello, everybody. Today is a fabulous day. Sitting here looking and we have a podcast of extraordinary we’ve got and bridges on today.

Stuart Turley [00:00:14] She is an authoress and I mean, she’s got books, she’s in Silicon Valley. And the we’re going to be talking about she’s got novels, and I don’t normally talk about novels and but this is going to be kind of fun because we’re actually talking about real world stuff with the novelist. And welcome and and thank you very much for stopping by the Energy News Beat Podcast.

Ann Bridges [00:00:39] Well, thank you very much for the invitation. I always look forward to talking to new people and kind of opening their eyes and minds, just things that they hadn’t heard before from nonfiction or the mainstream media.

Stuart Turley [00:00:51] Well, what started you off being an author?

Ann Bridges [00:00:55] Well, I had a career in Silicon Valley here, working in the communications industry mostly. And then the Internet happened and I was thrown into the computer industry and the Internet happened and VCs and I was with a small startup that went public.

Ann Bridges [00:01:12] And I just had all this this knowledge and experience, but it got overwhelming, so I kind of stepped out and then I realized, well, I have information. Especially I wanted to reach out to women because that was right when the there was an outreach to try to bring more women.

Ann Bridges [00:01:26] And I said, okay, well, I’ll tell my story and so that launched my first novel, Private Offerings, which actually won the wealth management best business fiction in 2015. And that actually was talking about how you can manipulate press releases and China’s yeah,.

Ann Bridges [00:01:47] China’s influence and their desires starting in the nineties you know late eighties early nineties to really I’ll say infiltrate but really expose and start extracting technology from Silicon Valley. So the defense industry had left are the Cold War was ostensibly over and all of a sudden we were opening up for the first time a lot of the technology that had been very closed off to the rest of the world.

Ann Bridges [00:02:10] So I wrote that novel and in the meantime, we had this embargo in 2010 of China against Japan for rare earths. And I understood what that meant in terms of just in time supply manufacturing, how the hardware had left this this region in terms of manufacturing.

Ann Bridges [00:02:33] And I kept on waiting for the big companies to talk about it, you know, the apples and the Peas and the Ciscos. Silence, absolutely silence, and so I decided to write a sequel called Rare Metal about Silicon Valley’s kind of stick an ostrich head in the sand approach to some of the issues that really were creating risk.

Ann Bridges [00:02:54] And that was basically it’s a sequel, continuing the same some of the same characters going forward. And that really resonated within the industry of minerals mining. And they couldn’t believe that someone from Silicon Valley was actually talking about it.

Ann Bridges [00:03:11] And in fact, one of my contacts had been blocked, a lot of the congressional record, a lot of the information coming out of the Pentagon had been considered classified.

Ann Bridges [00:03:21] And so he was unable to talk about what he knew to be the case. And so he kind of served as background for me on some of the critical Pentagon scenes being here in California. I see where there’s a lot of deal making going on there is an attraction to bring China’s money here and to create this good business relationship to China without really understanding or recognizing publicly what that meant.

Ann Bridges [00:03:50] And that morphed me into the coauthoring groundbreaking with Dr. Ned Mamphela, who wanted to bring a lot of these facts in a very easy to understand nonacademic book. And so we collaborated on that. I don’t have a degree in geology or chemistry, by the way.

Stuart Turley [00:04:09] But it was very fascinating and I really enjoyed prepping for this because when you sit back and you take a look at how groundbreaking is laid out, you talk about not only the regulations and here, but you also talk about what’s important.

Stuart Turley [00:04:25] People don’t realize how much things that we get, the number of commodities that we get, where we get them from. All these things are critical. I mean, if you sit here and take a look at some of the stuff that is in here, China has the what there’s forgive me for all, but I’m sorry, I should have all my paper notes here and everything.

Stuart Turley [00:04:49] But it’s, that China has so much of the rare earth minerals and 15 of those are so critical for the whole world and everything else. But regulations have killed the U.S.. I mean,.

Ann Bridges [00:05:04] They have, and they’re a by product of major mining. I mean, you have to look at the cost efficiencies of of pulling together these very small commodities. It’s like trying to extract a spice, a specific spice when you have a spice mixture in your cabinet. Okay.

Ann Bridges [00:05:21] So how do you find that? Well, the way to do it is you, you, mine tons of iron ore, which is why China dominates the steel industry. But when you deal with when you mine all that now you can cost effectively extract the tonnage needed for rare earth elements.

Ann Bridges [00:05:37] So you’ll often hear the pushback that rare earths are not very rare they are scattered around the world they are indeed, but they are scattered. And so to make it a good business proposition, China stepped forward and said, well, we’ll do it. That will be how we’ll pull ourselves out of communism.

Stuart Turley [00:05:53] And then you’re on page 53 on this January 2018 report. China put a long lock on much Africa’s vast resources, and China has got their hand all over the place. When you take a look at in Ethiopia just now, China had gone out and built a dam.

Stuart Turley [00:06:16] So they go out and they work with them and they say, oh, by the way, here’s the long arm of China. And then all of a sudden you’re into them for all this money.

Stuart Turley [00:06:27] So this whole mineral thing is so critical because it’s a way to get into these countries pocketbooks. Is that a fair statement?

Ann Bridges [00:06:36] Yeah. And they you know, this started Deng Xiao Ping, many people think of him as the person really kickstarted capitalism in China. But what he did really was he recognized that China had these minerals, China had rare earths, and the technologies were moving in that direction to be wholly reliant on computing, technology, communications, medical space, all the rare earths.

Ann Bridges [00:07:01] So rather than try to compete in areas that they did not have the resources, they modeled themselves actually after OPEC with oil, which we are now seeing today, how effective that is.

Ann Bridges [00:07:13] And they basically encouraged most of the U.S. manufacturers to move their manufacturing close to the source of these components. They graduate 100,000 university degrees in geology and metallurgy. We do 1000. I mean, that’s just a scale.

Ann Bridges [00:07:32] So they have the expertise. They are going all around the world trying to identify the natural resources that they can now excuse me, control, price, control, be a choke hold for national security, you could argue as well.

Ann Bridges [00:07:47] So it’s it’s back to the future in terms of fighting over natural resources, whether it’s water or land or oil and gas. But now rare earths. But it’s it’s the same issue. They have really established themselves very, very well in being the global leader in this.

Stuart Turley [00:08:03] Well, the next piece of this is there’s a couple of things supply chain and national security. And you address in here that minerals are national security, and where the we got we don’t even have a agency now that’s in charge of this. Did I get that or did I dream that? That’s.

Ann Bridges [00:08:20] Yes. We used to have what’s called the Bureau of Mines, and they were a single repository for all this information that was de-funded basically in the Clinton administration working with China. They said, sure, if you’re going to take all this on, we don’t need to fund this we have better things to do with with government money.

Ann Bridges [00:08:38] And so it’s kind of split between the Department of Energy and the Department of Interior. Now, the USGS is under the Department of Interior, but we have spent more time actually mapping other countries resources as part of our foreign outreach, for example, But then we have our own.

Ann Bridges [00:08:57] We we really don’t know exactly what we have except geologists can look and say, well, gentlemen, what you know, when you have, you know, nickel, you’re going to get this kind of rare earth.

Ann Bridges [00:09:07] So when you dig for copper, you’re going to get this kind of metal as a co-product and there’s nothing that’s really stopping us from doing it except the….

Ann Bridges [00:09:16] I think it’s fear at this point. We we implemented a lot of environmental laws in the seventies and the eighties, and since we’ve put them into place, we really have not had problems. All the pictures you’re seeing from the media, all the stories that they reference are from before we had these regulations in place.

Ann Bridges [00:09:36] But it’s taking 7 to 10 years to get permitting and even if you get permitted, for example, in Nevada, there are three new lithium mines that have been permitted and they are being blocked.

Ann Bridges [00:09:47] So you have the environmentalists who want the electric cars.

Stuart Turley [00:09:51] Right .

Ann Bridges [00:09:52] To clean up the air. But now you have people go, well, we got to worry about the groundwater. And then someone else says, we have to worry about the plant life. And someone else says, well, how about those sage grouse birds? And someone else comes forward says, Yes, but these are indigenous lands with sacred burial grounds.

Ann Bridges [00:10:06] So you have these very favorite leftist causes and they’re fighting each other, and in the meantime it’s stalling all progress on being able to truly be resource independent here, the same way we were with oil and gas we need to start establishing that beach head for America as well.

Stuart Turley [00:10:24] Aint that crazy. I’m sitting here and when you take a look at your metals operations in the United States, boy, The West is incredible and Alaska is really incredible. There’s only the ones up in Missouri, it looks like, on your map.

Ann Bridges [00:10:45] Yeah. And and the the Minnesota, Michigan, the old Rust Belt that was iron ore. And it still has a nickel. It still has cobalt. Those are, again, some mines that have been stalled out. Tesla, in fact, cut a deal with a mine I think it’s called Talon Mine up in Michigan.

Ann Bridges [00:11:04] But in order to even let some of that permitting go through, he had to agree to let the UAW, I believe one of the union’s major unions try to organize there.

Ann Bridges [00:11:14] So now they’re looking at putting it to Canada instead. I mean, it’s it’s crazy. We’re just letting all these politics get in the way.

Stuart Turley [00:11:22] And then when you talk about supply chain issues, we are now in the fourth commodities boom we’ve ever been in. And it is going to be just exacerbated to absolute misery for everybody because of the energy crisis.

Stuart Turley [00:11:39] Now we have in and so we have this whole world wide mess of printing money to get to renewables. That is, when you print money, it causes inflation. Then you’re going to have this. Now we have rising. I mean, the geopolitical stuff with oil and gas is raising this.

Stuart Turley [00:11:58] And then the supply chains that you alluded to have gone horribly wrong. How does rare earth minerals fit into the supply chain?

Ann Bridges [00:12:09] Well, in a number of ways. First of all, again, if the idea behind trying to be more environmentally friendly with these these mobile, smaller high tech gear and we’ll just we’ll just focus on that for a second and there are over in China.

Ann Bridges [00:12:28] Well you know it takes incredible heat generally coal furnace like coal heated furnaces to get the heat up to like the 3000 5000 degrees needed to melt these metals and shape them. Okay. So then they’re they’re all shaped there and then they’re shipped back here.

Ann Bridges [00:12:46] Well, we’ve got that transport costs and you’ve got the weight, and now you’re starting to see truckers complain about the fact they literally cannot afford the fuel. So we’re going to end up sitting in a situation where we have half of the components over in one area of the world waiting for supply and the other. And that’s what we saw. In fact, with the car manufacturers, they were all short chips.

Stuart Turley [00:13:07] Right.

Ann Bridges [00:13:07] So you can finish the entire car. But until you have chips, you’re not going to go forward. Same thing with the Defense Department the national security are submarines, for example, require magnets, very powerful magnets in order to stay submerged. Well, they need specific rare earths as well. I think Neil Debenham is one of them,.

Ann Bridges [00:13:29] And we have it here in Wyoming, but we’ve been doing it over in China. Well, why wouldn’t we want to to make a close make it under our own power to do it rather than just importing it through China.

Ann Bridges [00:13:43] But one of the reasons that happened is the defense contractors wanted to sell to China. And China said, well, if you want to manufacture here, if you want to sell to us, if you want to sell your, you know, fighter jets and we’re going to buy them, then you have to manufacture them here. If you want manufacturing here, then we will we will sell you the rare earths. And by the way, we’re going to a model the exact same plant and duplicate it.

Ann Bridges [00:14:06] So so Boeing, for example, Lockheed Martin would have to give their manufacturing plant designs, blueprints in advance to China. When they get there and they’d find out that an identical one has just been built in the parcel next door to it?

Stuart Turley [00:14:23] Right.

Ann Bridges [00:14:23] And I mean, it’s literally you could argue that’s IP theft. You could argue that it’s simply them, you know, planning on doing it there themselves eventually. It’s crazy. And this is all known, but no one wants to talk about it because it’s so stupid and no one knows exactly how to extricate themselves, you know, from it. So this is why it’s fiction. I just I can make comments like that.

Stuart Turley [00:14:45] Oh, okay. I don’t think this is fiction, though and this is rising.

Ann Bridges [00:14:52] That sure, well become Stranger.

Stuart Turley [00:14:53] Oh, this is this is crazy. And it’s just gonna get keep getting worse. We’re going down that rabbit hole of bad energy policy, and then the hypocrisy is just driving me nuts of people that..

Stuart Turley [00:15:08] Let’s leave going greener off the table because we do need to get rid of carbon. I don’t want to get into that argument. You know, we need CO2 to grow plants, but there is climate. Let’s just leave all that out of it, but how we get there is really important.

Stuart Turley [00:15:23] We just can’t print money, we can’t do all these things, but when we sit back and take a look at logical writing like yours, wow, why can’t we all have a nice conversation with other folks? And being in California, we were kind of joking before you came on our you’re not very popular at parties when you start bringing up these facts, are you?

Ann Bridges [00:15:47] No, no. People want to believe that batteries are everything, and especially in Silicon Valley. So maybe the decision makers are they’re affluent, let’s put it that way. And so when you say, like Secretary Buttigieg the other day said, we’ll just buy a Tesla or buy buy an electric car,.

Ann Bridges [00:16:06] They not only buy buy Tesla`s, but they have no problem with springing the money for the extra battery pack and Governor Newsom, Governor Newsom is now going to use GM trucks as grid backup for this summer we’re I’m sure we’re going to have a power problem.

Ann Bridges [00:16:22] So we in California, we have a basic electrical grid reliability issue in the summertime, and we’re talking about converting all these homes to electric, all the cars are electric we don’t have a grid, we don’t have copper, we have copper in Alaska we’re just not mining it.

Ann Bridges [00:16:38] And China has been stockpiling all these resources. In fact, I saw they had like 85% of the copper mined copper resources on hand right now. So they’ve stockpiled it. So they’re either going to do their own grid or they’re going to be selling it to all of us at a premium price sometime soon. So.

Stuart Turley [00:16:58] I’ll tell you, you and I are in our own business. I mean, we should have been stockpiling this stuff years ago.

Stuart Turley [00:17:04] But what is a gateway? We all know what a gateway drug is, but what’s a gateway metal? When we sit back and kind of think, okay, great, they’ve got the stockpile, but what is a gateway metal and how can the next question is, what are our next steps? How do we get to energy or excuse me, rare earth mineral because this is all related.

Ann Bridges [00:17:25] Mineral dependence.

Stuart Turley [00:17:26] Of anything else.

Ann Bridges [00:17:27] I’m going to I’m going to refer to the book. Like I said, I’m not a geologist or a chemist, but it’s an interesting one. So copper is an example. All the rare earths and there are 17 of them depending on how you define them and rare earths have unique qualities that’s why they’re in addition to the fact that they’re rare.

Ann Bridges [00:17:46] They have these unique qualities are what make your phone small and can handle these extreme heat when your your tiny little chips are the one make that bright red on your ear from your phone.

Ann Bridges [00:17:57] So they are all used for these very specific functions. So if we mined copper, we would get rare earths and you could cost justify the mining of that rare earths if you allowed us to mine copper. That’s right. But if you don’t let us mine copper then we won’t get to the rare earths.

Ann Bridges [00:18:15] Nickel is another one where we get cobalt so cobalt a lot of people are aware of because we’re getting it right now from the Democratic Congo where they literally use four year old girls to climb down to these tiny little holes to pull out of cobalt. Right. And we’ve known about this, in fact, the environmental officer for Apple, who used to be the EPA administrator, wrote reported this. Okay.

Ann Bridges [00:18:41] So it’s not like this is, you know, being done under the scenes, these are these are major people, major influencers who just are not saying, yes, we need to mine Cobalt and we can mine cobalt here in this country. But the other portion of it, besides just the gateway output, is the processing processing up to now. And the way China does it is really environmentally messy.

Stuart Turley [00:19:03] Oh, Yeah.

Ann Bridges [00:19:04] Has to be right. It doesn’t have to be as toxic as the pictures we’re seeing. There are a lot of new technologies that are coming forward that are doing it very cleanly. The question now is from the pilot program to the scalability, can we do it? so they’re trying that.

Ann Bridges [00:19:21] The other solution they’re putting forward is let’s recycle or you can’t recycle until you have a quantity to recycle from and the other thing is when you’re dealing with these kinds of metals and minerals, they change in the process of shaping them, you know, extreme heat, etc..

Ann Bridges [00:19:37] So unlike aluminum cans or glass, where you toss it in a barrel and be done with it. In rare earths, you could try to pull that out of your phone in a recycled batch. And the metal is totally different. So it is not retrievable the way it you know, the way you think it would be.

Ann Bridges [00:19:56] So how do we go from here?, That was your next question. I think the issue is a priority issue. I think when we as a country say we want to maintain our lead in technology, we want to have the kind of lifestyle that our 21st century citizenry expects needs, however you want to describe it,.

Ann Bridges [00:20:18] Then we have a similar obligation to invest back into our own resources, our land, and to be able to. And you do it very well. There’s no reason that we can’t match Canada and Australia’s environmental standards for mining they’ve been doing this forever.

Ann Bridges [00:20:34] We just have to say yes we can and we will do it and not worry so much about the fact that 100 years ago we polluted, right. That’s not where we are today.

Stuart Turley [00:20:44] Oh yeah. And it’s like the Texas oil and gas they were flaring for so long, you know, and they didn’t wait for the they in the last ten years by maybe seven years, they really cleaned up their own act. And it’s because they’re now starting to sell the product and it’s making more sense.

Stuart Turley [00:21:04] Back in Pennsylvania they’ve been taking care of all that for a long time because that was the way it was. Now, overregulating can kill Price and you explain a lot of that in the book about regulations kill the beast. I mean, and I loved your minerals are now the new oil. Chapter one. You got to like that. So how did you meet Ned, your coauthor, on the book?

Ann Bridges [00:21:34] So I’m a networker and I ended up not knowing anything about this. I was really looking for people in the industry to vet my book, to read it and make sure I hit all the high notes. Right. You look for alpha readers of beta readers,.

Ann Bridges [00:21:50] And the people there were wonderful they open up their Rolodexes and said, You need to talk to this person, that person that would talk to this person. So I was simply introduced and then it was a Cato Institute at the time, and we stayed in touch.

Ann Bridges [00:22:04] And he, you know, wrote to me once and said, please, let’s let’s collaborate on this. I’d like to do a book, but I want your style. So it worked. Yeah. Yeah. Well, he’s an academic, not an academic, but he knows that he was not able to to bring it down to that very clear, clear language.

Ann Bridges [00:22:22] And if you see in the book what I did, if all you do is flip through and read the boxes that I wrote, which are, you know, hey, you know, animal, vegetable, mineral, these are really basic things that we learn about with kids. But let’s think about what that means.

Ann Bridges [00:22:38] If you’re not growing it, it’s being manufactured somewhere, and just I was picking up, you know, items off of my my shelf today because potash, I don’t know if you’re aware Russia is now saying they’re going to stop the exports of potash, which is a fertilizer.

Stuart Turley [00:22:53] Oh, yeah.

Ann Bridges [00:22:54] Yeah. And we need it. There’s been tremendous droughts and floods throughout the world. California’s having a horrible drought, so we need potash and fertilizer in order to get the food yields up.

Ann Bridges [00:23:06] And what you’ve got is when you take your vitamins and minerals, when you have zinc for your cold, these are minerals, these are in the land, you know, you have to extract them somehow. You can’t just pretend that you don’t need them.

Ann Bridges [00:23:18] And that’s why I think we’ve raised a group of ignorant and I won’t say the pejorative that I think a lot of the young people are ignorant of the role that minerals and the earth plays in our life, they’ve been worried about climate change. I guess.

Stuart Turley [00:23:32] You just alluded to something that is just so horrible we’re in an energy crisis we’re in a the crisis of supply chain issues. Food is going to be the next big one this next year.

Stuart Turley [00:23:49] You’ve got to have natural gas and you got to have all those other ones to make fertilizer. Russia’s the breadbasket of Europe they export so much stuff out you’re going to see some crisis in the food area there. It’s all related. I mean, this is frightening.

Ann Bridges [00:24:08] It is because only China really, I think, has recognized how to really leverage those resources. So you talked about how they’re expanding through their Belt and Road program. It’s it’s the concept of reestablishing that old Silk Road.

Ann Bridges [00:24:24] And so they have reached out to a lot of these emerging countries and said,, we’ll finance X, Y, Z so that we can tap into your resources. And Congo is one of them. So Congo’s cobalt output goes directly to a Chinese distributor. It used to. So it’s still the case. Who then ships it to China.

Ann Bridges [00:24:41] Well, they would say, well, it’s not really Chinese cobalt. No, but they are controlling it. And if the DRC, for example, defaults on their debt payment, which is what happened, Sri Lanka, they defaulted and all of a sudden China ended up owning a very critical port.

Ann Bridges [00:24:59] One of the disputes in the Himalayas between India and China is water. China wants to tap into the snowmelt from the Himalayas in order to have hydropower, but also to make sure they have water for their citizenry and is very aware of that and is fighting back on that.

Ann Bridges [00:25:18] So it’s it’s very big. And let me also say, since we’re at war, antimony is used for bullets, anything, and explosives, anything that goes bang is how it was described to me.

Ann Bridges [00:25:30] So we have an antimony mine that is languishing in Idaho. It saved our but in World War two and it’s it’s we can’t get permitting and yet we’re we’re just sending ammunition to Ukraine and Poland or whomever we’re sending it to these days to fight a war.

Ann Bridges [00:25:46] But without thinking about the fact that in order for us to replenish those bullets, we’re going to need to rely on, at best, an ally and at worst, someone we’re at war with, That makes no sense.

Stuart Turley [00:25:59] I had not even thought of that. Things that make you know, when you said that, I thought you were thinking you’re speaking about alimony and not Alamo.

Ann Bridges [00:26:08] Antimony.

Stuart Turley [00:26:09] Antimony. Okay, great. Yeah. I was thinking, Holy, where does this guy do want to pay? So that’s a Texas way to think of alimony. It ain’t antimony anyway. Sorry, but no, I mean, that’s a horrible thing that we’re going to be held hostage to bullets.

Ann Bridges [00:26:25] Well, held hostage or need to ask permission and this is true with you know, we started manufacturing jeeps over in China. Night vision goggles. We saw this with the with COVID and the protective gear and the tests. All of a sudden, you know, whether you want to believe it was purposeful or not, you know, it’s clearly the virus started in China somehow, and we needed their cooperation to do it.

Ann Bridges [00:26:46] Well, pretend for a second it wasn’t accidental. Pretend they said, nope, we released this. And no, you’re not going to get any of this stuff manufactured. You saw we had to do to get our own manufacturing line turned around very quickly. It was a major, major effort. Now, try to do that when mining logistically takes years to did. All right. You can’t just, you know, have the fabric there yet. So.

Stuart Turley [00:27:11] I work in the oil and gas. They’re saying go ahead and turn on turn on the spigot and let’s pump more oil. It doesn’t work that way we’re years away from spinning everything back up.

Stuart Turley [00:27:24] Biden asking Venezuela for oil. They’re decimated. They don’t have any money at all in their oil and gas. And it’s going to mining is even worse.

Ann Bridges [00:27:36] Well, I think one of the problems that happened is, is there was this belief that Silicon Valley was tech and the Silicon Valley leaders would, of course, figure this all out. And what most people fail to realize is that Silicon Valley has turned into software and apps once the Internet happened in the nineties. It became we did not manufacture.

Ann Bridges [00:28:00] And so the people who are running the companies today, even an apple which has some manufacturing, it’s it’s done elsewhere. So the people they may design it and they may have an understanding of how this stuff works.

Ann Bridges [00:28:11] But when you get into supply chain, I was talking to an executive who worked at a lot of these companies and he said, you don’t get it. that, you know, when the purchasing agents want to buy something, they go to these software companies that have databases and they say, okay, where where can I get cobalt and what’s the price? And I need it in six months in this kind of quantities so they may be able to get that. But the the components. Right.

Ann Bridges [00:28:38] So if I need a very specific component for a chip layer, for example, you know, we have no idea what’s in it. It’s made in China. You ordered from China in its finished form and they’re already tracking something like 800,000 parts every day around the world.

Ann Bridges [00:28:55] And to now bring in the concept of, you know, ESG, where we know exactly what’s in every single component and where it comes from. It’s not. And I’ll give you a funny example.

Ann Bridges [00:29:07] So I was laughing because my Thanksgiving turkey had a barcode on it and I said, Oh, see, look, we’re even tracking food. And he laughed. He said, No, because that’s easy. You know, it’s a whole turkey. Now pretend you’re trying to figure out where that turkeys gizzard went into what cat food, you know, that’s going to be eaten in India. Now track that and I went, Oh, and do that for the entire turkey and all the different turkeys from all the different farms in the country.

Ann Bridges [00:29:34] And you get a sense of what you were talking about it seems so simplistic, but it’s very, very complicated and no one’s really been willing to take it on until there’s been a demand from the corporations to want to take it on. And they don’t want to do it until the government requires to.

Stuart Turley [00:29:51] Speaking of funny, did you hear that story not too long ago that they were going to ship chickens, live chickens to China, have them processed in China and then ship them back? Did you hear that one?

Ann Bridges [00:30:04] I did. And this is again, you know, this concept, they have no idea the logistics and the cost of the fuel, you know, back and forth. I suspect that was to get get chickens to China because they were having another avian food flu outbreak. And then, oh, well, they’ll be there for another year or so and they’ll breed them, and, you know, chickens, you know, that’s pretty fast.

Stuart Turley [00:30:26] So that was that was pretty weird. I mean, people have lost their minds. Yeah, I was saying, I mean, this is insane. I can’t wait to go to a cocktail party with you and just really kind of eavesdrop on some of these parties that who come forward to that,.

Stuart Turley [00:30:42] But it with the next steps. What can we do to get our congresspeople on the phone to do anything as we got to make. We’re at a point where we got to make some changes. What would you think are next steps if you’re just listening to this? What can we do, do you think?

Ann Bridges [00:31:01] I think if you really want to get into national policy. I think, yes, we need to elect the people who want to town America.

Stuart Turley [00:31:08] That was a heavy sigh. You just.

Ann Bridges [00:31:10] Yeah, well, we’ve been working this for a long time. The environmentalists are funded through a lot of these foundations, Right. So the Ford Foundation, etc.. And they have dominated discussion. I’ve I’ve suggested to mining companies that they go out and take their own pictures and try to get them into Getty Images, because that’s what media use. Right.

Ann Bridges [00:31:31] But the media want to they have their agenda, right. So OP ends, meet with your local people, meet with your school kids. I was talking to a dad. He said he just went in with a big garbage can to his kids and said, okay, did you grow your smartphone? No, it goes in here. And basically, except for stripping down to their underwear, everything that they touched, they used went into that bag.

Ann Bridges [00:31:54] And even when you talk about fossil fuels, they don’t even understand the things that you need rubber tires for your electric car, you need fossil fuels, you need Vaseline for your baby’s diapers. So a lot of them just need to understand the very basic, everyday things that they touch do require minerals. And the phrase I’ve been using is minerals, advanced civilization. So if you remember the Flintstones,.

Stuart Turley [00:32:21] Can you say that again,.

Ann Bridges [00:32:22] Minerals, advance civilization.

Stuart Turley [00:32:25] Oh,.

Ann Bridges [00:32:25] Otherwise point back to the Stone Age. Right? Literally. Right. That’s that’s where we went. We’re Stone iron, bronze, etc.. The information age, as much as it was tagged that way, was way too virtual and we lost the sense of the reality of life.

Ann Bridges [00:32:41] And so if we want to keep our Western civilization, if we want to advance, if we want to have technology, we are going to require minerals and we need to prioritize them in a fashion that we can do and we must do. You can do it at the state level.

Ann Bridges [00:32:56] Nevada is more supportive of mining. West Virginia clearly is starting to now coal mining Pennsylvania. So it’s both national and local, but we need to start talking about it as in terms of how realistic it is that to push this green agenda through without having the fundamental minerals mined here and and efficiently transported even in a local quarries, they do all the cement. You want to have roads, you need to have cement.

Stuart Turley [00:33:25] And cement uses a lot of coal. It uses coking coal in order to get that heat up.

Ann Bridges [00:33:30] Yep, that’s exactly right. It’s the heat and solar and wind are never going to do that kind of manufacturing. So,.

Stuart Turley [00:33:36] No, in fact, we were doing a study on California, and they’re down to one coal plant. They’re down to one nuclear plant, and they’re still using as much coal as they were in the past because in putting out the same amount of CO2, because of the cement and all the other, manufacturing is still having to use coal.

Ann Bridges [00:33:59] Yep.

Stuart Turley [00:33:59] I’m like, wait a minute, those numbers are buried at the EIA and they’re we’re looking and going, Wait a minute. Why isn’t anybody talking about this?

Ann Bridges [00:34:08] They’re buried. Well, you know, and I blame media on some of this. You know, they take the talking points from these press releases Governor Newsom had on on the lithium that was announced a couple of weeks ago and they mushed together.

Ann Bridges [00:34:23] There’s a Department of Defense, $35 million went towards a mine for rare earths in Southern California. In addition, a small amount of money was going to see whether or not we could extract lithium.

Ann Bridges [00:34:37] And the media reported, oh, $35 million is going to go to build lithium ion batteries in California. So we could have it in a couple of years. And yes, just so you know, it’s it’s an education. That’s all it is.

Stuart Turley [00:34:55] All right. What’s next for And you got like you got 15 more bucks coming around the corner. Tell us what’s going around the corner for Ann.

Ann Bridges [00:35:04] Ann is still plugging away, trying to change policy with that. We’ve been doing a lot of op ads. We see that there is an opportunity with the sadly with the what’s going on now with the war and the price of oil, etc..

Ann Bridges [00:35:17] There’s much more of a recognition that maybe this this green energy transition is not going to be seamless and it’s not going to be harmless. So how do we how do we plan for that? I think there hasn’t been a plan.

Ann Bridges [00:35:30] And so I’m encouraging that actually to try to come up with maybe a template for policy statement that we can do that we can say here this this might work and get the Congress behind that, but it’s going to take electing people who want to do that and having a realistic end to the priorities that our country needs to have.

Stuart Turley [00:35:49] In your book. I think it’s called Breaking Ground. I think something like that. You also talked about having the Clean Water Act because the Clean Air Act came out not too long ago and then the Clean Water Act was very, very Was it 78? If I can, I can’t.

Stuart Turley [00:36:06] But you did great bringing that one in. And then the Clean Air Act brought in a whole bunch of new stuff. And that wasn’t that many years ago. So what was interesting.

Ann Bridges [00:36:17] Right in the Supreme Court actually has a water a case in front of it that they need to decide by June that may may start regulating what the EPA’s power really is or bouncing that a little bit. We’re seeing that with some of what they did with Commerce and and HHS with the COVID, that these regulatory bodies have decided that they are all powerful in determining what’s going on. And they really have been limited by legislation.

Ann Bridges [00:36:44] In fact, there’s a very small piece of legislation that was passed in 1980s called Flip Ma and I’m sorry, I don’t remember what the acronym stands for, but basically it required that there be balance between regulatory oversight and the ability to develop the mining resources and mineral resources. It required this is legislation.

Ann Bridges [00:37:06] So any regulation that’s saying, well, no, we want to give the sage grouse bird habitat priority. No, that is not in the law. You want to have that in the law, you have to pass a new law.

Stuart Turley [00:37:19] That’s brilliant. And so that is going to be some stuff I would like to invite you to please send us anything that you would like for us to put in the story. We’re going to transcribe this. We’re going to take out anything that makes me sound smart because, you know, I, I steal all your material.

Stuart Turley [00:37:37] And anyway, we do thank you very much for stopping by the podcast today. And we’re going to have all of your contact information there as well, too. So thank.

Ann Bridges [00:37:46] You. Very wonderful. I would just end with, you know, you don’t have to be brilliant or a geologist to understand, you know, that the things that you rely on every single day do require these minerals to be extracted. So let’s do it right. Let’s do it here.

Stuart Turley [00:38:00] Oh, this is a refreshing conversation. And I’m going to fly out when I win my bet. If we get 25,000 downloads on this, we’ll go have lunch. But I want to go to a cocktail party with you and then really hear some of your discussions at those cocktail parties. So.

Ann Bridges [00:38:17] Okay, you may have to wait a year. We just literally opened up last week for Covid. Okay. Silicon Valley was the last one.

Ann Bridges [00:38:24] That’s funny. All right. Well, thank you very much.