While you may have heard me talk about the new pricing matrix and key factors influencing the prices, there is a complicated problem with diesel fuel at the pump. If you listen to the mainstream media, you will think it’s big oil taking profits at the cost of consumers’ pocketbooks.

Well, it is actually a lot more complicated. We’re dealing with some of the worst geopolitical problems since WWII. To figure out what’s causing the pain at the pump with diesel, we need to look at the EU and move through the supply line to the United States to see how the price trickles down to the pump.

Russia is projected to lose over 3 million barrels per day in production through the attrition of oilfield service companies leaving, buyers switching to other sources, and shut-in wells. There is a good question as to the ability of Russia to bring these wells back online in the future, though this does not put Russia out of selling oil even when there are purchasing embargos in place.

Let’s start with the world demand for oil products from 2020 to 2045. We can see from the graphic below that the pandemic in 2020 had a negative impact on world oil demand. The consistent growth in demand through 2045, even with the migration to renewable energy. The King Operating research team has data indicating that the “Greener” we go, the more fossil fuels we will require.

The EIA breaks down the country into several areas called the Petroleum Administration for Defense Districts (PADDs). The East Coast region includes states from Maine to Florida along the U.S. Atlantic Coast. The Gulf Coast region comprises states between New Mexico in the west to Alabama in the east along the Gulf of Mexico.

Looking at diesel and gasoline we see that the demand remains flat. Even with the projections for EV cars to take over the personal transportation sector the technology is not available to replace the power and long-haul capabilities of a diesel truck. The graphic below from the EIA helps show the different areas of the country by consumption and refinery capabilities. Texas and Louisiana gulf coast regions are the only areas with the additional refinery capacity.

The pipeline structure is critical to getting the refined products from the gulf coast region to the U.S. consumers. The entire east coast from New England to Florida is reliant on imports for their gas and diesel. The next graphic really points out the key for the pricing structure. The pipelines from the gulf service a significant portion of the United States through the Colonial and the Plantation pipelines. Florida can take advantage of tankers to provide refined products. They can do this by importing from the gulf coast using smaller tankers that are owned and operated by U.S. companies.

In New England and much of the east coast, they rely on refined products from countries outside the United States.

This is where you can see why the East Coast is facing the highest gas and diesel prices we have seen. The imports of diesel come from Russia and other refineries in the middle east. These are the same refineries that the EU is trying to source their transportation fuels. So, the pricing matrices are based upon where the refined product is shipped. Shipping by pipelines will be the only way the United States can ever become truly energy independent.

The Bottom Line

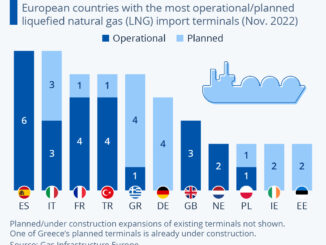

The EU is trying to source diesel from other non-Russian sources and has effectively caused a 30% decrease in Russian exports. The surplus has been picked up by Turkey and several other countries. Where this is going to get tricky is that after oil is refined and diesel is blended with smaller blends, the molecules are untraceable. Several countries like Iran are taking advantage of this hole in the supply side. The East Coast has been buying LNG from sanctioned countries for years, so why would they change their behavior now?

Mixing the blends does add costs, but as it is being purchased at a discount and demand will remain beyond demand destruction you will see a way for Russia to move both oil and diesel. Thus, protecting some cash flow while they create avenues to move energy to alternative markets.

Based on the numbers, the East Coast of the United States has the potential to see $7 diesel and higher this summer and into the fall. At this price, we will see many smaller independent trucking companies shut down, and inflation will have a dramatic boost in shipping costs being passed onto consumers.

The only way out of this crisis is to have energy policies that have incentives for pipelines build which will take years and a new political climate. A shorter-term solution would be enacting a wartime clause in the Jones Act (which has been done many times in the past) to allow refined products shipped from the Gulf Coast to the East Coast. Until then get ready for inflation, a recession, and the need for portfolio protection.

As always check with your CPA if alternative investments are good for your portfolio

Check out the tax savings guide. HERE.

Please reach out to our team at any time for answers to your questions.

Jay R. Young, CEO, King Operating

ForbesBooks Author of “The Upside of Investing in Oil and Gas”