Energy News Beat Publishers Note (ENB): The data is showing that the greener the energy movement goes – Oil production will also increase. Three reasons: 1: More total energy is being required 2: Green energy installations require a lot of fossil fuels to implement and 3: renewable power cannot solve the total energy demand. BP is wrong in the assumption that the peak oil production has occurred.

A multibillion-dollar project to tap virgin oil fields in east Africa is expected to get the green light this weekend, highlighting an uncomfortable truth about the energy industry.

Even as Total SE, the supermajor behind the new project straddling Uganda and Tanzania, makes genuine efforts to begin the transition to low-carbon energy, the industry is nowhere close to ending its appetite for oil.

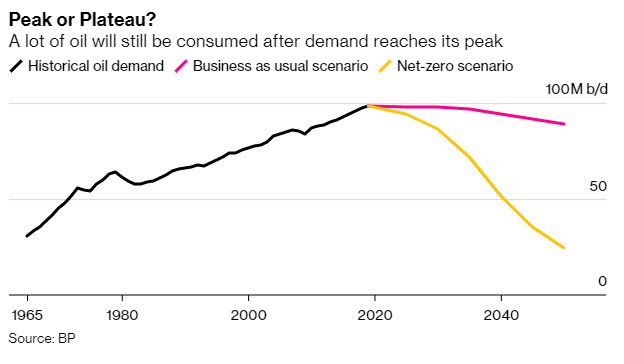

If you accept that petroleum demand may have already peaked — and that’s still a controversial opinion — the world is expected to burn hundreds of billions of barrels of oil in the coming decades.

That gives plenty of incentive for giants like Total or Royal Dutch Shell Plc, plus the hundreds of smaller explorers that remain in business, to keep searching the world’s frontiers for the next place to sink their drill bits.

BP Plc is the only oil major to have gone so far as to call an end to the era of oil demand growth. The London-based company said last year that consumption may never return to levels seen before the coronavirus pandemic.

The rest of the industry still expects at least another decade or so of demand growth before the global need for oil maxes out. And even BP’s less bullish outlook shows a world where a lot more petroleum will be used.

In the BP scenario where we achieve “net-zero” emissions by 2050 and oil demand falls rapidly, the world will still have an appetite for 660 billion barrels of oil over the period, according to the company’s estimates. That’s not too far below the 880 billion barrels consumed during the prior 30 years.

That’s partly because most companies expect greenhouse gases to be eliminated not by the world forsaking fossil fuels, but by using technology to capture their emissions, or planting trees to re-absorb them.

In BP’s “business as usual” scenario, where there’s limited progress in agreeing new measures to reduce carbon emissions but oil demand still sees little or no further growth, another 1.1 trillion barrels will have been used by 2050.

The sheer size of the demand that oil companies are anticipating in a lower-carbon future explains why Total is ready to spend $5.1 billion to drill along the remote shore of Lake Albert in Uganda and build a 1,443-kilometer (897-mile) heated pipeline to transport the waxy crude for export at the port of Tanga in Tanzania.

The more than 1 billion barrels that the project will tap are only a small drop in the ocean of what oil companies believe they can still sell in the future.