A basket case for years. Acquiring W.S. Badcock was another great idea; 7 months later, both are bankrupt and liquidating.

By Wolf Richter for WOLF STREET.

Conn’s Inc., which has long been in trouble and finally filed for bankruptcy last week, and seems to be liquidating, according to the “going out of business sale” now posted on its website, is a 552-store retailer of furniture, appliances, electronics, and mattresses; and it is a lender, including for rent-to-own, to subprime customers who could not borrow elsewhere to fund their purchases at Conn’s. And those businesses – retail and high-risk credit – were one, with high-risk credit opening the door for more sales, despite Conn’s protestations to the contrary in its quarterly reports.

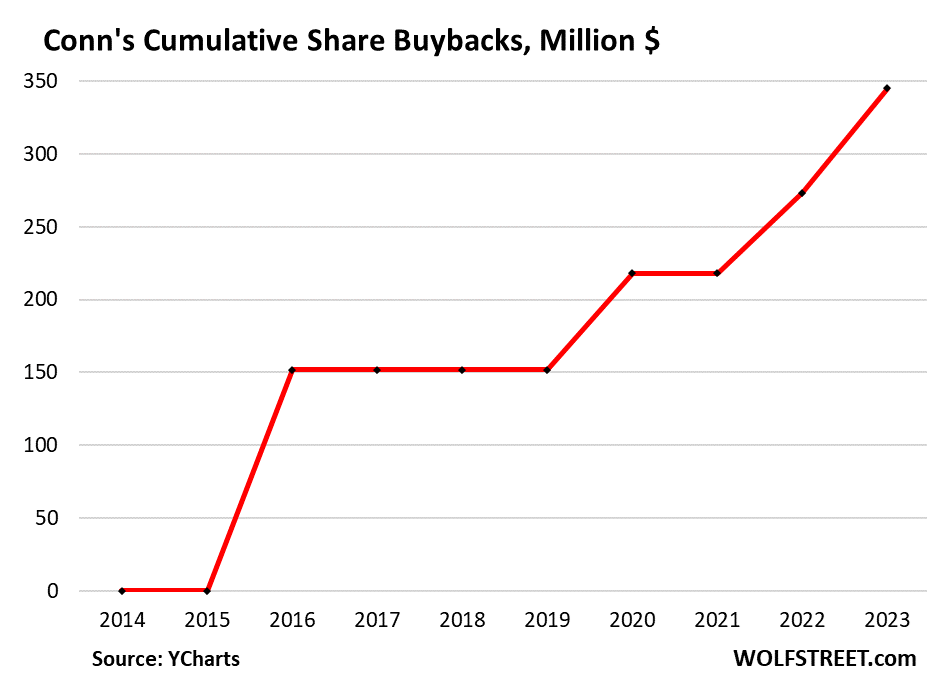

Let’s get this straight upfront: Conn’s wouldn’t have had to file for bankruptcy if it hadn’t kowtowed to Wall Street and incinerated $345 million in cash on share buybacks from 2016 through 2023, including $71 million in 2023 to unlock shareholder value or whatever, and prop up its collapsing shares, which expedited its fate.

Without those $345 million in share buybacks, it would have had enough cash and less debt to hang on for a while longer (data via YCharts):

The subprime-specialized retailer-lender then acquired with an all-share deal another troubled subprime-specialized retailer-lender, W.S. Badcock, in December 2023, with 376 stores. That addition to the 176 Conn’s stores brought the total store count to 552, according to its annual report for the fiscal year ended January 31, 2024.

The “Conn’s HomePlus” stores and “Badcock Home Furniture & more” stores are now engaged in an “everything must go” “Going Out Of Business Sale,” according to the landing pages of their respective websites. And “Conn’s no longer offers in-house credit,” it says, so bring your own damn money? The company appears to be liquidating.

Here are the credit-related subsidiaries involved in the bankruptcy:

Conn Credit Corporation, Inc.

CAI Credit Insurance Agency, Inc.

CAI Holding LLC

Conn Credit I, LP

New RTO, LLC

S. Badcock Credit I LLC

S. Badcock Credit LLC

S. Badcock LLC

Conn Lending, LLC.

Periodically, Conn’s stock collapsed when it confessed to credit issues. These are two different businesses – retailing and high-risk lending to its own customers. As with the subprime-specialized auto dealers (some of which have imploded, Conn’s-like), those two businesses are fused into one, despite assurances of a Chinese wall between them.

But to prop up sales, bigger credit risks are taken, which initially looks good on the quarterly earnings reports because the revenues are visible, but not the potential losses on the credit when those customers cannot pay. And then periodically, there was some housecleaning and disclosure, and the stock collapsed.

Conn’s is the story of a subprime-specialized brick-and-mortar retailer amid what we’ve called since 2016 the Brick-and-Mortar Meltdown that has sent countless retail chains into bankruptcy and liquidation as Americans shifted their shopping to ecommerce. Conn’s made it into our Brick-and-Mortar Meltdown in December 2019, when its shares plunged 33% that day when it admitted to big issues in its credit portfolio, which suddenly re-caused the company to re-become “prudent” again and “tighten credit,” which then caused same-store sales to drop 8.5%.

And in 2014, there was another admission of subprime credit issues, which caused its shares to collapse by 60% in a week, and by 83% from their all-time high of $79.24 in December 2013.

So now, instead of another disclosure of credit issues and a cleanup that caused sales to plunge, the company admits it has run out of runway, and it’s over. Mopping up the mess is going to take place in bankruptcy court.

There was a meme-stock quality to these shares before the phrase had even been invented. They rocketed higher to a $2.8 billion valuation at the end of 2013, and then plunged, but kept bouncing back, but never to the prior highs, and the result was a 10-year-long jagged downtrend to bankruptcy that started in December 2013. Today, shares closed at $0.35 on their way to worthless (data via YCharts):

Buying troubled competitor W.S. Badcock in 2023 was another great idea that made a desperate situation even worse. The all-share acquisition closed in December 2023, seven months before the bankruptcy filing.

At the time, Conn’s press release was titled: “Conn’s, Inc. Announces Transformative Transaction with W.S. Badcock LLC.” Indeed, it was very “transformative,” resulting in bankruptcy and liquidation seven months later of both companies.

The acquisition was supposed to cover up the plunge in Conn’s own revenues. They’d peaked in 2015 at $1.61 billion. By its fiscal year ended January 31, 2024, they’d dropped 23% to $1.24 billion, despite rampant inflation in the prior years, and despite aggressive lending to their subprime customers so that they could buy this stuff, whose ultimate losses will now be sorted out under the supervision of a judge:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/