Flip-flopping headlines from OPEC+ leaks and China COVID restrictions prompted a volatile day in crude markets today but WTI ended higher.

OPEC+ does “not like contango and that is what has raised market expectations of deeper cuts,” Amrita Sen, chief oil analyst at consultant Energy Aspects, said in a Bloomberg TV interview.

“I’m not ruling out deeper cuts — that’s of course on the table — but I would say that’s not our base case.”

Earlier in the session, prices rallied above $79 a barrel after Beijing said it would bolster vaccination among seniors then prices briefly flirted with losses after Reuters reported that the production cartel would stick with its current oil-output policy

API

Crude -7.85mm (-2.49mm exp) – biggest draw since April 2022

Cushing -150k

Gasoline +2.85mm

Distillates +4.01mm

This is the 3rd sizable crude draw in a row…and the 3rd straight week of sizable product builds…

Source: Bloomberg

WTI was hovering around $78.50 ahead of the API print and extended gains after…

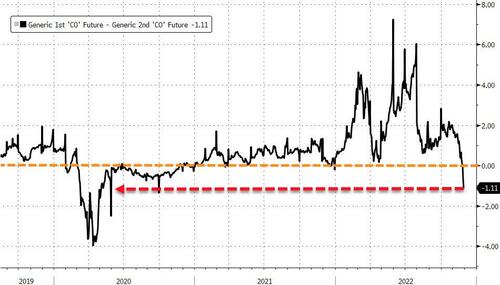

Notably, the shape of the futures curve has flipped in recent weeks, continuing to signal an oversupplied market.

Source: Bloomberg

That is the largest contango since 2020.