Oil prices pumped and dumped overnight as a big crude draw reported by API prompted gains into Asia and a statement crushing hopes of an end to China’s Zero-COVID policy sent prices back down to unchanged. Today’s FOMC decision and press conference are also weighing on traders desires to extend positions.

“Crude trades near the top of its range, but the lack of visibility regarding the short-term direction continues to keep the market mostly rangebound,” said Ole Hansen, head of commodities strategy at Saxo Bank.

“The demand side is torn between the prospect of a pickup in Chinese demand once Covid restrictions are lifted and worries global economic activity will continue to weaken in the coming months.”

The next leg from here will likely be driven in the short-term by the official inventory/demand data until The Fed hit at 1400ET..

API

Crude -6.53mm (+267k exp) – biggest draw since June

Cushing +883k

Gasoline -2.64mm

Distillates +865k (-733k exp)

DOE

Crude -3.115mm (+267k exp)

Cushing +1.267mm

Gasoline -1.257mm

Distillates +427k (-733k exp)

While not as extreme as the API report, official data showed an unexpected crude draw last week (and the 3rd weekly build in a row in distillates stocks)…

Source: Bloomberg

Cushing inventories are steadily rising, but remain at the lowest seasonal level since 2009. Refiners are set to wind up their fall maintenance, presenting a tug once again on domestic inventories. In addition, the final tranche of SPR sales are about to conclude.

Refinery utilization rebounded and is back to over the 90% mark nationwide. Rates rose after three consecutive weeks of declines as maintenance wraps up in all PADD regions.

Source: Bloomberg

Fuel tightness in the US East Coast is showing no signs of letting up. Last week, gasoline inventories slid further to the lowest since late November 2014.

Source: Bloomberg

And there is only 26 days of Diesel supply left…

Source: Bloomberg

Gasoline demand is falling yet again, based on the four-week moving average of product supplied. The figure sank over 200,000 b/d and is narrowing in on Fall 2020 levels. Despite this, critically low inventories continue to sink further even with refinery utilization on the rise.

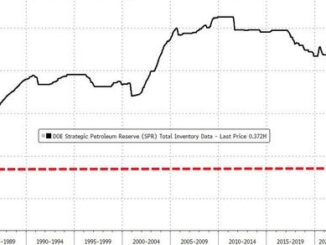

The Strategic Midterm Reserve dropped below 400mm barrels for the first time since 1984…

US Crude Production slowed last week, dropping to its lowest since June back below 12mm b/d…

Source: Bloomberg

WTI was hovering around $88.00 ahead of the official data and lifted modestly after the print…

Finally, Bloomberg notes that oil options markets have turned steadily more bullish in recent weeks. Premiums of bullish call options over bearish puts have climbed to the highest level since June, according to data compiled by Bloomberg.