Daily Standup Top Stories

China may be About to Unveil a New Global Currency: Dollar Dominance Challenged, Global Trade Reshaped

In the ever-evolving landscape of global finance, whispers from Beijing suggest that China may be on the cusp of a groundbreaking move: unveiling a new initiative that could position the yuan as a formidable contender […]

Russia Wins in China with New Pipeline

In a significant development underscoring the deepening energy ties between Russia and China, Presidents Vladimir Putin and Xi Jinping met in Beijing on September 2, 2025, where a breakthrough agreement on the Power of Siberia […]

Germany Sees Bigger Role for Gas to Keep the Lights On

In recent years, Germany has been at the forefront of the global energy transition, championing ambitious green policies and aggressively phasing out both coal and nuclear power. However, as the country grapples with energy shortages […]

US Records Highest Ever LNG Exports in August

The United States has achieved a new milestone in its liquefied natural gas (LNG) sector, exporting a record-breaking 9.33 million metric tons (MT) in August 2025. This figure surpasses the previous monthly high of 9.25 […]

Highlights of the Podcast

00:00 – Intro

00:12 – China may be About to Unveil a New Global Currency: Dollar Dominance Challenged, Global Trade Reshaped

03:46 – Russia Wins in China with New Pipeline

06:13 – Germany Sees Bigger Role for Gas to Keep the Lights On

08:41 – US Records Highest Ever LNG Exports in August

11:22 – Markets Update

12:51 – ConocoPhillips says it will cut workforce by 20-25%, shares fall

13:24 – Outro

Need Power For Your Data Center, Hospital, or Business?

– Get in Contact With The Show –

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:00] Will China take down the petrodollar? We’ll find out next on the Energy Newsbeat Standout. [00:00:04][4.4]

Michael Tanner: [00:00:12] China may be about to unveil a new global currency, dollar dominance challenge, and global energy trade reshaped. This is pretty unbelievable guys. There are whispers coming out of Beijing that suggest that China may on the cusp of a groundbreaking move which would be unveiling a new initiative that could position the yuan as a formal competitor to the dollar in the international currency arena. There is no official announcement that has been made as of September as we record this year on September 3rd, but recent developments within the BRICS Alliance, which again consist of Brazil, Russia, India, China, South Africa, and the newly expanded members, are pointing to an effort that its goal is to erode the U.S. Dollar’s longstanding hegemony. It’s not just about currency. This is extremely intertwined with what’s going on in the energy markets where the petrodollar has basically reigned supreme now for decades. As the stagnation of the BRICS Alliance has gone forward, this current week’s meeting of the Shanghai Cooperation Organization is extremely important. We’ve seen China, India, and Russia holding meetings this week. For this Shanghai cooperation organization, which basically is attempting to restructure trade between all three. And this idea that China is going to attempt to… Cut out the U.S. Petrodollar is something that we’ve heard about. We’ve covered this last year when BRICS was considering their alternative currency. But this is another push and could be an attempt to replace the yuan as instead of creating a new currency, let’s just use the yuan. And we’ve already seen this. I think the reason why this is coming up to surface is because Russia has proven the sanctions that the United States put on Russia showed the rest of the world that you can survive without using the dollar. And we know oil is generally traded in the dollar, AKA the petrodollar, but that’s not what Russia’s been doing. Russia has been denominating the oil in their own currency or in gold or other commodities. And so it’s shown China and India that they can survive not being beholden to the United States. And quite frankly, it’s one of the biggest leverage points the United State has internationally other than our military. I mean, outside of, you know, rolling tanks through New Delhi, but what else can we do to make India do what we want? Well, we could theoretically put economic sanctions on them, kick them out of swift and do all that. The problem is Russia has shown that you can survive without that. So it was a real miscalculation from that standpoint, and this would completely reshape the energy markets. I mean if you started seeing a Petro-Huan where these oil and gas trades are now settled in Huan, This would absolutely expose the fragility of the U.S. Financial system, and so I think it’s pretty unbelievable. Stu’s done a great job talking about this, but this is something that I want to keep on the people’s mind. We did see that People’s Bank of China Governor Peng Gaoxuan has openly, quote-unquote, envisioned a future where multiple sovereign currencies coexist and compete signaling, which is an end to the unilateral dollar damas. So we’re going to keep an eye on this one. We’ve also seen China go all in on gold. Now for nine straight months now increased their purchase of gold. They’re currently sitting on about 2300 tons of gold, which is valued a little over $208 billion, which isn’t, I mean, a lot by Chinese standards, but they’re going to continue to increase this, you know, as the volatility of oil goes up, the stability of other hard commodities goes up. So it’s going to be very interesting to see. [00:03:46][213.7]

Michael Tanner: [00:03:46] Let’s jump to the next one here. Russia wins in China with new pipeline sticking on our Russia China theme. There is a new energy tie or a deepening of the energy ties between Russia and China in this meeting of the Shanghai Cooperation Initiative or Organization as it’s called. They introduced the Power of Siberia 2 pipeline, which has been long in negotiation, which has now been approved in partnership with Gazprom and have signed a legal binding memo to construct the pipeline and it will be going through Mongolia. So if we can go ahead and put this picture up on the screen, the power of Siberia, where the natural gas pipeline runs between Russia and China. If you’re listening to this, what we see is the original power of Syberia I, which sort of does kind of a hook and ladder from Irkutsk and the Kovata field, which is heavy in natural gas in Southern Russia, swoops around and ends up in China through, I’m not even gonna go and attempt to pronounce that name, Blago Stagnsten. That’s my hybrid German-Russian right there. Whereas now the power of Siberia too will go from the Yamal Peninsula, which is very, very rich, solid natural gas goes directly through Mongolia and into China. Very interesting. You know, as we talked a little bit about. In the open, which Stu and I were kind of talking about stories for me to cover here, you know, this pipeline is actually a much larger in diameter pipeline, which is why it’s a lot harder to move and crack, because my first thought was, well, why go through Mongolia? Just cut them all out to the middle and just go directly into China. Well, it makes sense from the standpoint of, you know the large diameter pipe makes it easier just to roll straight. Mongolia gets a little bit of out here, but I mean, this is all of this gas, and I think this is the interesting part about this. This is gonna completely reshape the global energy markets because from the standpoint of a lot of this gas was going to Europe and now it’s going to China and. What’s going to happen? You know, we, we’re about to cover Germany’s lights are turning off because they’re gone all in on renewable energy. Well, the gas that could helping them keep the lights on is now being redirected through Siberia and heading down to China through this power of Siberia too, so I think it’s a, for, for obviously for Russia and China, this is a great agreement. We, you know, knew this was probably going to get signed, but it was made official at this meeting over the last couple of days, but I think it’s disaster for Germany. I want to roll and and really the European Union at large. [00:06:13][147.2]

Michael Tanner: [00:06:13] I want a roll into this next one here. Germany sees bigger role for gas to keep the lights on guys. This is pretty Unbelievable, you know as we know Germany has been really at the forefront of this global energy transition It championed a pretty strong and ambitious green policies and aggressively attempted to phase out both coal and nuclear power. The interesting part is they’re now dealing with energy shortages and growing instability in their power grid. We are now seeing natural gas emerge as a critical resource that they are continuing to need in order to help keep the lights on. It’s pretty unbelievable that their energy mix has undergone a drastic transformation over the past two decades. The country’s energy transition or what they call energy energy in wind aimed to replace fossil fuels and nuclear power with wind and solar by 2024. Wind and solar count of nearly 55 of their electrical generation while coal had dropped below 25 percent and nuclear power so dumb that was phased out entirely in 2023. Natural gas once a minor player is now 20% so this goes back to what Turley is talking about from Turley’s law okay as we increase renewable use we also have to increase natural gas because the intermittencies of this stuff so it’s pretty unbelievable it’s very you know in terms of this achieving net zero probably not going to happen and it well it’s not not that it’s probably not him it’s not going happen unless unless you consider natural gas a net zero which I don’t think most people do, so it’s just, I mean, we do, I love natural gas, but I don’t t think people in Germany are going to get that. So it just goes to show you guys that the more you dive into renewables, the more you’re going to need natural gas. And that’s fine. Renewables are fine. I’m not the biggest wind power guy, but hey, guess what? If- need renewables as part of your energy stack. Just know you’re going to need natural gas because it’s a baseload energy power and obviously natural gas is better than coal so I don’t fault anybody there but I’m just going to read quickly the bottom line here. Germany’s experience underscores the complexities of transitioning to a green economy. While renewables are critical for long-term climate goals, the company’s recent struggles reveal the importance of a balanced and reliable energy mix. Quote, renewables in its current form are not sustainable nor are they for the environment. They only work when the sun shines, the wind blows, or subsidies flows. This is also one, and I’ll leave you with this guys, there’s also one has to ask when will the Germans demand that nuclear reactors start being turned back on? They turned off clean energy, which has led to the energy crisis. I think that’s the craziest part. [00:08:40][146.8]

Michael Tanner: [00:08:41] Next up here guys, US records highest ever LNG exports in August. This is pretty unbelievable guys. The United States has continued to increase its LNG export and has reached a new record in the month of August 2025, 9.3 million metric tons of exports. This surpasses the previous monthly high of 9.25 metric tons, which was set back in April of 2025 and represents a pretty large increase from July’s 9.1 metric tons. A lot of this has to do with increased production from new facilities coming online and also strong demand from international market. Specifically Europe so I think this is pretty unbelievable we go down here and we see so who’s buying all this LNG Italy Germany Egypt India France Dominican Republic Belgium Greece Croatia Finland I mean Japan it’s all these EU countries I mean that’s the funniest part about this the EU has gone all in on renewals yet they’re continuing to increase LNG so to go back to what we talked about with this power of Siberia well for the United States it could actually good thing because now there’s a market in Europe for all of our natural gas and LNG so it actually could all work out if China begins to buy all of Russian natural gas it all then goes to India and then the EU is left buying it from the United States I mean heck it works out for us here in America but the question is does it make EU secure. I don’t know about that. So it’s going to be very interesting guys, but shout out to the United States LNG record exports in August of 2025. [00:10:10][89.4]

Michael Tanner: [00:10:11] Well, let’s jump to oil and gas finance guys. Before we do that, let us quickly pay the bills as always. Thank you for checking us out. World’s greatest website, energynewsbeat.com. Subscribe to our substack, theenergynewsbeat.substack.com again. That’s the energynewsbeat.sub stack.com Thank you to Reese Energy Consulting for being a wonderful sponsor of the show, guys. TheBestMidstreamConsultants. You have any questions about the midstream space or you’re in the upstream space and you need help dealing? With the midstream space. They have the ever. Hundreds of years of experience to help answer those questions. Guys, reeseenergyconsulting.com. Check them out, tell them Energy News. We said to you, and finally, guys, it’s never too early to start thinking about your 2025 tax situation. December’s right around the corner here, and you don’t want to be left scrambling to figure out how to not pay Uncle Sam and figure out to minimize your tax liability. Investinoil.energynewsbeat.com is a great resource to find out what’s your tax burden, take an oil and gas portfolio survey and figure out exactly what the best place to do with your capital is. We love oil and gas here. Fill out that portfolio survey. We’ll send you a quick, quick. A bunch of information and depending on if you qualify, we will point you in the right direction guys. That’s invest in oil dot energy newsbeat. [00:11:22][70.9]

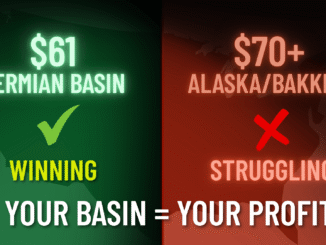

Michael Tanner: [00:11:22] Let’s go ahead and run through top line indices, S&P 500 up about half a percentage point. Nasdaq up about six-tenths of a percentage, point two and 10 year yields dropped about 0.5 percentage points and about one percentage points, dollar index down about a tenth of a percentage points. Bitcoin up about one-percentage point, $112,000. Crude oil dropped about 2.5% points, about $1.65 down to $63.95. Brent oil pretty flat, $67.59. Natural gas up about two-per percentage points $3.06. XOP, E&P securities contract down about 2.5 percentage points and OIA, which are oil field service down 1.9 percentage points. Now the big news of the day really that drove prices down was the fact that OPEC in their meeting that’s upcoming Sunday, they are considering to possibly continue and further raise oil production. Above and beyond those 2.2 million barrels that they’ve already put on the market, which went from April to September. So the real question is, will they do that? I know Stu would tell you, I think there’s some, some spare capacity issues with specifically Saudi Arabia and what’s going on with OPEC. I don’t necessarily know if I agree with that, but you can make the argument pressure depletion is obviously a real thing over there. So. It’s going to be very interesting to see how that plays out. We’ll be following that very, very close, but that’s really the big reason why we saw this massive drop in prices that it was because of this. So I think it’s going be extremely, extremely interesting to see how plays out. [00:12:50][88.1]

Michael Tanner: [00:12:51] The final story, which is actually pretty sad. ConocoPhillips came out and said they’re going to cut their workforce by 20 to 25%. That’s going basically be about 2,600 and 3,200 employees be effective. Never a great sign when your CEO comes out and says, I know these changes create uncertainty and they are unsettling. It’s never, never great when your SEO says things are unsettled. So we will continue to follow that. I think this is just part of what happens in a consolidated era as, as cost inputs go up, prices go down. It’s going to force people to make these cuts. So it’s going be very unfortunate. And I feel for everybody at ConocoPhillips is going to be affected by this. [00:13:24][33.0]

Michael Tanner: [00:13:24] So But with that guys, we’re gonna let you get out of here, get back to work, start your week. We’ve got some great podcasts coming out on Friday. Stu is gonna be interviewing some data center people. So check that out, the weekly recap guys. But as always, thank you for checking us out. We’ll see you next time. [00:13:24][0.0][793.4]