By Wolf Richter for WOLF STREET.

Distressed debt exchanges are an alternative by companies to restructuring their unmanageable debts in a bankruptcy court, if they can get their creditors to agree to what are usually haircuts of some form. Distressed debt exchanges are a form of default, though they’re not always included in default rates.

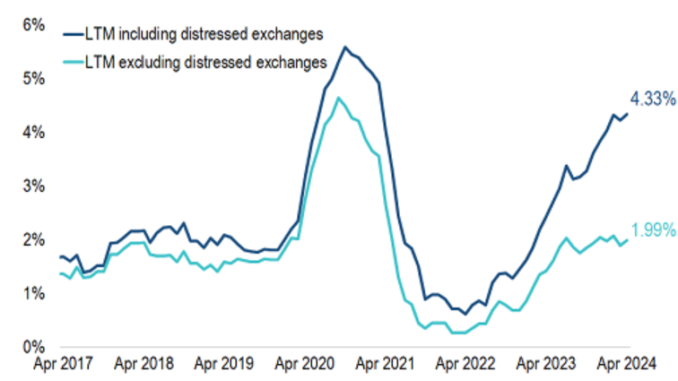

But when distressed debt exchanges are included, the default rates are much higher. And the number of distressed debt exchanges has surged since the Fed started hiking interest rates. And thanks to the ultra-loose financial conditions despite the Fed’s tightening, investors are eager to work out deals.

Hard defaults and bankruptcies in April. In terms of leveraged loans in the Morningstar LSTA US Leveraged Loan Index, the default rate in April by number of companies ticked up to 1.99%, which is above the 10-year average of 1.61%, according to LCD, now a unit of PitchBook. Included in April were:

ConvergeOne Holdings, which provides cloud computing, cyber security, and other services through its subsidiaries, filed for a prepackaged Chapter 11 bankruptcy, after it failed to make payments on $1.23 billion in leverage loans.

Xplore Inc., a Canadian rural broadband service provider, deferred interest payments on over $1.2 billion in leveraged loans (most of it in USD).

Distressed debt exchanges in April. But when distressed debt exchanges are included, the default rate by issuer count rose to 4.33%, according to LCD.

Two companies with leveraged loans in the Morningstar LSTA US Leveraged Loan Index conducted distressed debt exchanges in April:

Rackspace Technology Global, an Apollo-backed cloud computing service provider, got most of the holders of a $2.3 billion first-lien leveraged loan to agree to haircuts via three debt exchanges.

City Brewing Co., which brews beers and makes beverages under contract for other brands, got a majority of holders of its $850 million in senior secured term loan B to agree to a debt exchange, which cause S&P Global to downgrade the company to D for Default (our cheat sheet for corporate credit ratings by rating agency). LCD notes that “the term loan B lenders that elect not to participate in the exchange will have a reduced claim on collateral, diminishing their recovery prospects.”

LCD tracks both, the leveraged loan default rate without debt exchanges (1.99%), and with debt exchanges (4.33%). Chart via LCD/PitchBook:

Leveraged loans – the issuers are “junk”-rated companies with credit ratings of BB and below – are generally secured by some collateral.

Banks originate many leveraged loans, but they don’t keep them on their balance sheets because they’re too risky; they sell them to investors such as loan funds and institutional investors seeking to increase their returns; or they securitize them into Collateralized Loan Obligations (CLO) that are then bought by investors. Sometimes banks get stuck with leveraged loans as yields jump and investors vanish suddenly, and then the banks eventually have to sell those loans at a discount and take some losses. But they do sell them. So when leveraged loans go bad after they’re sold, it’s investors that take the losses.

Private credit has been aggressively going after the leverage-loan business, competing directly with banks. And this has been a booming business, and investors are on the hook for any losses, not banks.

Leveraged loans are traded in the leveraged loan market and are tracked by the Morningstar LSTA US Leveraged Loan Index.

Since they come with floating interest rates, their interest payments increase when the Fed hikes its policy rates, unlike fixed-rate bonds, and so they hold their value, which makes them attractive for risk-tolerant yield investors during times of rising yields.

But, but, but… Rising rates, and therefore much higher interest payments – precisely why they’re appreciated by investors – also make it more difficult for the already junk-rated borrowers to come up with the cash to make those much higher interest payments. And so stressed build up, default rates rise, and debt restructuring follows.

Nevertheless, thanks to the ultra-loose financial conditions, and similar to the dazzling boom in junk bond issuance so far this year, leveraged-loan issuance has soared from the ashes in Q1, reaching $325 billion, according to LCD, just a hair below the free-money record of Q1 2021, and nearly five times the volume of Q1 last year.

Distressed debt exchanges are also a growing thing in the junk-bond arena. A shining example we’ve covered here was the distressed debt exchange by Carvana, proposed in March 2023. Moody’s considered the transaction a “limited default.” Carvana got its unsecured note holders – PE firms led by Apollo that had bought the unsecured notes for cents on the dollar amid bankruptcy talk – to agree to exchange that debt for new 2nd lien secured debt, but for an amount that was much smaller than the face value of the unsecured notes.

The PE firms made money on the deal because they’d bought the unsecured notes for cents on the dollar. And with the new 2nd-lien secured debt, they also ended up higher in the capital structure. The exchange wiped out $889 million in debt – which Carvana booked as a one-time gain (debt forgiveness) in Q3. Everyone came out ahead in this deal except the investors that sold the original bonds for cents on the dollar to the PE firms.

Source: