“The “reacceleration of inflation” suggests “the Fed cannot totally shift its focus away from its inflation target.”

By Wolf Richter for WOLF STREET.

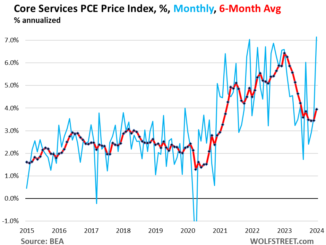

Underlying inflationary dynamics are picking up steam, after having cooled a lot. Today, S&P’s preliminary Flash US Composite PMI (Purchasing Manager Index), based on data collected from September 12 through 20, entailed multiple warnings about the Fed’s future rate cuts, in light of reaccelerating selling-price inflation in both the services and manufacturing sectors, and in light of input-cost inflation in services.

The price gauges of the PMIs “serve as a warning” that “the FOMC may need to move cautiously in implementing further rate cuts,” the report said. We’ve already seen the second month-to-month re-acceleration in a row of CPI inflation.

Overall, “business activity growth remained robust in September,” the PMI report said. The flash Composite PMI, which combines services and manufacturing PMIs, came in at 54.4 in September, indicating solid growth (above 50 = growth compared to the prior month). With July and August also showing solid growth, September is “rounding off the strongest quarter since the first three months of 2022.”

The Composite PMI was driven by strong growth in services, which make up the majority of the economy, and “modestly falling output” in the manufacturing sector.

Continued divergence between services and manufacturing.

The S&P’s Flash Services PMI for August came in a 55.4, meaning growth at a “solid pace,” with “the rate of increase running at the second-highest seen over the past 29 months.” The Services PMI has shown roughly the same pace of solid growth for the past five months. Services are the majority of the economy, and they carry it.

Manufacturing, which accounts for a much smaller part of the economy and employment, has been in the doldrums coming off the phenomenal spike during the pandemic. For September, the flash Manufacturing PMI ticked down “modestly” to a 15-month low of 47 (below 50 = contraction compared to the prior month).

Inflation dynamics entail a warning to the Fed about rate cuts.

“Prices charged for goods and services are both rising at the fastest rates for six months, with input costs in the services sector – a major component of which is wages and salaries – rising at the fastest rate for a year,” the report said.

“The “reacceleration of inflation” suggests that “the Fed cannot totally shift its focus away from its inflation target as it seeks to sustain the economic upturn,” the report said.

“The survey’s price gauges meanwhile serve as a warning that, despite the PMI indicating a further deterioration of the hiring trend in September, the FOMC may need to move cautiously in implementing further rate cuts,” the report said.

Selling price inflation in both, services and manufacturing: “Prices charged rose at the fastest rate for six months, pushed higher by input cost growth accelerating to a one-year high,” it said.

“The acceleration of selling price inflation was common across goods [manufacturing] and services, in both cases hitting six-month highs,” and “in both cases running above pre-pandemic long-run averages to point to elevated rates of increase,” it said.

Input cost inflation: services diverge from manufacturing. “Service sector input cost growth notably struck a 12-month high, linked to reports of wage growth,” it said.

“Higher charges were driven by increased costs, with input costs rising at fastest pace for a year in September,” and it was “often linked to the need to raise pay rates for staff,” it said.

“In contrast, manufacturing input cost growth cooled to a six-month low thanks to lower energy prices and fewer supply chain price pressures,” it said.

How the PMIs work. They are based on surveys of a panel of company executives that get the survey each month.

A value = 50 means that there was no change in the current month from the prior month: the number of respondents who said there was growth equals the number of respondents who said there was a decline, and the rest said there was no change.

A value higher than 50 means that more respondents said there was growth than said there was decline, and the rest said there was no change, in the current month from the prior month.

Conversely, a value below 50 means decline. The distanced from 50 indicates the pace of growth or contraction in the current month from the prior month.

Take the Survey at https://survey.energynewsbeat.com/