And labor market conditions are no longer easing. The reasons for further rate cuts — dropping inflation, weakening labor market — vanished. Pretty hawkish.

By Wolf Richter for WOLF STREET.

The FOMC voted unanimously today to keep the Fed’s five policy rates unchanged, as widely telegraphed, after 100 basis points in cuts over the past three meetings:

- Target range for the federal funds rate at 4.25-4.50%.

- Interest it pays the banks on reserves at 4.40%.

- Interest it pays on overnight Reverse Repos (ON RRPs) at 4.25%

- Interest it charges on overnight Repos at 4.50%.

- Interest it charges banks to borrow at the “Discount Window” at 4.50%.

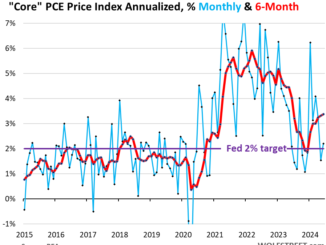

A month ago, at the December meeting, the Fed had shaken up markets with the FOMC statement, press conference, and projection materials that had pushed back against rate cut expectations for 2025. The median projection of the FOMC members indicated only 50 basis points in cuts all year, in face of reheating inflation that had caused Powell to lament at the press conference: “We still have work to do though, is how we’re looking at it. And we need policy to remain restrictive to get that work done, we think.” And he then threw doubts on those two rate cuts in 2025.

Since then, the Consumer Price Index for December, released in mid-January, has accelerated further, with the month-to-month CPI accelerating to +4.8% annualized, the worst increase since February; with the three-month CPI accelerating to +3.9% annualized, the worst increase since April; and with the year-over-year CPI accelerating to +2.9%, the worst increase since July. The PCE price index for December, which the Fed favors, will be released at the end of this week.

The labor market has been relatively solid, though it has cooled from its overheated state after the pandemic. A weakening labor market would provide urgency for rate cuts, but that’s not the case; that was the case briefly over the summer, which had triggered the 50-basis-point cut in September, but that data was upwardly revised, and the data points that followed were decent, and turns out, the labor market is just fine.

With inflation accelerating again, and the labor market on reasonably solid footing, the Fed pivoted back to wait-and-see.

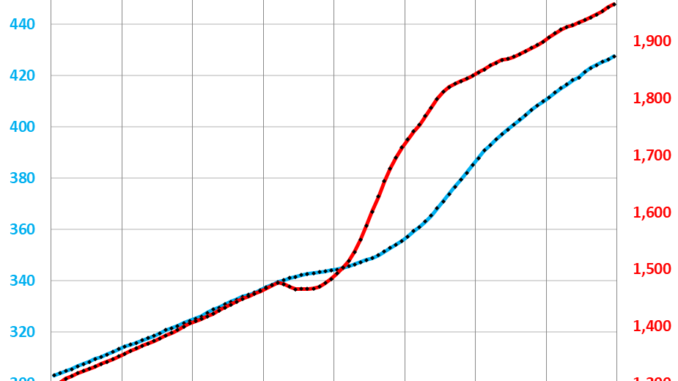

QT continues. The Fed has already shed $2.11 trillion in assets since it started QT in July 2022, and according to the FOMC’s Implementation Notes today, will continue to shed Treasury securities and MBS as outlined in May.

It was a no-dot-plot meeting. Today was one of the four meetings a year when the FOMC does not release a “Summary of Economic Projections” (SEP), which includes the infamous “dot plot” which shows how each FOMC member sees the development of future policy rates. SEP releases occur at meetings that are near the end of the quarter. The next SEP will be released on March 19 after the FOMC meeting.

What changed in the FOMC’s statement:

New: “The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid.”

Old: “Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low.”

Meaning: Labor market conditions are no longer easing.

New: “Inflation remains somewhat elevated.”

Old: “Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.”

Meaning: No more “progress toward” the 2% objective, as inflation has been rising recently.

New: “…decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent.”

Old: “…decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/4 to 4-1/2 percent.”

Here’s my discussion of the FOMC post-meeting press conference: Powell: In “No Hurry” to Cut, Need to See “Further Progress” on Inflation, No Timeline to End QT (Not Even Close)

The whole statement:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

We give you energy news and help invest in energy projects too, click here to learn more