Last time, $840 billion got sucked out in 5 months, all from excess cash in ON RRPs. But after $2.26 trillion of QT, ON RRPs are nearly gone.

By Wolf Richter for WOLF STREET.

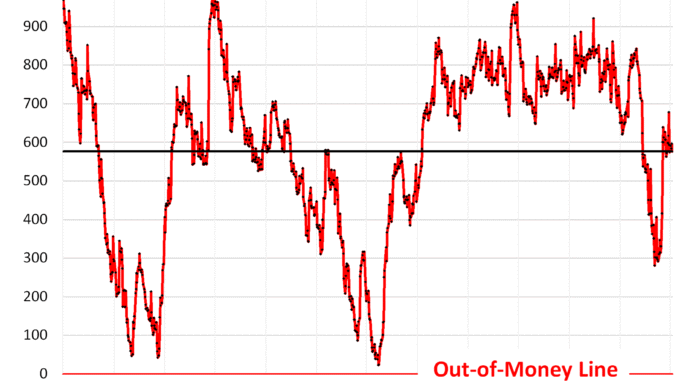

Back on April 3, 2025, cash in the government’s checking account, the Treasury General Account (TGA) at the Federal Reserve Bank of New York, had plunged to $296 billion, from over $800 billion in mid-February. Then came the flood of tax receipts, and by April 16, the TGA balance had shot up to $639 billion, and by April 30, to $678 billion. Then, the balance began to decline again.

On May 8, the closing balance was already down by $100 billion, to $576 billion, according to the Treasury Department. The flood of tax receipts likely moved the out-of-money date into August. The balance of the TGA got pretty close to zero during the prior debt-ceiling farces, which is about when Congress agrees to lift/suspend the debt ceiling. The TGA is cash parked at the Fed and is a liability on the Fed’s balance sheet. Draining the TGA pulls that cash from the Fed and throws it into the markets. That’s what we’re seeing now.

But note what happened the last two times after the debt ceiling was lifted or suspended: the TGA balance exploded.

The balance in the TGA is determined by the cash inflow from issuance of Treasury debt and collections from taxes, fees, and tariffs, minus the cash outflow to pay for daily outlays and to pay off maturing Treasury securities. The daily inflows and outflows can be huge.

The desired level of cash in the TGA is $800 billion to accommodate those huge daily flows, according to the Treasury Department. Once the debt ceiling is lifted/suspended, the TGA will be refilled pronto.

In 2023, in the six weeks between June 1 and July 11, the government sucked $520 billion in liquidity back out of the financial markets to refill the TGA by issuing huge amounts of T-bills on top of the long-scheduled regular auctions. Then over the next 3.5 months, it sucked another $320 billion out of the markets, $840 billion in total in less than five months.

But back then, that cash came entirely out of the cash that money market funds had parked at the Fed via overnight reverse repos (ON RRPs). ON RRPs essentially represent cash that money market funds don’t know what to do with, and so they place it at the Fed and collect interest.

ON RRPs plunged by $1 trillion in less than five months as money-market funds bought the T-bills that the government issued and paid for them with the cash from unwinding their ON RRPs at the Fed.

Last time when the debt ceiling was suspended, on June 3, 2023, money market funds had $2.2 trillion in excess liquidity parked in ON RRPs at the Fed, some of which they deployed to buy those T-bills that the government issued to refill the TGA.

ON RRPs are a liability on the Fed’s balance sheet, like the TGA. And the cash to refill the TGA essentially came from ON RRPs at the Fed via money market funds and T-bill issuance. From the Fed to the Fed. And markets barely noticed.

This time around, the Fed’s $2.26 trillion in QT has whittled down that excess liquidity in ON RRPs to just $142 billion. And if the TGA gets drawn down to near-zero again, and if Treasury then issues $800 billion in additional T-bills over a few months later this year and early next year, ON RRPs can only provide a small portion of that cash, and the rest of the cash to buy those T-bills will come from the financial markets and the banking system’s reserve balances at the Fed.

That’s what is different this time, compared to the last two times. This time, financial markets are going to notice that $800 billion in liquidity getting sucked out in a short time.

Buying a little bit of time: The large inflow this year by Tax Day pushed out the TGA’s out-of-money day. The tax haul was driven in part by massive capital gains taxes. The S&P 500 gained 26% in 2024 after having already gained 21% in 2023. Investors who sold winners in 2024 had to pay capital gains taxes by April 15. Payroll taxes were also strong, driven by record employment and record high wages. And then in April, $17 billion in tariffs washed into the TGA, up by 81% from March.

All this bought a little bit of time before the liquidity drain on the financial markets begins – assuming that Congress waits again till the last minute to raise/suspend the debt ceiling, rather than doing it, like, right now.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()