Amid tight supply and solid demand.

By Wolf Richter for WOLF STREET.

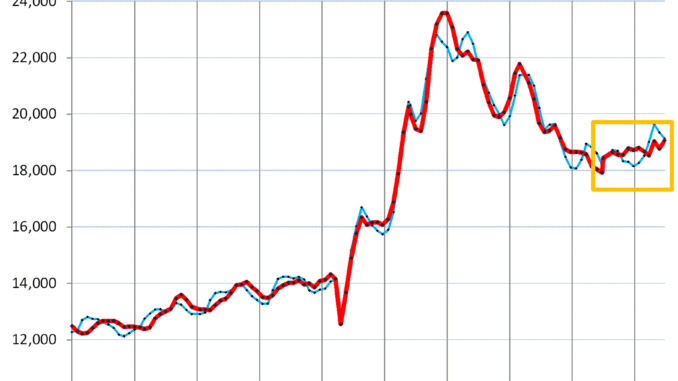

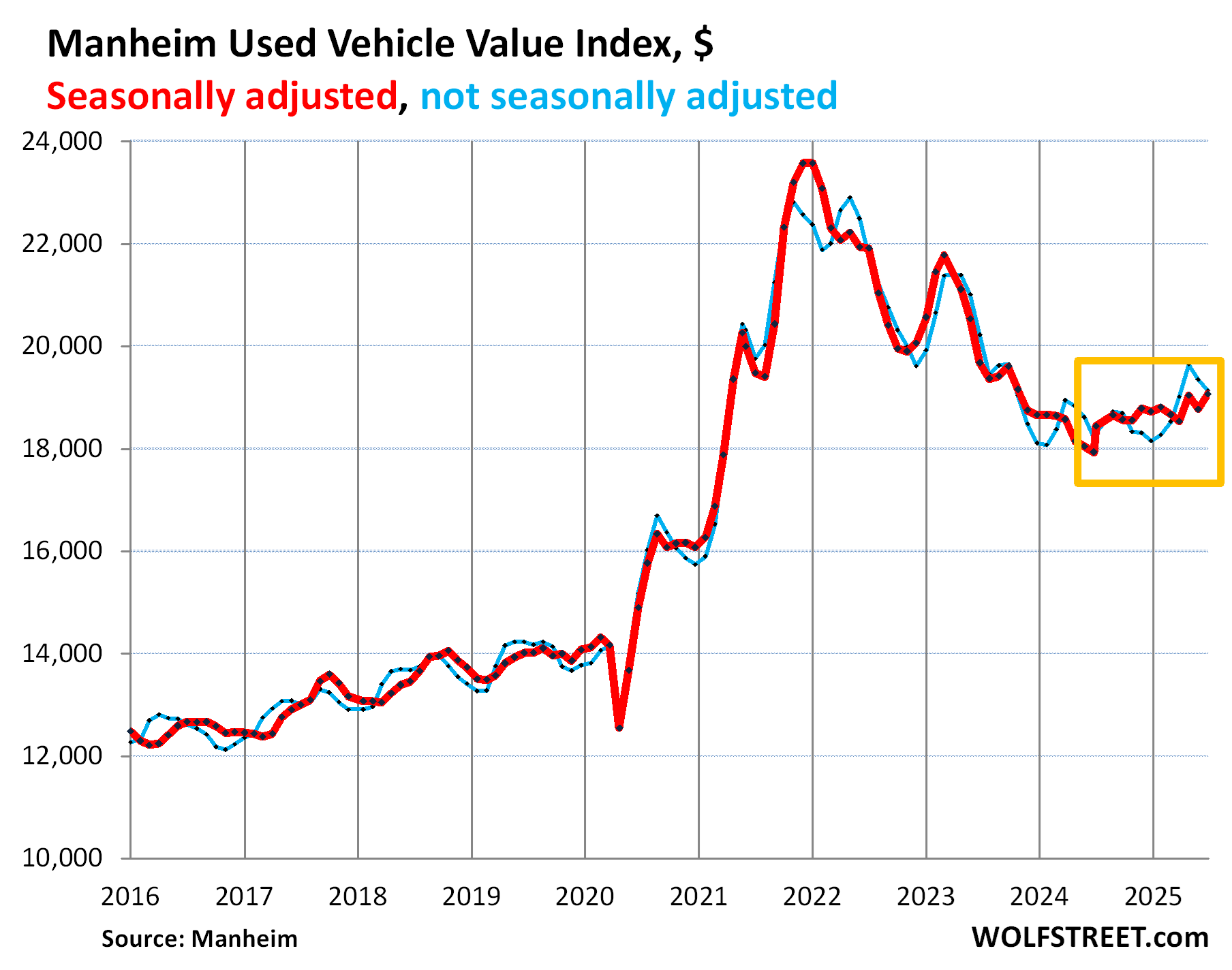

Inflation pressures in used vehicle prices, after the historic plunge from the historic spike, have now been rebuilding for an entire year.

Prices of used vehicles sold at auctions where franchised and independent dealers replenish their inventories jumped by 1.6% in June from May, and were up by 6.3% year-over-year, seasonally adjusted (red line). Not seasonally adjusted, prices were up by 5.1% year-over-year (blue line).

Is Oil & Gas Right for Your Portfolio?

These year-over-year price increases, which began in November 2024, were the biggest since mid-2022 when the historic price spike petered out.

The data is from today’s Used Vehicle Value Index by Manheim, the largest auto auction house in the US, and a unit of Cox Automotive. The index is adjusted for changes in mix and mileage.

Supply at these auctions comes from rental fleets that sell vehicles they pulled out of service, from finance companies that sell their off-lease vehicles and repos, from corporate and government fleets, other dealers, etc. These prices are the costs for dealers. Prices that consumers pay when they buy from dealers, as tracked by the used-vehicle CPI, follow these wholesale prices with a lag.

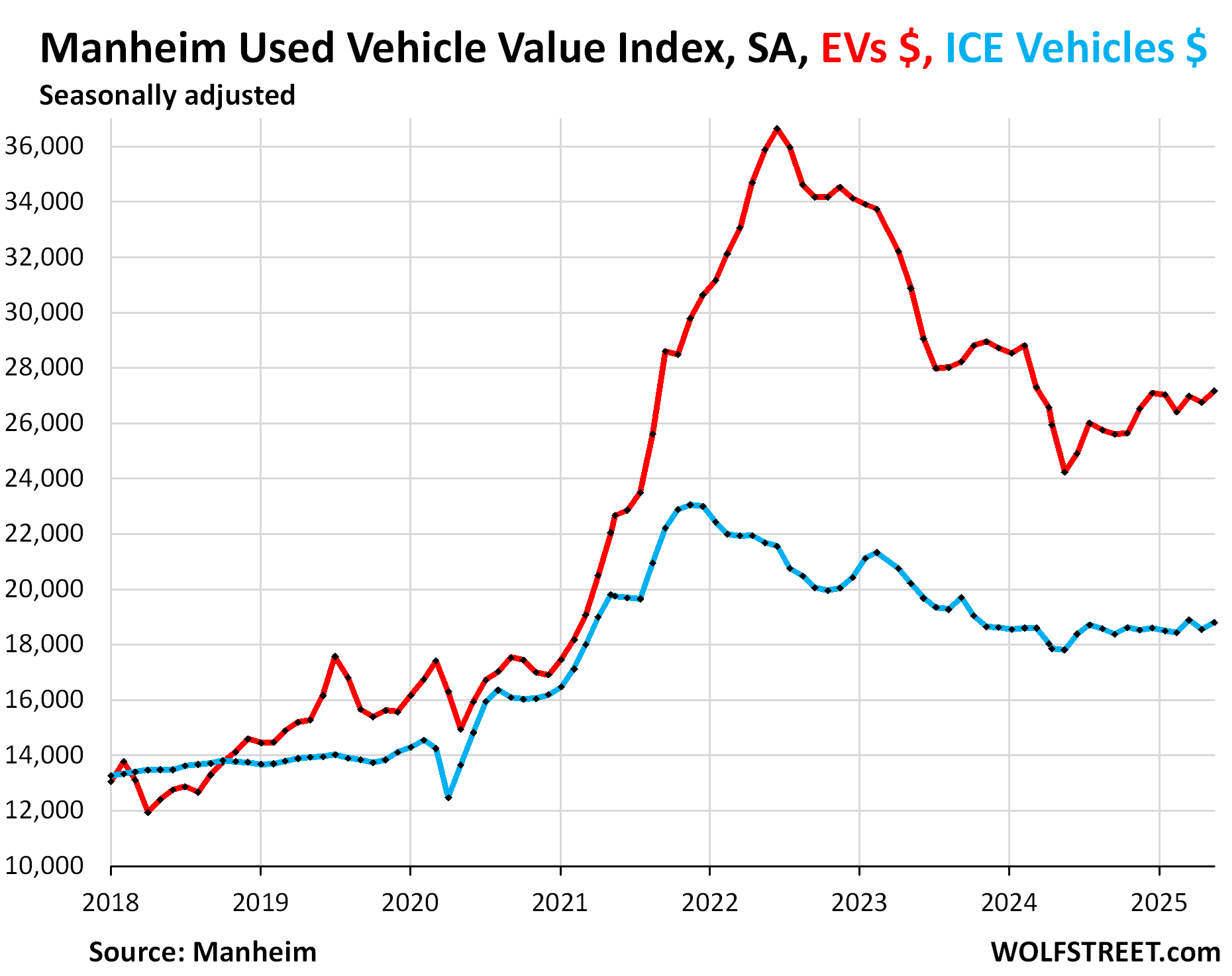

Some of the price pressures come from EVs.

Used EV wholesale prices have been ratcheting higher for a year at a substantial rate, and in June were up by 12.1% year-over-year seasonally adjusted, and by 9.8% not seasonally adjusted, according to the data from Manheim.

Prices of used vehicles with internal combustion engines (ICE) were up year-over-year by 5.6% seasonally adjusted, and by 4.5% not seasonally adjusted.

Both EV and ICE-vehicle year-over-year price increases in June were the hottest since mid-2022, but EV prices increased by over double the rate of ICE vehicle prices.

EVs are still a small but rapidly growing segment of what’s going through auctions, supplied mostly by lease returns and rental fleets.

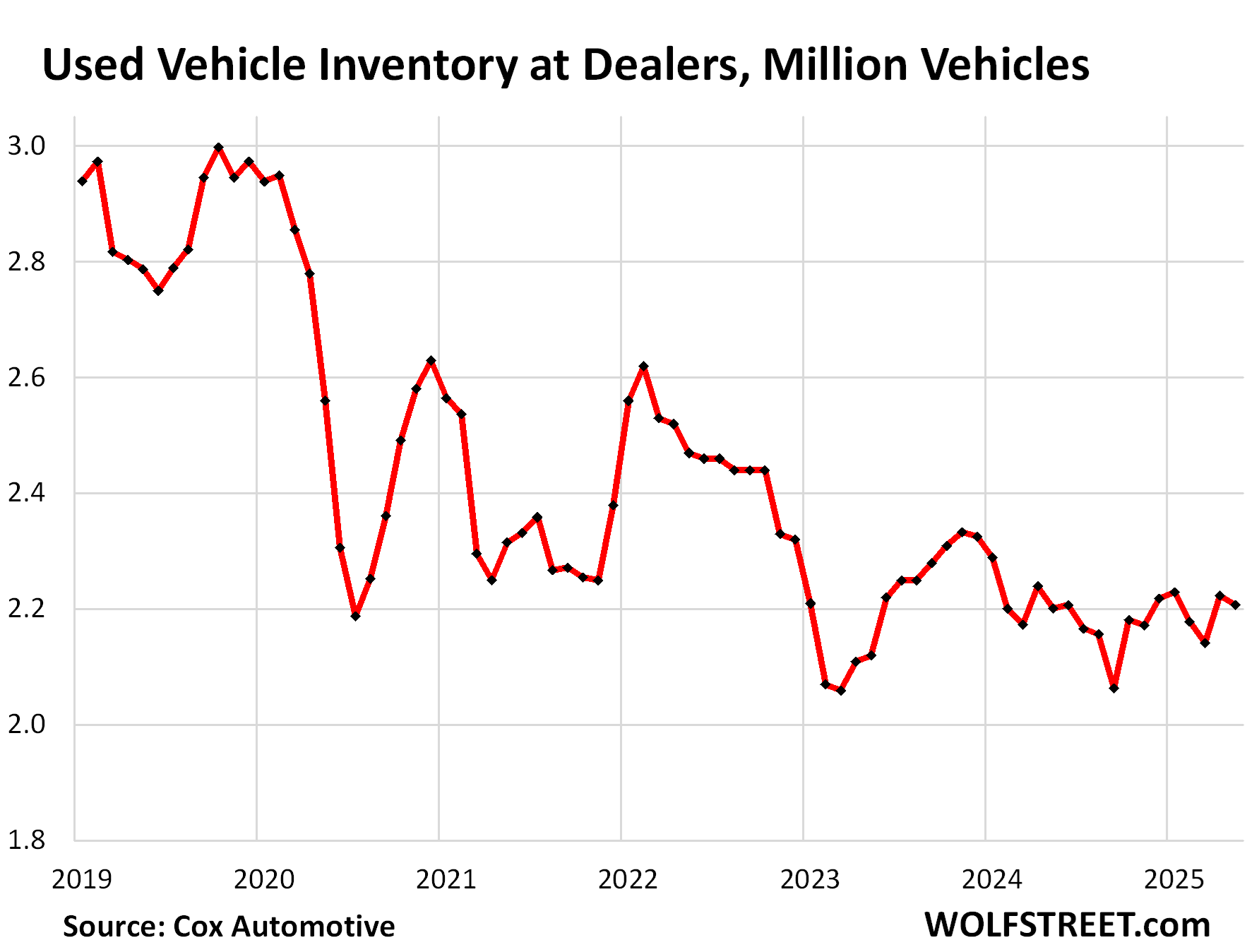

Amid tight inventories and solid demand.

“Even so, retail sales continue to run a bit hotter than prior years, and off-lease supply into the market is still on a downward path, two factors which should be fairly supportive of higher values as we move onward,” Manheim said.

Retail inventories are tight amid supply constraints from off-lease vehicles and solid demand. The inventory at used-vehicle dealers at the end of May (latest data available from Cox Automotive) ticked down to 2.21 million units, roughly flat year-over-year, amid higher sales, and down by about 20% from the same period in 2019.

Influx into the used vehicle market comes from vehicles that had been purchased new some time ago. They enter the used market via trade-ins, lease returns, fleet turnover such as at rental operations (2.5 to 3.5 million vehicles in a normal year), etc.

The influx of supply into the used-vehicle market is still seeing the effects of the semiconductor shortages in 2021 and 2022 that had caused global vehicle production to plunge. In the US, 6 to 10 million fewer new-vehicles were sold over the two-year period than might have been otherwise, and these 6-10 million vehicles are now missing, and are not entering the supply pipeline of used vehicles.

As part of this scenario, leasing activity plunged during this time, and so the number of leases that have been maturing recently has been way down, and so supply from leasing companies, when they sell the two and three-year-old off-lease vehicles at auctions, has plunged. This may drag into 2026. And if demand remains solid amid tight inventory, prices will continue to feel the heat.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack