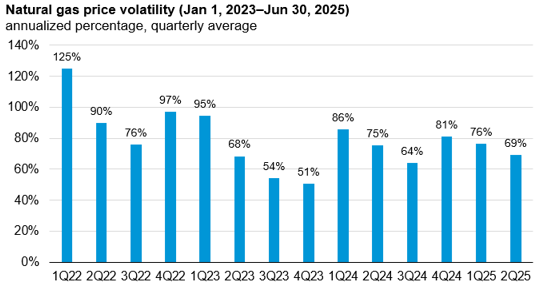

Note: Annualized percentage, a widely used trading measure of price volatility, is the standard deviation for the previous quarter of daily changes in the Henry Hub front-month futures price multiplied by the square root of 252 (number of trading days in a year) multiplied by 100. Percentages are averages for that period. 1Q25=first quarter of 2025

The average historical volatility of the daily Henry Hub front-month futures price, a key benchmark for U.S. natural gas, trended downward through the first half of the year, with quarterly volatility falling from a recent high of 81% in the fourth quarter of 2024 to 69% by mid-2025. This decline marks a return to more typical seasonal patterns and reflects greater market stability as storage inventories return to levels close to the prior five-year average. Since 2022, natural gas markets have experienced a series of extremes, including both unusually high and low inventory levels, which contributed to elevated price volatility. Recent quarters, by contrast, have seen more seasonally consistent price movements, suggesting that natural gas market dynamics have steadied amid record storage injections and more balanced inventories.

Are you from California or New York and need a tax break?

Historical volatility measures daily price changes relative to average prices during a specific period in the past. This measure provides insight into market uncertainty by quantifying how much prices deviated from average levels. Changes in supply, demand, and inventories are reflected in price movements and volatility.

At the end of the first quarter of 2025 (1Q25), U.S. Lower 48 natural gas storage volumes were 4% lower than the five-year average. A polar vortex in January led to increased natural gas consumption, contributing to the fourth-largest weekly withdrawal from storage on record over the week ending January 24, 2025. The large withdrawals contributed to 30-day historical volatility increasing to 102% on February 3 this year, the highest 30-day historical volatility since March 8, 2023. Natural gas inventories continued to decline through the week ending March 7, 2025, reaching a low of 1,698 billion cubic feet (Bcf).

Note: Annualized percentage, a widely used trading measure of price volatility, is the standard deviation for the previous quarter of daily changes in the Henry Hub front-month futures price multiplied by the square root of 252 (number of trading days in a year) multiplied by 100. Percentages are averages for that period.

The previous 30-day volatility eased in 2Q25 as weekly injections grew. From late April through June, net injections into storage were particularly robust, surpassing 100 Bcf per week the week of April 25 for the first time this year, according to our Weekly Natural Gas Storage Report. Net injections totaled more than 100 Bcf per week for seven consecutive weeks, the longest stretch since 2014. Natural gas storage inventories began increasing the week of March 14, and by the end of 2Q25, inventories were 6% (173 Bcf) above the previous five-year (2020–24) average. The increased inventories and pace of the storage injections reduced concerns regarding supply availability, and price volatility declined.