The announcement above prompted me to examine the overall German Energy mix and the rankings of energy costs in Germany. As part of a larger article, we are examining the overall costs of Net Zero policies and their negative environmental impacts.

Germany’s Overall Energy Mix

-

Wind: 29.4% (predominantly onshore wind at 25.9%, with offshore contributing the rest)

-

Coal: 21% (includes lignite at ~14% and hard coal at ~7%)

-

Solar: 13.5%

-

Natural Gas: 12.1%

-

Biofuels/Biomass: 9.1%

-

Hydropower: 8.7%

-

Net Imports: 5.1% (Germany was a net importer in 2024, with imports mainly from Denmark, Norway, Sweden, and France)

-

Oil: 0.7%

-

Other (e.g., non-renewable waste, unspecified): 0.3%

-

Renewables (wind, solar, biofuels, hydropower) accounted for ~59% of net public electricity generation in 2024, up from 56% in 2023.

-

Primary energy consumption (including electricity, heating, and transport) is broader. In 2023, Germany’s primary energy consumption was 3,169.55 TWh, with fossil fuels (coal, gas, oil) dominating, though renewables have grown significantly (~60% of the power mix in 2024 came from renewables).

-

Energiewende: Germany’s energy transition policy has driven renewable growth, with wind and solar contributing ~43% of the power mix in 2024, up from 8% in 2010.

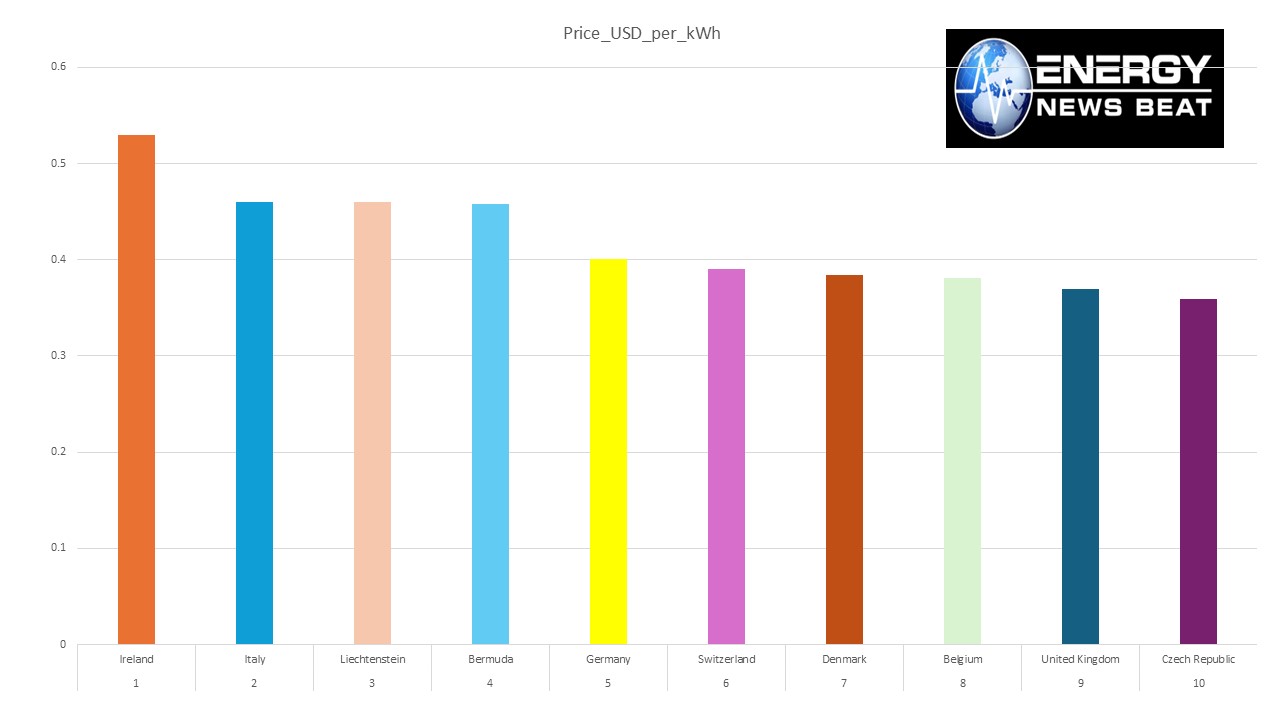

Ranking Energy Costs for Top 10 Countries (Last 10 Years)

-

Metric: Household electricity prices (EUR/kWh) for medium-sized consumers (2,500–5,000 kWh/year), as these are widely reported.

-

Timeframe: 2015–2024 (or latest available data).

-

Countries: Focused on EU countries and select non-EU countries (e.g., Norway, UK) where data is available. Global non-EU countries (e.g., USA, China) lack consistent EUR-based household price data over 10 years.

-

Data Source: Primarily Eurostat, supplemented by IEA and other sources where applicable.

-

Cost Ranking: Based on average household electricity prices over the period, adjusted for inflation where possible. Note that costs vary by year due to market dynamics (e.g., 2022 energy crisis).

|

Rank

|

Country

|

Avg. Price (EUR/kWh)

|

Notes

|

|---|---|---|---|

|

1

|

Germany

|

~0.32

|

Highest in EU due to renewable energy fees (EEG until 2022), taxes.

|

|

2

|

Denmark

|

~0.29

|

High taxes, strong renewable integration.

|

|

3

|

Belgium

|

~0.27

|

High network and environmental costs.

|

|

4

|

Ireland

|

~0.25

|

Rising prices post-2020 due to gas reliance.

|

|

5

|

Italy

|

~0.24

|

High energy import costs, taxes.

|

|

6

|

Austria

|

~0.22

|

Stable prices, renewable-heavy mix.

|

|

7

|

Spain

|

~0.22

|

Spiked in 2022 due to gas prices.

|

|

8

|

Netherlands

|

~0.21

|

Price drops in 2020 due to tax refunds.

|

|

9

|

Sweden

|

~0.20

|

Low prices due to hydro, nuclear; spiked in 2022.

|

|

10

|

France

|

~0.19

|

Nuclear-heavy mix keeps prices relatively low.

|

-

Germany: Consistently the highest due to renewable energy surcharges (EEG, abolished in 2022), grid fees, and taxes. Prices peaked in 2022 (~0.35 EUR/kWh) during the energy crisis.

-

Denmark and Belgium: High due to taxes and renewable investments, though Denmark’s prices are partly offset by efficient energy use.

-

2022 Spike: The Russia-Ukraine war drove prices up across Europe, with Germany’s wholesale prices hitting 235 EUR/MWh in 2022 (vs. 40 EUR/MWh in 2020).

-

Non-EU Data: Limited data for countries like the USA (avg. 0.12 EUR/kWh in 2020, converted from USD) or China prevents inclusion in the ranking. Norway (0.18 EUR/kWh in 2020) could rank ~10th if included.

-

Industrial Prices: Germany also had the highest non-household prices (~0.18 EUR/kWh in 2020), impacting industry competitiveness.

-

Data Gaps: Full 10-year data for non-EU countries (e.g., USA, Japan) in EUR/kWh is unavailable or inconsistent.

-

Total Energy Costs: Combining electricity, gas, and heating costs is complex and not uniformly reported.

-

Wholesale vs. Retail: Wholesale prices (e.g., Germany’s 78.51 EUR/MWh in 2024) differ significantly from retail prices.

-

Currency Fluctuations: Non-EU prices require conversion, introducing variability.