By Wolf Richter for WOLF STREET.

At the auction today, on the eve of the release of the CPI inflation data that may “surprise” markets with a further acceleration of inflation, the US Treasury Department sold $39 billion in 10-year Treasury notes, maturing on August 15, 2034, at a yield of 4.066%, substantially higher than the yield at the last 10-year Treasury auction on September 11 of 3.648%.

There was plenty of demand at the auction, given the juicy yield – yield solves demand problems, that’s what yield is for – including from foreign investors. The total amount bid was $97.3 billion.

Indirect bidders, which include foreign bidders, bid $34.6 billion, and were awarded $30.2 billion, or 77.6% of the total, the second-highest share ever, behind February 2023.

Primary dealers, bidding for their own house accounts, were awarded 13.9%, or $5.4 billion. Direct bidders were awarded $3.3 billion. And the New York Fed (SOMA) got $535 million to replace maturing securities that were in excess of the $25-billion a month cap of the Fed’s Treasury QT roll-off.

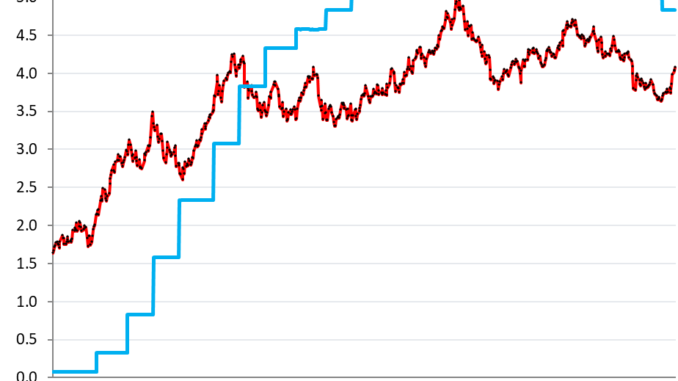

In the market, the 10-year yield jumped to 4.08% at the moment, the highest since July 31, up by 43 basis points from the day before the monster rate hike (3.65%), and up by 10 basis points from Friday (blue = effective federal funds rate which the Fed targets with its headline policy rate):

Today and over the past few trading days, yields for maturities of 6 months and longer rose, while yields of short maturities are pricing in rate cuts in November and December.

And in another milestone of sorts, the two-year yield jumped back over 4% today, now at 4.03%, the highest since August 9.

Longer-term yields, especially 10-year and longer, are driven by inflation fears. No one wants to end up holding a 10-year Treasury security with a yield as purchased of 3.6% when the average inflation rate over the life of the security is 4%. That’s the demand-side of it.

Longer-term yields are also driven by supply, and there will be a tsunami of supply over the next few years as Congress and the White House – whoever will end up in it – are recklessly ballooning the deficit, and thereby the issuance of new debt to fund the ballooning deficit, including 10-year Treasury notes.

This surge of the longer-term yields continues the process whereby the yield curve un-inverts step by step, but in the opposite way of what was expected: with longer-term yields rising sharply – instead of falling slowly – thereby pushing up longer-term interest rates that matter for the economy, including mortgage rates.

At the same time, as rate-cut-mania got dialed back, shorter-term yields fall more slowly.

The chart below shows the “yield curve,” with Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

Gold: July 23, before the labor market data went into a tailspin.

Blue: September 17, the day before the mega-rate cut.

Red: today, October 9.

The 10-year yield is now just 17 bases points below where it had been on July 23, before the most recent rate-cut mania started, and the 30-year yield is just 14 basis points below July 23, a massive disappointment for those who had been counting on a flow of monster rate cuts to drive longer-term interest rates down further. So the opposite happened.

Mortgage rates had spiked on Friday and Monday by 36 basis points combined, to 6.62%, a huge move, but yesterday and today, they rested a little, and today ended at 6.61%, per the daily measure of Mortgage News Daily for the 30-year fixed rate mortgage.

The bond market is now smelling the inflation rat again. Suddenly, the perceived labor market weakness vanished, wages increased sharply, nonfarm job creation was revised up sharply, CPI inflation already accelerated, and tomorrow – that’s the worry – the next shoe might drop. And then there’s this tsunami of supply to worry about.

We give you energy news and help invest in energy projects too, click here to learn more