“A sales recovery did not occur in midsummer”: NAR. Because prices are way too high, doesn’t take a genius to figure that out.

By Wolf Richter for WOLF STREET.

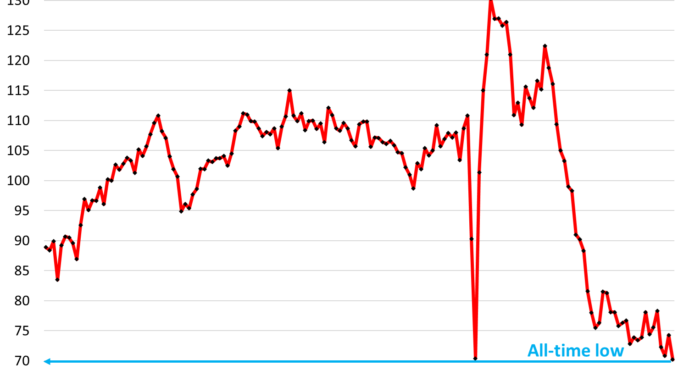

Pending home sales – a forward-looking indicator of “closed sales” over the next couple of months – dropped by 5.5% in July from June, and by 8.5% from a year ago, to an index value of 70.2 (seasonally adjusted), the lowest in the history of the index going back to 2001, when the index value was set at 100, according to the National Association of Realtors today (historic data in the chart via YCharts).

Pending sales are based on contract signings and track deals that haven’t closed yet and could still fall apart or get canceled.

So compared to the Julys in prior years:

July 2023: -8.5%

July 2022: -22%

July 2021: -37%

July 2020: -42%

July 2019: -34%.

What NAR said about this situation:

Predictions of rising sales during the summer amid much lower mortgage rates turned into the opposite:

“A sales recovery did not occur in midsummer.”

Prices are way too high, plus wait-and-see:

“The positive impact of job growth and higher inventory could not overcome

“affordability challenges

“and some degree of wait-and-see related to the upcoming U.S. presidential election.”

Lower mortgage rates will drive up sales, the same thing NAR has said for months, the opposite of which has been happening:

“Current lower, falling mortgage rages will no doubt bring buyers into the market.”

Mortgage rates have already priced in massive rate cuts.

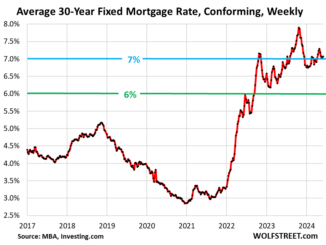

The average 30-year fixed mortgage rate dropped to 6.35% in the latest reporting week, according to Freddie Mac today. This rate is nearly 1.5 percentage points lower than it was in October 2023.

Mortgage rates, which roughly parallel the 10-year Treasury yield but at higher levels, have already priced in a long series of rate cuts. They’re now just 88 basis points above the one-month T-bill yield (5.47%).

Even if the Fed cuts a bunch of times, mortgage rates might not move much further since those cuts are already fully priced in. And if the Fed doesn’t cut that many times, or more slowly, then, well, we’ll see.

While supply is piling up.

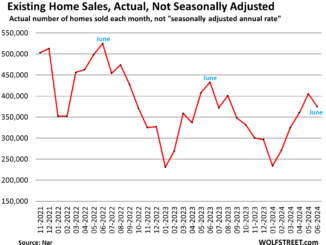

This sustained plunge in demand despite much lower mortgage rates is occurring even as supply in June and July jumped to around 4 months, both the highest since May 2020, according to NAR last week:

And active listings in July jumped by 36.6% year-over-year to the highest since May 2020, according to data from Realtor.com.

And in August, the Buyers’ Strike Continued.

Applications for mortgages to purchase a home in August have dropped back to the near record lows in November 2023, when they’d dropped to the lowest levels in the data going back to 1995, according to the latest weekly data from the Mortgage Bankers Association.

Mortgage applications are an early indication of pending home sales for August (to be released a month from now), and closed sales further down the road. And those indicators are still going to heck despite much lower mortgage rates and surging supply — because prices are way too high, doesn’t take a genius to figure that out:

Take the Survey at https://survey.energynewsbeat.com/