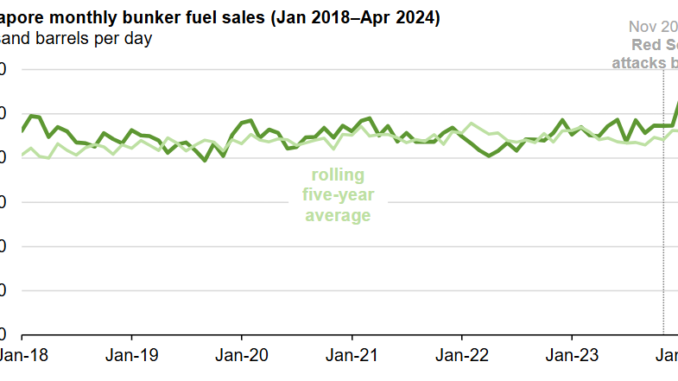

Sales of bunker fuel in Singapore, the world’s largest bunkering fuel port, have increased to all-time highs, indicating increased global consumption as cargo ships, tankers, and other marine vessels take longer routes to avoid the Red Sea. Ship operators have been avoiding the Red Sea following Yemen-based Houthi militia attacks that began in November 2023.

Many of the new routes involve rounding Africa’s Cape of Good Hope, which can add several thousand miles and two to three weeks of travel time compared with a voyage transiting the Red Sea, depending on origin and destination.

The number of cargo and tanker ships transiting the Suez Canal at the northern end of the Red Sea has decreased by more than half compared with the same time period a year ago, from around 75 vessels transiting to around 35, according to data from the International Monetary Fund’s Portwatch tool.

Recent data on bunker fuel sales from the Maritime and Port Authority of Singapore show bunker fuel sales have increased year over year starting in December of 2023 through the first quarter of 2024, reaching an all-time high in December 2023 based on data that goes back to 1995. More bunkering fuel is sold in Singapore than in any other port.

In the coming weeks, we will update our World Oil Transit Chokepoints, which will include analysis on how flows through all global chokepoints have changed in recent years.