Inventory of completed houses jumps to highest since 2009. This pile-up of spec houses is exactly what the housing market needs.

By Wolf Richter for WOLF STREET.

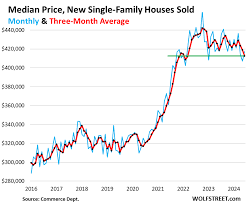

Prices of new single-family houses at all stages of construction have been meandering lower since the peak in late 2022, as builders try to make deals by offering houses at lower price points – smaller, less fancy houses, and less fancy appliances and finishes – and they’re throwing in big incentives, including mortgage-rate buydowns, which are costly for builders (Lennar disclosed that they cost $47,100 per house on average).

The median price of new houses (based on contract prices) is subject to heavy revisions every month, including a double-decker-whopper-revision two months ago, when the Census Bureau revised away 25% of the pandemic-era price spike in one fell swoop. So we focus on the three-month moving average of the median price, which includes all prior revisions, and irons out some of the monthly squiggles.

This three-month average of the median price of sales contracts declined to $412,667 in June, according to the Census Bureau data today, down a hair from a year ago, and down by 6.7% from the (slashed) peak in October 2022, and the lowest since March 2022. The contract price does not include the costs of the mortgage-rate buydowns.

Prices of new houses fall below prices of existing houses.

At the same time, the median price of existing single-family houses rose to $432,700 in June, piercing its June 2022 high (blue in the chart below). It is now roughly $20,000 higher than the median price of new houses.

For seasonal reasons, the median price of existing houses will drop sharply for the rest of the year into early 2025, and June was the seasonal peak for the year. What we’re going to look for in the second half of this year: Will new house prices stay ahead on the way down, or fall behind, with the price of existing houses dropping once again below it?

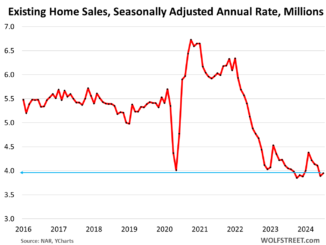

Builders have to deal with this market, and mortgage rates, and they cannot outwait this market, they have to build homes and make deals, and they’re doing it, and so sales have hobbled along below, but not far below, pre-pandemic levels, unlike sales of existing homes, which have plunged to historic lows.

Builders sold 53,000 houses in all stages of construction in June, not seasonally adjusted, down 8.6% year-over-year, and down by 3.6% from June 2019.

Inventory piles up. Exactly what the housing market needs.

Homebuilders’ inventories of houses in all stages of construction, including construction not yet started, rose to 475,000 houses in June, the highest since 2008. Supply jumped to 9 months.

So builders are aggressively adding supply to the market, no matter what the market does, and that’s good for the market, there’s nothing like lots of new supply to bring home prices back to reality, the more supply, the better. This supply of new houses ripples across the market for existing houses, as builders are competing with homeowners who want to sell.

Inventory of completed houses jumped to 98,000 houses in June, the highest since 2009. These speculative homes are essentially move-in ready, they have to be sold quickly, builders have tied up lots of money in them, and that inventory is encouraging builders to throw more incentives and mortgage rate buydowns into the fray.

This surge in spec houses, after the trough during the pandemic, is exactly what the housing market needs. People who are frustrated with trying to buy an existing house, can go out and make a deal for a move-in ready new house, at a lower-than-market mortgage rate, and come out with lower payments — and to heck with homeowners that sit on their vacant homes, hoping to run up the price spike all the way, or cling to 2022 prices. Homebuilders have to build and make deals no matter what the market is.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/