The CRE meltdown just doesn’t let up.

By Wolf Richter for WOLF STREET.

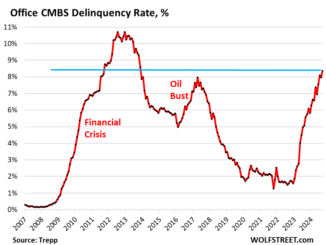

Delinquencies of office mortgages that were securitized into commercial mortgage-backed securities (CMBS) have been in the red-hot zone since mid-2023 and in December 2024 hit 11.0%, surpassing even the debt-meltdown during the Financial Crisis. Then, during the first three months of 2025, the delinquency rate backed off some, but in April re-spiked by 52 basis points to 10.3%, according to data by Trepp today, which tracks and analyzes CMBS.

The 52-basis-point increase of the delinquency rate represented a U-Turn from the feeble signs of hope earlier this year and put the delinquency rate right back into the peak of the Financial Crisis meltdown.

A flight to quality has divided the office market into two: Amid much reduced demand for office space, vacancies in the latest and greatest buildings allow companies to move from older office towers into new fancy offices, while downsizing space at the same time. But landlords of older properties have trouble finding new tenants to replace them, and their vacancy rates have soared. It’s those older office towers that are on the problem list, not the latest and greatest towers.

The office sector of commercial real estate (CRE) has been in a depression for two years, and the office vacancy rates in the US worsened to a record 22.6% in Q1. But it’s now multifamily CRE (rental apartments) that is chasing after it.

Multifamily is huge and delinquencies are turning ugly.

The multifamily CMBS delinquency rate in April spiked by 113 basis points, after spiking by 98 basis points in March, for 2.11 percentage points in two months, to 6.57%, having nearly quintupled year-over-year from 1.3% in April 2024.

These multifamily CMBS are “private label” — the mortgages in their mortgage pools are not backed by the government. More on government-backed multifamily mortgages in a moment.

The spike in delinquencies in April was triggered by over $1 billion in debt becoming newly delinquent, with the top three mortgages in that group amounting to $831 million, according to Trepp.

The plunge in January 2016 reflects a $3-billion delinquent mortgage on Stuyvesant Town–Peter Cooper Village in Manhattan (11,250 apartments spread over 110 buildings on 80 acres) that was paid off when Blackstone and Ivanhoe Cambridge purchased the complex. That mortgage had become delinquent in March 2009 and had contributed substantially to the Financial Crisis spike. The arrow connects the month of delinquency and the month when the delinquency was resolved.

Overall multifamily debt (not just CMBS) is the largest category of CRE debt, with $2.2 trillion in mortgages outstanding at the end of 2024, accounting for 45% of the $4.8 trillion in total CRE debt, according to the Mortgage Bankers Association.

That $4.8 trillion in CRE debt excludes loans for acquisition, development, and construction; and loans collateralized by owner-occupied commercial properties, in order to reflect the performance of properties that rely on rents and leases to make mortgage payments.

Governments are on the hook for over half of multifamily debt:

- Federal, state, and local governments: $1.17 trillion (54%), many of them securitized into government-backed CMBS:

- Federal government: $1.07 trillion (49.8%), mostly Fannie Mae and Freddie Mac, which have tripled their exposure over the past 10 years.

- State & local governments: $92 billion (4.2%)

- Banks and thrifts: $628 billion (29.2%)

- Life insurers: $255 billion (11.8%)

- private label CMBS, CDOs, and other Asset Backed Securities (ABS) issues: $68 billion (3.2%)

Multifamily debt securitized into CMBS accounts for only a small portion of the total multifamily debt. In general, CMBS make up only a small portion of CRE debt. The rest of CRE debt is spread across other investors, governments, and banks.

But CMBS delinquency rates shed some light on the tough situation CRE is in overall.

Mortgages count as delinquent when the landlord fails to make the interest payment after the 30-day grace period. A mortgage doesn’t count as delinquent if the landlord continues to make the interest payment but fails to pay off the mortgage when it matures, which constitutes a repayment default. If repayment defaults by a borrower who is current on interest were included, the delinquency rate would be higher still.

Loans are pulled off the delinquency list when the interest gets paid, or when the loan is resolved through a foreclosure sale of the property, or a sale of the loan, generally involving big losses for the CMBS holders, or if a deal gets worked out between landlord and the special servicer that represents the CMBS holders, such as the mortgage being restructured or modified and extended – the infamous extend-and-pretend.

We give you energy news and help invest in energy projects too, click here to learn more