As retail sales rose despite dropping prices of goods, inflation-adjusted retail sales – adjusted for this deflation in goods – rose even faster: hence the jump in GDPNow.

By Wolf Richter for WOLF STREET.

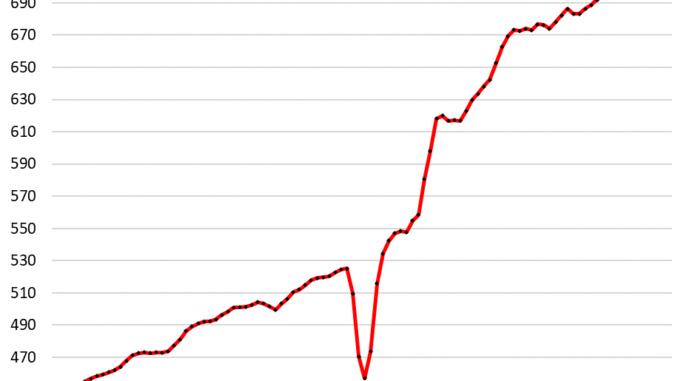

Retail sales rose 0.1% in August from July, seasonally adjusted, on top of the upwardly revised 1.1% jump in July, and the 0.3% dip in June. Not seasonally adjusted, retail sales jumped by 1.5% in August from July to $737 billion.

To iron out the month-to-month squiggles and revisions, we like to look at the three-month average (chart below), which rose 0.3% month-to-month and 2.3% year-over-year. The biggest gainer was ecommerce, the second-largest retailer category behind auto dealers: +1.4% month-to-month, +7.8% year-over-year.

What is remarkable is that retail sales continue to rise even as prices of many goods that retailers sell, have been dropping all year, particularly durable goods and gasoline. When prices drop and consumers buy the same amount of stuff, retail sales in dollars would decline with prices (and we see that with gasoline where dollar-sales track gasoline prices lower).

But retail sales have risen despite price declines in goods that retailers sell, which shows that consumers are buying a lot more stuff, particularly durable goods.

We saw this yesterday: Used-vehicle retail sales in units jumped by 8% in August from July, and by 14% year-over-year, to 1.68 million vehicles; and new vehicle unit sales jumped 11% in August from July and by 7.6% year-over-year, to 1.42 million vehicles: people are buying more vehicles! And they’re doing it because the pandemic price spike is getting unwound, and as prices come down, they’re spending less per vehicle, but more people are buying vehicles.

Note the slowdown in retail sales late last year and earlier this year. But that’s like so behind us. Our Drunken Sailors, as we lovingly and facetiously have been calling them for over a year, are back at it, splurging at retailers.

Price drops in goods make retail sales even stronger.

Back in 2021 and 2022, massive price increases in the goods that retailers sell – motor vehicles, food, gasoline, electronics, clothes, sporting goods, furniture, etc., online and at brick-and-mortar stores – caused retail sales to jump as consumers scrambled to keep up with the price increases.

Since 2022, much of this stuff (except foods) has been seeing price declines, and retail sales of those items measured in dollars, not units, should fall based merely on the price declines. And some did, like gasoline, because consumers aren’t buying more gasoline when it gets cheaper.

The CPI for durable goods has dropped by 6.1% from the peak two years ago. Prices for used vehicles have plunged by 20%. New vehicle prices have dropped 2%. Consumer electronics, appliances, furniture, sporting goods, etc. have all seen price drops.

So, on an inflation-adjusted basis – adjusted for this deflation in goods – retail sales look even better. Lower prices and higher sales translate into much higher “real” sales. And this will show in the inflation-adjusted consumer spending and GDP data.

And it did show in July’s “real” consumer spending, adjusted for inflation, which jumped by 0.4% from June, the biggest month-to-month growth rate since February 2023.

And it did show in today’s Atlanta Fed’s GDPNow, which, upon the data for retail sales and industrial production, jumped to +3.0% “real” GDP growth for Q3, which is relatively high for the US whose 10-year average GDP growth is 2.0%. The recession is going to have to take a back seat to our Drunken Sailors.

Sales at the largest categories of retailers.

Sales at new and used vehicle dealers and parts stores, the #1 category with 19% of total retail sales, bounced back plus some, with big increases in unit sales in July and August, from the mayhem in June due to the CDK hack that had put thousands of dealers on ice for a few weeks.

And the rise in sales volume overcame the effect of lower prices and of the shift away from overpriced high-end trucks – the erstwhile pandemic darlings – that are now clogging up dealer lots.

The three-month average in August rose 0.2% from July on top of the 0.4% increase in the prior month, to $132 billion.

The spike in dollar-sales in 2021 and 2022 was based on price gouging by dealers and automakers, even as unit sales volume plunged due to vehicle shortages. The relatively flat dollar-sales for the past 18 months, despite rising retail unit sales, are a result of these gouge-prices getting unwound.

Ecommerce and other “nonstore retailers” (#2 category, 17% of retail), includes ecommerce retailers, ecommerce operations of brick-and-mortar retailers, and stalls and markets, three-month averages:

Sales: $123 billion

From prior month: +1.1%

Year-over-year: +7.4%

Restaurants and bars, officially “Food services and drinking places,” #3 category with 13% of total retail, includes everything from cafeterias to restaurants and bars.

After a slowdown earlier this year, growth resumed over the past five months (three-month averages):

Sales: $95 billion

From prior month: +0.1%

Year-over-year: +3.4%

Food and Beverage Stores (12% of total retail). Generally, only price increases and population growth increase sales.

Prices have about flattened out at very high levels after spiking from 2020 to early 2023. In August, the CPI for food at home was unchanged from July and roughly flat with January, and up just 0.9% from a year ago.

But the population has surged in 2022 and 2023 by 6 million people due to immigration, and in 2024 has continued to rise, according to the Congressional Budget Office, using ICE and Census data. These people work, or are looking for work, and they’re buying stuff, including at food and beverage stores, thereby pushing up their retail sales, which is what we can see here even has prices have remained roughly stable (three-month averages):

Sales: $83 billion

From prior month: +0.1%

Year-over-year: +2.2%

General merchandise stores, without department stores (9% of total retail), are also where the 6 million additional people buy their essentials, such as groceries at Walmart.

Sales: $65 billion

From prior month: +0.3%

Year-over-year: +3.0%

Gas stations (8% of total retail sales). Dollar-sales at gas stations move in near-lockstep with the price of gasoline. The price of gasoline plunged from mid-2022 through mid-2023, and has since then meandered lower, including in August. These price declines push down sales in dollars (three-month averages):

Sales: $52 billion

From prior month: -0.9%

Year-over-year: -1.9%

Sales in billions of dollars at gas stations, including other merchandise that gas stations sell (red, left axis); and the CPI for gasoline (blue, right axis):

Building materials, garden supply and equipment stores (6% of total retail). The prepandemic trendline in blue. The remodeling boom fizzled in late 2022, and expectations were that spending at these retailers would revert to trend, amid lower demand and lower prices, and that happened for a while. But earlier this year, growth started picking up again, and strongly so over the past few months:

Sales: $41 billion

From prior month: +0.8%

Year-over-year: -0.2%

Clothing and accessory stores (3.7% of retail), all three-month averages:

Sales: $26 billion

From prior month: -0.2%

Year-over-year: +2.5%

Miscellaneous store retailers (2.2% of total retail): Specialty stores, including cannabis stores (three-month averages).

Sales: $15 billion

Month over month: +0.8%

Year-over-year: +6.2%

Take the Survey at https://survey.energynewsbeat.com/