Wall Street Reacts To The Fed’s “Confused” 2024 Hawkish Shock

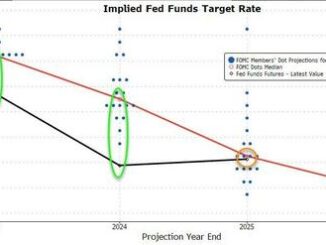

In our FOMC preview, we said that the only thing that will matter today was the Fed’s 2024 median dot… … and that’s precisely what happened: with a statement that was a carbon copy of […]

In our FOMC preview, we said that the only thing that will matter today was the Fed’s 2024 median dot… … and that’s precisely what happened: with a statement that was a carbon copy of […]

“One and done”? The Fed statement was a hawkish pause – signaling “some additional policy firming may be appropriate” as opposed to “some additional policy easing may be appropriate.” Can Fed Chair Powell walk […]

Oil held near $74 — after the longest run of losses this year — as prices swung with a fluctuating dollar and traders looked toward US inventory figures due later. West Texas Intermediate was little […]

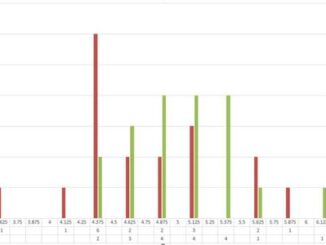

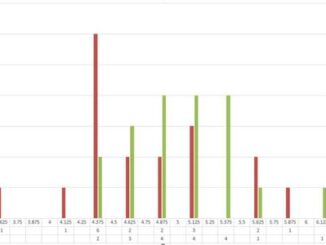

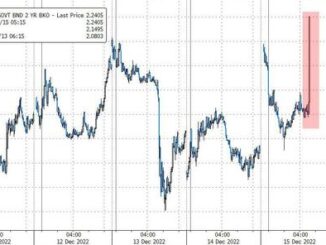

Friday’s payrolls print started the panic, but the weekend’s reality-checks on what Powell said and what the market wanted to hear has sparked a massive resurgence in the short-term interest-rate market’s perceptions of The Fed’s […]

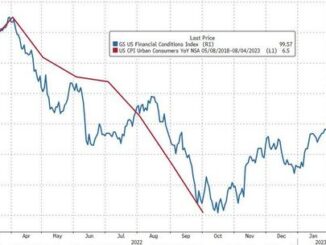

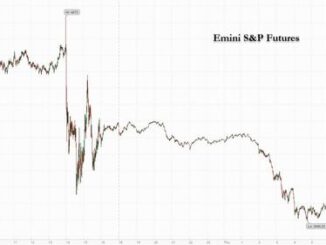

US futures extended declines on Thursday following hawkish signs from the Federal Reserve that it would keep rates higher for longer even as it pushed the US economy into a stagflationary recession. Contracts on the […]

Expectations of a 50bps hike were pretty much locked in – so no surprise there at all from The ECB’s decision today (to hike 50bps), but the timing of the start of quantitative tightening is […]

Copyright © 2026 | Sandstone Group