There was an extra-special spectacle in Q1 among the Swiss franc, Australian dollar, British pound, and Japanese yen.

By Wolf Richter for WOLF STREET.

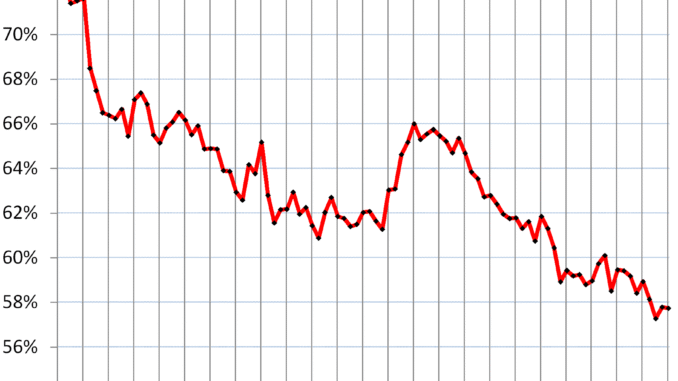

The dollar’s status as dominant foreign exchange-reserve currency has been diminishing for years as central banks have been diversifying to other currencies and over the past three years massively into gold. The decline of the dollar has been slow and halting, a couple of steps forward, one step back, sometimes bigger steps, other times smaller steps, and it remains by far the dominant global reserve currency. But the long-term trend is clear – and this has significant long-term consequences for the US.

The share of USD-denominated foreign exchange reserves declined to 57.7% of total foreign exchange reserves in Q1, according to IMF’s data today. In Q3 2024, the dollar’s share had dropped to a 30-year low.

Is Oil & Gas Right for Your Portfolio?

The hump starting in 2014 was a result of the Euro Debt Crisis when central banks briefly diversified away from euro securities back into USD securities.

USD-denominated foreign exchange reserves include US Treasury securities, US agency securities, MBS, corporate bonds, and other USD-denominated assets held by central banks other than the Fed.

The dollar’s share had plunged to 46% in 1991. At the time, inflation had exploded in the US, and eventually the world lost confidence in the Fed’s ability or willingness to get this inflation under control, and they sought refuge for their foreign exchange reserves somewhere else.

But after inflation had been brought under control, central banks started switching back to dollar-assets, until the arrival of the euro – the first plausible alternative to the dollar until that concept was nixed by the Euro Debt Crisis.

This six-decade chart shows the dollar’s share at the end of each year except 2025 = Q1.

But they didn’t dump US Treasury securities, they just added more other stuff.

In Q1 this year, their holdings of Treasury securities rose to $3.96 trillion, the highest since Q1 2022, but below the high in 2021, and essentially unchanged from 12 years ago, according to the Treasury Department’s data on foreign holders.

These are holdings of Treasury securities, as reported by the Treasury Department, while the USD-denominated foreign exchange reserves reported by the IMF include all USD-denominated securities, from Treasuries to corporate bonds. [Here is our discussion on who overall held US Treasury securities: Who Held or Bought the Huge US Government Debt].

Total holdings of USD-denominated assets as foreign exchange reserves – so US Treasuries, agency securities, MBS, corporate bonds, etc. – rose in Q1 to $6.72 trillion but remain below the high in 2021 of $7.1 trillion and are about level with Q1 2019.

The other reserve currencies.

The euro’s share, #2, ticked up to 20.1%. It has been around 20% for years (blue in the chart below).

The other currencies are the colorful tangle at the bottom of the chart. More on those in a moment. Combined, they have been gaining share over the years, at the expense of the dollar, while the euro’s share has remained roughly stable since 2015.

The colorful tangle at the bottom under the microscope.

Q1 provided an extra-special spectacle there in that tangle at the bottom of the above chart that we now look at under the microscope:

- Spiked: Swiss francs (CHF, gray), pound sterling (GBP, light blue), “other currencies” (red)

- Plunged: Australian dollars (AUD, black dotted), Japanese yen (YEN, purple), Canadian dollars (CAD, green dotted).

This massive shift among these smaller foreign exchange reserves may have had something to do with the huge global shifts of gold in Q1, including massive imports of gold into the US largely from Switzerland. These unprecedented massive imports of gold into the US that blew up the Atlanta Fed’s GDPNow may have also entailed or paralleled large-scale shifts in foreign-currency assets held by central banks.

The category “other currencies” (red in the chart above) is a basket of “nontraditional reserve currencies,” as the IMF calls them, whose combined share has been surging since 2020. That’s really where the action has been, spread across many small reserve currencies.

China is the second largest economy in the world, but the renminbi plays only a small role as a reserve currency. And it has lost ground against the USD and other currencies since 2022, as central banks have not been enamored with RMB-denominated assets for a variety of reasons, including capital controls, convertibility issues, and other issues.

Far behind the USD and the EUR, the largest currencies by share (chart above):

- British pound, 5.2% (GBP, blue).

- Japanese yen, 5.1% (YEN, purple).

- “All other currencies” combined, 4.9% (red).

- Canadian dollar, 2.6% (green dotted).

- Australian dollar, 1.4% (black dotted), down from 2.1% in Q4.

- Chinese renminbi, 2.1% (red).

- Swiss franc, 0.8% (gray), up from 0.2% in Q4.

The diversification into gold.

Gold bullion is not a “foreign exchange reserve” asset of central banks, and is not included in the data above. But both, gold and “foreign exchange reserves,” are “reserve assets” that central banks hold.

In 2011, central banks started rebuilding their gold holdings, after having spent decades unloading them. Then in 2022, 2023, and 2024, they suddenly bought gold at a record pace, over 1,000 tonnes of gold per year, double the average of the prior 10 years. And the price of gold spiked from this dramatic buying pressure.

These purchases of over 1,000 tonnes of gold per year for three years in a row pushed up total gold holdings by central banks to 36,000 tonnes, close to the all-time high of 38,000 tonnes in 1965 during the Bretton Woods era, according to an ECB report, citing data from the World Gold Council.

The chart from the ECB shows purchases in tonnes per year (blue columns, left scale) and the price of gold through 2024 (yellow line, right scale, $ per troy ounce):

The ECB’s report adds:

“With the price of gold reaching new highs, the share of gold in global foreign reserves at market prices, at 20%, surpassed the share of the euro (16%).

“Survey data suggest that two-thirds of central banks invested in gold for purposes of diversification, while two-fifths did so as protection against geopolitical risk.

“The share of gold in total official foreign reserves – comprising foreign exchange and gold holdings – increased to 20% at the end of 2024, surpassing that of euro, on the back of historically high gold prices and purchases.

“Surveys suggest that hedging motivated by economic and geopolitical factors played a role in these historically large purchases of gold, notably in emerging and developing economies.

“Countries that are geopolitically distant from the West have been active diversifiers into gold.”

Why is the dollar’s status as global reserve currency important?

Central banks other than the Fed have purchased $6.7 trillion in dollar-denominated financial assets, largely US Treasury securities. This money flow into the US has helped the US fund its twin deficits – the huge trade deficit and the even huger budget deficit – and thereby has enabled the US to incur those two deficits.

The dollar status as the dominant reserve currency has been crucial for the US, it has enabled the US to live beyond its means. As that dominance declines slowly — two steps forward, one step back — all kinds of risks pile up ever so slowly, including the sustainability of the government deficits and the debt.

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

![]()