But some metros hit all-time highs. By Metro: Toronto, Vancouver, Victoria, Calgary, Ottawa, Montreal, Halifax, Edmonton, Quebec City, Winnipeg.

By Wolf Richter for WOLF STREET.

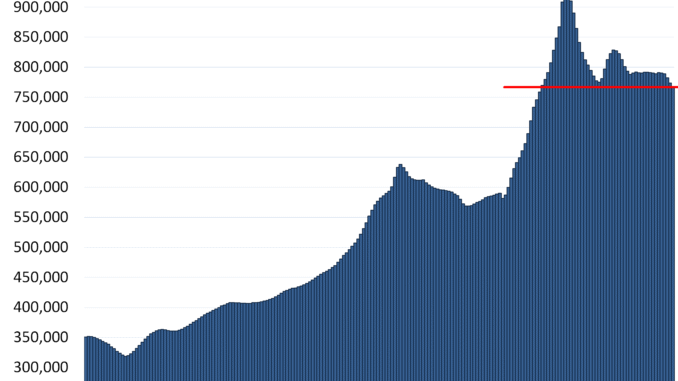

Demand in Canada’s spring selling season has sunk into a morass, with sales down 9.8% from the already beaten-down levels a year ago. Supply of homes on the market has surged to 5.1 months, the highest since the 2020 lockdown. And the national price index has careened down further.

Prices of single-family properties in Canada fell by 1.1% in April from March, seasonally adjusted, and by 3.1% year-over-year, to the lowest level since May 2021, according to the Canada MLS Home Price Index released by the Canadian Real Estate Association (CREA) today.

Since the crazy peak in February 2022, prices have plunged by 18.3%. But individual markets have vastly diverged, with Greater Toronto carving out a new multi-year low, while prices in Montreal and Quebec City rose to all-time highs.

Condo prices fell by 1.3% in April from March, to the lowest level since August 2021, and are down 4.4% year-over-year. Since the peak in March 2022, prices have dropped by 12.1%.

Prices in the major Canadian markets.

Big price drops to multi-year lows in the Greater Toronto and Hamilton Area and smaller drops in Greater Vancouver coexist with continued price spikes in other markets, particularly Montreal and Quebec City. The Calgary market seems to have turned the corner after an astonishing four-year price spike.

The price indices below are in Canadian dollars and seasonally adjusted.

Greater Toronto Area, single-family MLS Home Price Benchmark Index:

- Month-to-month: -0.8%, to $1,212,000; the lowest since May 2021

- From peak in February 2022: -21.1%

- Year-over-year: -5.2%.

The crazy peak occurred in February 2022. Then false-hope recovery peaked in June 2023, and since then it has been mostly downhill.

Greater Toronto Area, condo benchmark price:

- Month-to-month: -1.9% to $584,200, lowest since February 2021.

- From peak in April 2022: -18.4%

- Year-over-year: -6.9%.

Hamilton-Burlington metro single family benchmark price (part of the “Greater Toronto and Hamilton Area”):

- Month-to-month: +0.9% to $876,300 about where it had been in May 2021

- From peak in February 2022: -22.5%

- Year-over-year: -3.4%.

Hamilton-Burlington metro condo benchmark price:

- Month-to-month: -0.5% to $515,100, lowest since September 2021.

- From peak in April 2022: -18.6%

- Year-over-year: -3.4%.

Greater Vancouver single-family benchmark price:

- Month-to-month: -1.3%, to $1,989,000, below where it had been in January 2022.

- From peak in March 2022: -3.8%

- Year-over-year: -0.6%.

Greater Vancouver condo benchmark price:

- Month-to-month: -1.2%, to $750,400, where they’d first been in February 2022.

- From high in October 2023: -3.4%.

- Year-over-year: -2.1%, the 10th year-over-year decline in a row.

Victoria, single-family benchmark price:

- Month-to-month: unchanged at $1,173,800, where it had first been in December 2021

- From peak in March 2022: -7.1%

- Year-over-year: +3.9%.

Victoria, condo benchmark price:

- Month-to-month: -0.1% to $561,100, where it had first been in December 2021

- From peak in March 2022: -7.0%

- Year-over-year: +0.6%.

Ottawa, single family benchmark price:

- Month-to-month: -0.5% to $691,400 where it had first been in November 2021

- From peak in March 2022: -9.4%

- Year-over-year: +1.4%.

Ottawa, condo benchmark price:

- Month-to-month: +0.1% to $401,300, where it had been in April 2021

- From peak in March 2022: -10.4%

- Year-over-year: -2.6%.

Calgary, single family benchmark price:

- Month-to-month: -0.5%, to $688,200, same as in October, after a four-year spike totaling 55%.

- Year-over-year: +3.1%, smallest increase since April 2023.

Calgary, condo benchmark price:

- Month-to-month: -0.5%, to $340,300.

- From peak in August 2024: -2.9%

- Year-over-year: +0.6%.

Montreal, single family benchmark price:

- Month-to-month: +0.7%, to $669,000, a new all-time high.

- Year-over-year: +9.2%.

Halifax-Dartmouth, single family benchmark price:

- Month-to-month: -0.7% to $557,300

- From peak in March 2022: -1.7%

- Year-over-year: +2.1%.

Edmonton, single-family benchmark price:

- Month-to-month: -0.1% to $494,300.

- Year-over-year: +12.7%

Quebec City Area, single-family benchmark price:

- Month-to-month: +0.4%, to $467,200, a new all-time high, after a four-year 73% spike.

- Year-over-year: +16.1%

Winnipeg, single-family benchmark price:

- Month-to-month: -1.2% to $397,700

- Year-over-year: +8.0%

Even in California, inventories of homes for sale are now surging; the issue isn’t new listings, but the plunge in demand that has caused inventory to pile up. Active listings in San Diego +70% yoy, Los Angeles +50% yoy, San Jose & Silicon Valley +67%; and San Francisco metro +43% to the highest April level since at least 2016. Read: California Inventory of Homes for Sale Suddenly Piles Up: +51% Year-over-Year, to Highest April in Years

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack