But inventories of 2- to 3-year-old vehicles are tight because of the new-vehicle shortages 2 and 3 years ago.

By Wolf Richter for WOLF STREET.

Retail sales of used vehicles at independent and franchised dealers jumped by 8% in August from July, and by 14% year-over-year, to 1.68 million units, according to estimates from Cox Automotive.

June had been the month when a ransomware attack shut down the cloud-based dealer management system from CDK that about 15,000 dealers use to manage every aspect of their operations. On June 19, they suddenly couldn’t process sales for the rest of the month and into July. This caused the plunge in used vehicle retail sales in June. In early July, as the system came back up, they got those June sales processed, hence the big jump in July sales. The jump in August sales was on top of that.

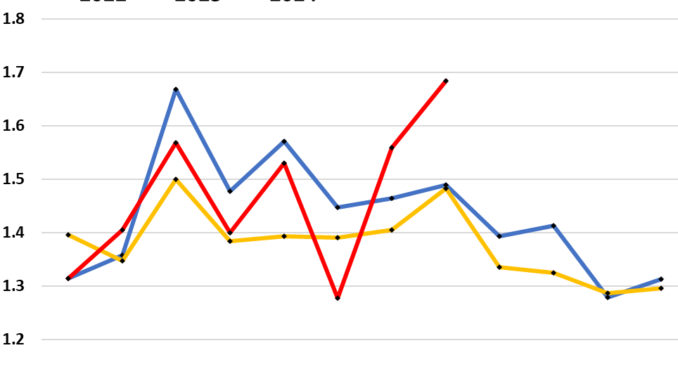

For June, July, and August combined – which irons out the effects of the CDK software shutdown – used-vehicle retail sales rose by 5.7% year-over-year to 4.52 million units, an acceleration from the first five months of this year, when used-vehicle sales were up 2.8% year-over-year (red = 2024, yellow = 2023, blue = 2022):

Note the blue line: In 2022, retail prices of used vehicles began their historic plunge off the ridiculous spike that peaked in late 2021 to early 2022. The price drops weren’t driven by lack of demand but by more ample supply showing up and by the unsustainability of that ridiculous price spike in 2020-2021.

But now, used-vehicle inventories are tight and wholesale prices have begun to rise, on strong demand from dealers to replenish their inventories to meet strong demand from consumers, as these sales figures show.

Tight inventories have been a particular issue with two- and three-year-old off-lease vehicles and trade-ins due to the shortages of new vehicles two and three years ago. So sales of certified pre-owned (CPO) vehicles have been running below last year’s level, and were down 3.3% year-over-year in August, though they also jumped 11% in August from July, to 235,150 vehicles, according to Cox Automotive.

The big jump in volume comes in part from a “notable rise” of vehicles that were priced under $15,000, in part as more vehicles made it back into that category after two years of historic price declines from the pandemic spike, including wholesale prices at auctions where dealers replenish their inventories.

But the price declines may have run their course: Wholesale auction prices via Manheim, the largest auto auction house in the US, rose for the second month in a row in August, both seasonally adjusted (red) and not seasonally adjusted (blue):

Retail prices lag wholesale prices by a couple of months, and they still fell in August, according to the CPI for used vehicles, seasonally adjusted (red) and not seasonally adjusted (blue), having given up 60% of the 2020-2021 price spike. So clearly, the steep price declines are bringing in the buyers.

New-vehicles sales also jumped in August, undoing the steep drop in June and the smaller drop in July, caused by the mayhem following the CDK ransomware attack. For June, July, and August combined, sales rose 0.5% year-over-year, to 4.01 million vehicles, according to data from the Bureau of Economic Analysis earlier this month, when we discussed new vehicle sales for Q2.

On Tuesday morning (September 17), the Census Bureau will report total retail sales for all goods that consumers buy, including new and used vehicles, but these are dollar-sales, not unit sales. We know that vehicle prices, particularly used vehicle prices, have come down over the past two years (deflation in vehicle prices), so the retail sales in dollars will reflect those lower prices. Then, in the next data release of inflation-adjusted consumer spending, that deflation in vehicles will boost inflation-adjusted consumer spending.

Take the Survey at https://survey.energynewsbeat.com/