Oil and gas producers drove a surge in share buybacks in the fourth quarter, before energy prices hit their highest in over a decade this year, according to data from S&P Dow Jones Indices.

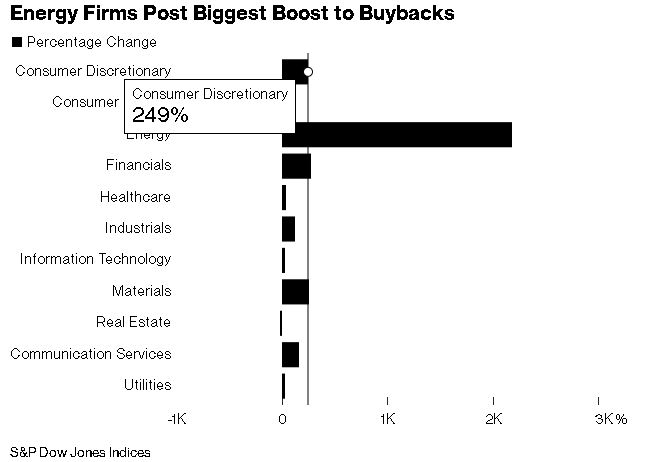

The companies raised spending on share repurchases by 2,182% in the fourth quarter from the year-earlier period, handily beating the second-place 279% increase by financial firms. The energy industry accounted for 2.8% of a record $881.7 billion in buybacks in all of 2021.

The rapid increase in energy buybacks came before this year’s 28% increase in West Texas Intermediate crude oil prices, though energy costs had started to increase in May of 2020. The jump in prices and buybacks represents a bonanza for shareholders, though not necessarily for the long-term industry prospects.

“Buybacks artificially inflate earnings per share and return-on-asset and capital metrics, but the underlying health of an E&P’s operations doesn’t improve,” Bloomberg Intelligence analyst Vincent Piazza wrote in a note.