Month-to-month, core services inflation jumped while durable goods deflation deepened, and so core PCE price index hits Fed’s target.

By Wolf Richter for WOLF STREET.

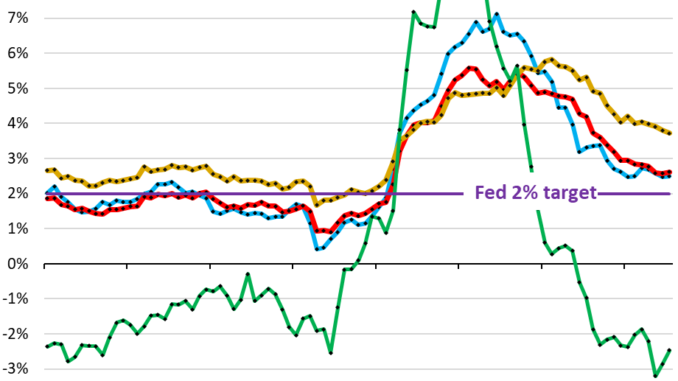

The “Core” PCE price index, the Fed’s primary yardstick for its 2% inflation target, rose by 2.62% from a year ago in July, a hair up from the June reading of 2.58% (red in the chart below). This “core” index attempts to show underlying inflation by excluding the components of food and energy as they can be very volatile, spiking and plunging with commodity prices (red in the chart below).

The overall PCE price index, which includes the food and energy components, rose by 2.50% year-over-year in July, also a hair up from June’s 2.47% (blue). Within it, energy prices edged up year-over-year by 0.2%, and food prices rose 1.4%.

The “core services” PCE price index rose by 3.72% in July, down a hair from June’s 3.81% increase (yellow). But the durable goods PCE price index fell less than in the prior two months, in July by -2.5% year-over-year. May’s drop of -3.2% had been the biggest drop since 2004 (green):

The month-to-month moves.

The “core” PCE price index rose by 2.0% annualized in July from June (not annualized, +0.16%), same as in June. Both months were right on the Fed’s target (blue in the chart below).

Within it, core services inflation accelerated sharply in July from June (+3.3% annualized), while the durable goods index dropped deeper into the negative (-3.7% annualized). Those two forces combined, pulling in opposite directions, caused the index to rise by 2.0% annualized. And that has also been the dynamic we’ve seen so far this year: Durable goods prices are deflating sharply from the pandemic spike while services inflation is still uncomfortably high.

The six-month annualized core PCE price index, which irons out the month-to-month squiggles and revisions, and which Powell cites a lot, decelerated to 2.6%, as the January spike fell out of the index (red):

The “core Services” PCE price index accelerated to 3.1% annualized in July from June, up from 2.25% in the prior month.

The six-month core services index decelerated sharply to 3.26%, the lowest since February 2021, as the spike in January fell out of the six-month period.

Core services include housing, healthcare, financial services & insurance, transportation services, non-energy utilities, communication services, recreation services, food services & accommodation, and “other” services.

The housing costs PCE price index, which is part of core services, rose by 4.78% annualized in July from June, reversing the outlier drop in the prior month.

The six-month index decelerated to 4.8% annualized, and that’s still very high:

Durable goods PCE price index fell in July from June by 3.7% annualized. Durable goods include motor vehicles, recreational goods and vehicles, appliances, electronics, furniture, etc.

The six-month index fell by 2.1% annualized. The durable goods index tends to run in a slightly negative range during normal times amid manufacturing efficiencies, technological improvements, and globalization. It’s the services that have been the driving force of inflation for many years, which is why we pay so much attention to services.

Take the Survey at https://survey.energynewsbeat.com/