By Wolf Richter for WOLF STREET.

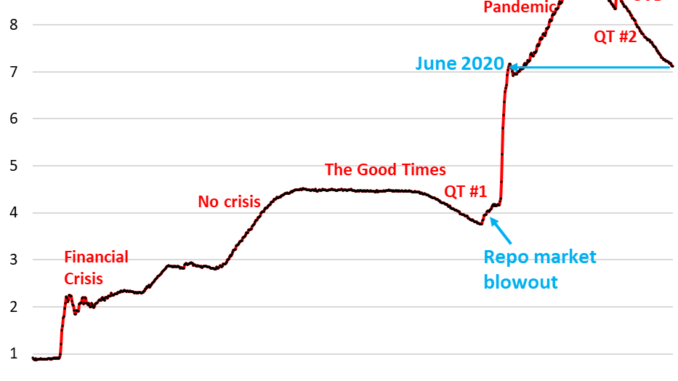

Total assets on the Fed’s balance sheet dropped by $66 billion in August, to $7.11 trillion, according to the Fed’s weekly balance sheet today.

The balance sheet first reached this level on June 3, 2020 (blue arrow in the chart), as the Fed was wrapping up three months of super-mega QE. This is another QT milestone of sorts:

Since the end of QE in April 2022, the Fed has shed $1.85 trillion, or 38% of the assets that it had added during pandemic QE.

August was the third month at the new pace of QT, announced in May, that reduces the cap for the Treasury runoff to $25 billion a month, but removes the cap for the MBS runoff, and whatever MBS come off, will just come off; any amount over $35 billion will be reinvested in Treasury securities.

The idea of the slowdown is to get the balance sheet down as far as possible without blowing anything up – to avoid a fiasco, such as the repo market blowout in September 2019 after QT-1 that the Fed dealt with by undoing a big part of QT-1.

QT by category.

Treasury securities: -$25 billion in August, -$1.38 trillion from peak in June 2022, to $4.39 trillion, the lowest since September 2020.

The Fed has now shed 42% of the $3.27 trillion in Treasury securities that it had added during pandemic QE.

Treasury notes (2- to 10-year) and Treasury bonds (20- & 30-year) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is now capped at $25 billion per month, and about that much rolled off in August, minus a small amount of inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which was added to the principal of the TIPS.

Mortgage-Backed Securities (MBS): -$18 billion in August, -$440 billion from the peak, to $2.30 trillion, the lowest since June 2021. The Fed has shed 32% of the MBS it had added during pandemic QE.

MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made. But sales of existing homes have plunged, and mortgage refinancing has collapsed, and so fewer mortgages got paid off, and passthrough principal payments to MBS holders, such as the Fed, have been reduced to a trickle. As a result, MBS have come off the balance sheet at a pace that has been below $20 billion in most months.

In recent weeks, applications for refinance mortgages have begun to rise and are up sharply from the very low levels late last year and earlier this year. There is a long lag between a refi mortgage application and – if that mortgage actually closes – when the Fed finally gets the passthrough principal payments from the old mortgage that was paid off. Some of it has started to show up: MBS QT has accelerated from an average of $14 billion a month early this year to $18 billion per month currently.

Bank liquidity facilities.

Only two bank liquidity facilities currently show a balance: The Discount Window and the Bank Term Funding Program (BTFP). The other bank liquidity facilities — Central Bank Liquidity Swaps, Repos, and Loans to the FDIC — are either at zero or near zero.

Discount Window: -$5.4 billion in August, to $1.5 billion. During the bank panic in March 2023, loans had spiked to $153 billion.

The Discount Window is the Fed’s classic liquidity supply to banks. The Fed currently charges banks 5.5% in interest on these loans – one of its five policy rates – and demands collateral at market value, which is expensive money for banks. In addition to the cost, there’s a stigma attached to borrowing at the Discount Window. So banks don’t use this facility unless they need to.

The Fed has been exhorting them to make more regular use of it, or at least figure out how to use it – apparently SVB hadn’t. Powell said the system was “clunky” and that banks should practice using it with small-value exercise transactions and that they should preposition collateral so that they can use it when they need to.

Bank Term Funding Program (BTFP): -$3.7 billion in August, to $98 billion.

The BTFP had a fatal flaw when it was cobbled together over a panicky weekend in March 2023 after SVB had failed: Its rate was based on a market rate. When Rate-Cut Mania kicked off in November 2023, market rates plunged even as the Fed held its policy rates steady, including the 5.4% it pays banks on reserves. Some banks then used the BTFP for arbitrage profits, borrowing at the BTFP at a lower market rate and then leaving the cash in their reserve account at the Fed to earn 5.4%. This arbitrage caused the BTFP balances to spike to $168 billion.

The Fed shut down the arbitrage in January by changing the rate. It also decided to let the BTFP expire on March 11, 2024. Loans that were taken out before that date can still be carried for a year from when they were taken out.

So no later than March 11, 2025, roughly in six months, the BTFP will be zero, removing another $98 billion by then from the Fed’s balance sheet, on top of regular QT.

What else caused total assets on the balance sheet to drop?

The balance sheet declined in total by $66 billion in August. Above, we accounted for $52 billion:

$25 billion Treasury securities

$18 billion MBS

$5.4 billion Discount Window

$3.7 billion BTFP

Here are $13.4 billion of the $14 billion we left out above that also reduced the balance sheet:

$10.6 billion of “other assets,” mostly accrued interest on its bond holdings that the Fed had set up as a receivable, and that it got paid in August. When it gets paid interest, it destroys the money (instead of having a “cash” account, like companies do, that it could put cash into or take cash out of, the Fed creates money when it needs to pay for something and destroys money when it gets paid.

$2.8 billion “unamortized premiums”: the amount the Fed writes off every month to account for the premium over face value it had to pay for bonds during QE that had been issued with higher coupon interest rates and that had gained value as yields dropped. Institutional bondholders, such as the Fed, amortize that premium over the life of the bond. The remaining balance of unamortized premiums is now down to $259 billion, from $356 billion at the peak in November 2021. And there’s a chart for that:

Take the Survey at https://survey.energynewsbeat.com/