Rise of Zombie VCs that stick around collecting fees as their startups run out of cash and die. The AI boom is the exception.

By Wolf Richter for WOLF STREET.

Outside of the boom in anything with AI or Machine Learning (ML) in its name or description, a lot of hot air has come out of the Venture Capital industry from the steamy levels during the free-money era of the pandemic.

Since the Fed started hiking rates and switched from QE to QT, marking the end of free money, VC funds experienced large-scale write-downs of their portfolio companies. They now cannot exit those startups by selling them because the market has tightened, after many hundreds of companies that VCs sold to the public during the free-money era via IPO or SPAC merger collapsed and entered into our pantheon of Imploded Stocks.

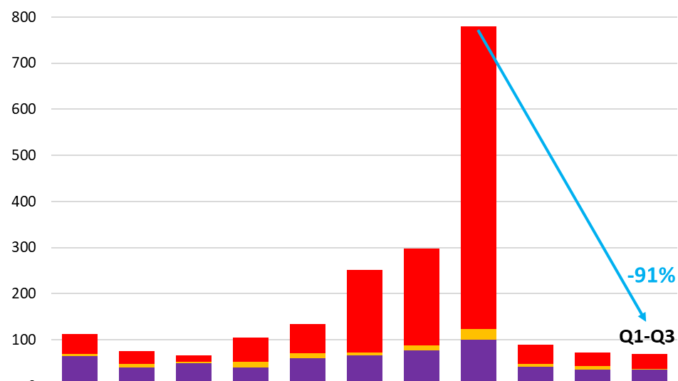

Exits in dollar terms amounted to only $10 billion in Q3, according to the Venture Capital Monitor for Q3 from PitchBook. VC funds sold only 14 portfolio companies via public listings. For the year through Q3, VCs booked only $69 billion in exits, down by 91% from the full-year 2021 of $780 billion in exits, which was the steamy and final year of free money. In 2024 so far, compared to 2021:

Exits via IPOs or SPACs: -95% (red)

Exits via buyouts by PE firms: -91% (yellow)

Exits via acquisition by Corporations: -64.5% (purple)

Successful exits are what makes the VC industry work. VC funds have to be able to sell their portfolio companies, at least some of them, at a huge profit, and then distribute the proceeds from the sale to the limited partners (LPs) in their funds so that these investors can re-invest their VC allocations in new VC funds that invest in the next cycle of startups.

The exit is when everyone makes money – except, as we learned over the past three years when these newly public IPO and SPAC stocks collapsed, the buyers; they ended up holding the bag. But now the whole system of exits, fundraising, and dealmaking has gotten clogged up because the pipeline of exits is blocked.

“The market continues to be flush with headwinds despite the 50-basis-point rate cut from the Federal Reserve (the Fed) in September, which will continue to pressure the exit market for the near term,” PitchBook said in the report.

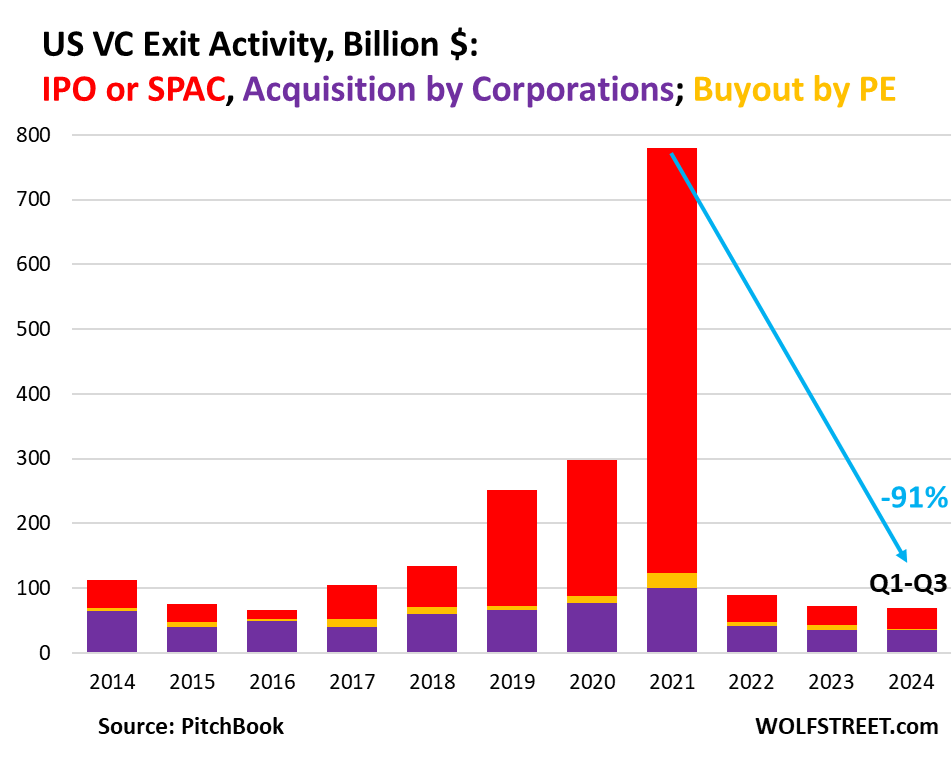

Exits via merger with a SPAC, which have proven to be particularly destructive to buyers of those shares, have collapsed by 96% in dollar terms from the peak of the whole year in 2021 to just $4.7 billion so far this year.

Blocked exit pipeline causes indigestion. Because VC funds cannot sell, or don’t want to at currently possible valuations, their portfolio companies have been staying private for longer as they wait for the miracles to be performed by some rate cuts from the Fed.

These still private companies have to raise funds in new rounds of funding, often down-rounds at lower valuations. And those that are not so lucky and cannot raise funds are left to fend for themselves by cutting expenses until they run out of money and shut down.

The backlog of companies in the blocked exit pipeline has ballooned the US private company inventory by about 26% over the past three years, to a record high of 57,674 startups, according to PitchBook.

“This upward trend of private company inventory means investors are struggling to translate numbers on their balance sheets into realized returns to reinvest into VC, so startups are having a harder time securing additional rounds of funding,” PitchBook said.

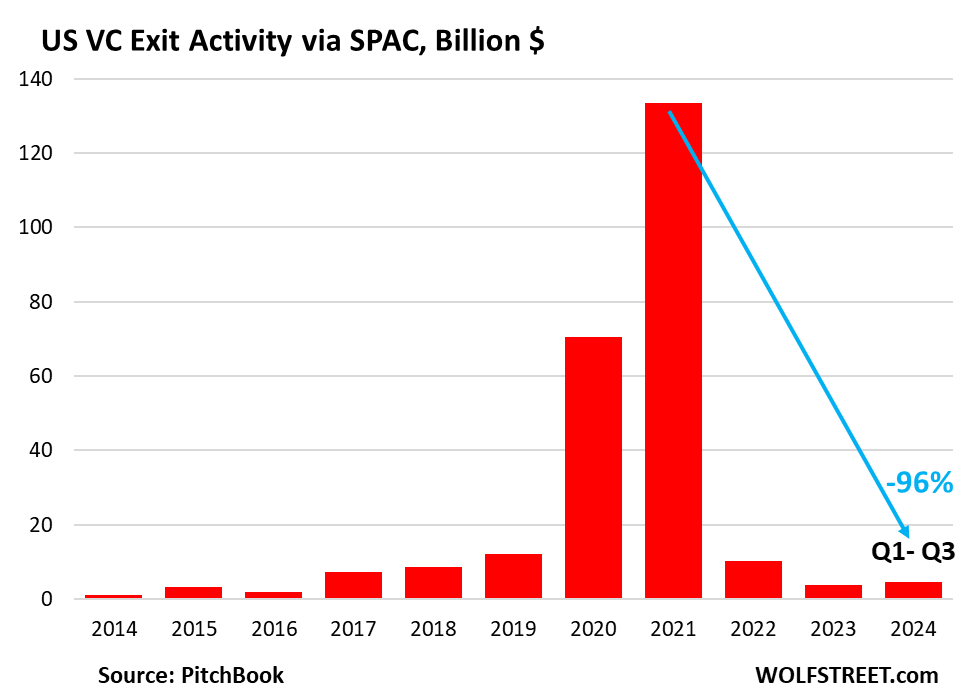

And cash distributions to their Limited Partners have plunged. PitchBook:

“As a share of net asset value (NAV), our most recent data shows that cash back to LPs is flowing at a rate nearly as low as during the global financial crisis (GFC) and has been in the single digits for eight consecutive quarters.

“The average quarterly rate of distributions over the past decade has been 16.8%, demonstrating just how dire the distribution scene has been.

“This lagged data point is as of March 31, 2024, and knowing that Q2 and Q3 were also incredibly slow in terms of exits, we expect this rate to remain as low as data is added.”

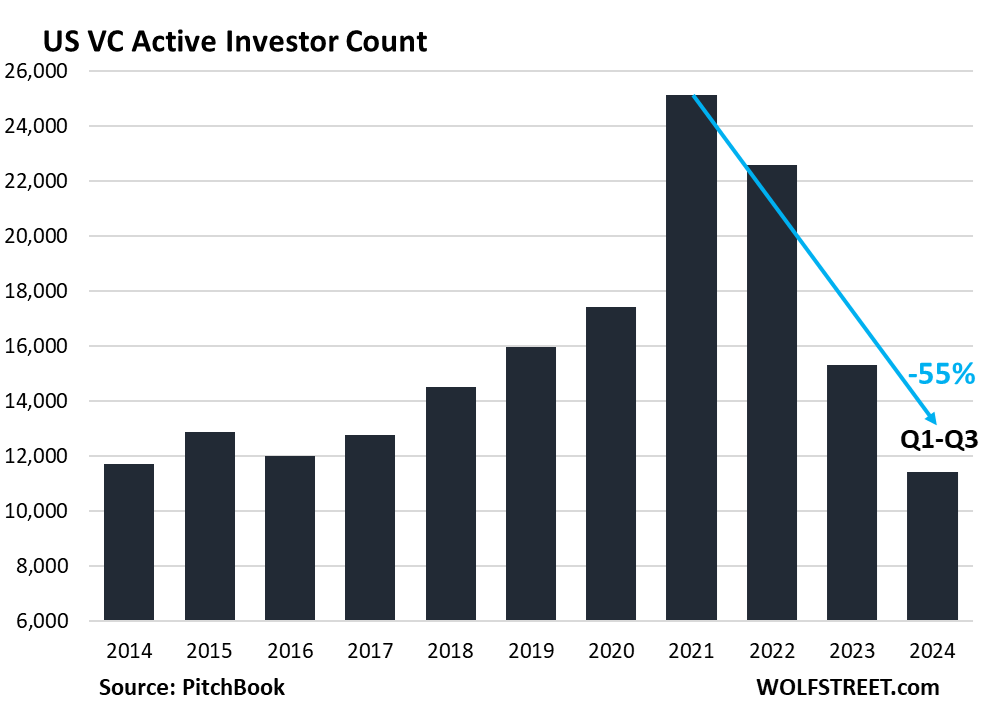

The rise of the zombie VCs. The number of active venture investors – those that made a deal in 2024 so far – has collapsed by 55% from 2022, to just 11,425 unique investors, according to PitchBook.

The other 45%, around 14,000 venture investors, have not made an investment so far in 2024. They represent the ballooning ranks of the zombie funds. PitchBook said in a note:

“So-called zombie funds can’t raise money from LPs or write checks to new startups. Unlike the companies they back, which go bankrupt when they run out of money, GPs tend to disappear quietly. By overseeing their existing portfolio and collecting management fees, these firms can operate for years as zombies.

“When the venture market took a turn over two years ago, industry watchers began to warn of an impending rise in these funds.

“One prominent voice, then-CEO of Techstars Maelle Gavet, predicted in a 2023 CNBC interview that: “[it] could be as high as up to 50% of VCs in the next few years that are just not going to be able to raise their next fund.”

Clamoring for lower rates to unclog the pipeline. Free money is the best money obviously, including for the VC industry whose free-money boom was spectacular, allowing them to exit a huge number of portfolio companies at huge valuations via IPOs and SPAC mergers that then collapsed within the portfolios of retail investors. But this may have been as good as it was going to get.

Now the Fed has cut by 50 basis points and everyone is clamoring for more cuts to make sure that T-bill yields of 5% are wiped off the face of the earth, so that this competition for VC funds vanishes, thereby making VC funds more appealing to LPs as an alternative.

But those rate cuts may be a mixed blessing. Since the Fed has started its rate-cut cycle, longer-term Treasury yields have shot higher, with the 10-year yield up by 45 basis points to 4.10% as of Friday, as the yield curve begins to un-invert and inflation fears resurface in the bond market.

We give you energy news and help invest in energy projects too, click here to learn more

Be the first to comment