And the backlog of unfilled orders remained at record high.

By Wolf Richter for WOLF STREET.

New orders for durable goods received by manufacturers in the US in April “plunged,” as the headlines had it, by 6.3% in April from March, on “Tariff Uncertainty,” or better yet, “as Trade Policy Swings Rattle Manufacturers,” or whatever, the worst drop since Adam and Eve, etc. etc.

But they’d jumped by 7.6% in March, driven by huge Boeing orders in March, and the plunge in April was driven by the lack of huge Boeing orders, because that’s what aircraft orders do, one month an airline orders dozens of jets, and the next month no airline orders dozens of jets, and then the next month, another airline orders dozens of jets, and huge month-to-month spikes and plunges are normal – and the three-month average irons them out.

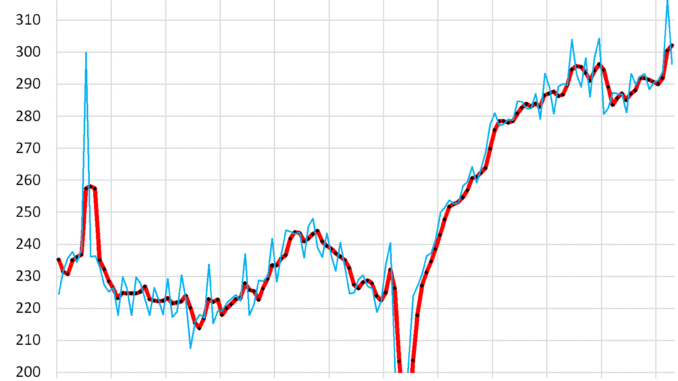

And the three-month average of durable goods orders rose by 0.6% in April from March to a record $302 billion (red line).

Excluding Defense and excluding Nondefense Aircraft & Parts. Durable goods orders excluding “nondefense aircraft & parts” (so excluding Boeing among others) and excluding “defense” declined by 1.3% from the record in March to $261 billion. Note the ups and downs in the blue line in the chart below. It always does that. But the three-month average irons out those squiggles.

The three-month average rose by 0.3% to a record $263 billion (red in the chart below).

This is a measure of demand for US-manufactured durable goods that excludes defense and the ups and downs of civilian aircraft orders. It’s an indicator of business and consumer demand for durable goods, other than aircraft, manufactured in the US, such as machinery; motor vehicles of all kinds; fabricated metal products; computer and electronic products; electrical equipment, appliances, and components; etc.

The historic boom in orders coming out of the pandemic shortages peaked in late 2022, then eased off a little but remained at high levels in 2023, and in 2024 started rising again.

And in March and April 2025, the three-month average set records again.

Orders for aircraft and parts are the biggest source of the volatility in overall durable goods orders. They have massive month-to-month swings as a matter of routine. In February, there were $14 billion in orders, in March $37 billion, and in April $18 billion.

The order backlog remains at record highs, after a big spike in March to $1.41 trillion. Of those unfilled orders, $596 billion are for nondefense aircraft and parts.

Unfilled orders without nondefense aircraft and parts also remain high, unchanged in April at $813 billion. After the surge during the pandemic shortages, manufacturers were expected to be able to reduce their backlog again, but it remains 35% higher than at the beginning of 2020:

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack