ENB Pub Note: This article is from the Energy Bad Boys on Substack. Isaac Orr and Mitch Rolling are fantastic energy thought leaders and we highly recommend subcribing to their Substack. They make some great points, and yet I am still shocked at everyone’s thought processes, which suggest that wind and solar are cheaper. They are not when you look at the total cost, and the cost for total back ups. Look at Texas ERCOT and wonder why they need an estimated 92 GW but have 180 GW nameplate on their grid. How much extra did that 88 GW cost consumers?

Wind, solar, and storage advocates are celebrating the news that natural gas turbine prices and fuel costs are increasing, suggesting that rising costs for electricity generated by natural gas make their preferred technologies the obvious answer for meeting new power demand for data centers and manufacturing.

What these advocates don’t seem to realize is that rising natural gas prices also make wind and solar more expensive by increasing the cost of the backup generation needed to provide power when wind and solar don’t show up to work.

Are you Paying High Taxes in New Jersey, New York, or California?

These rising prices mean it makes much more sense to keep existing coal and nuclear plants online for as long as possible rather than relying on some combination of wind, solar, storage, and natural gas.

Totally Turbulent Turbine Prices

CC Gas Costs

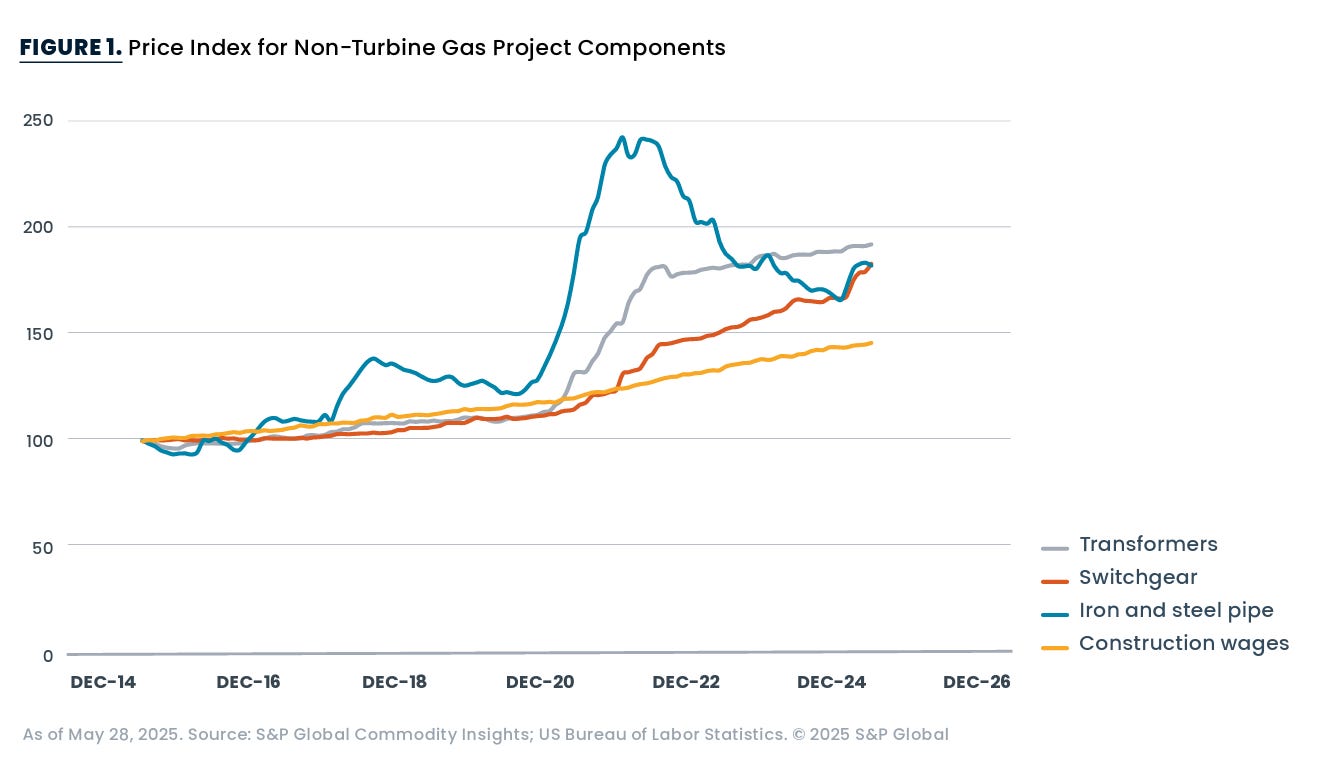

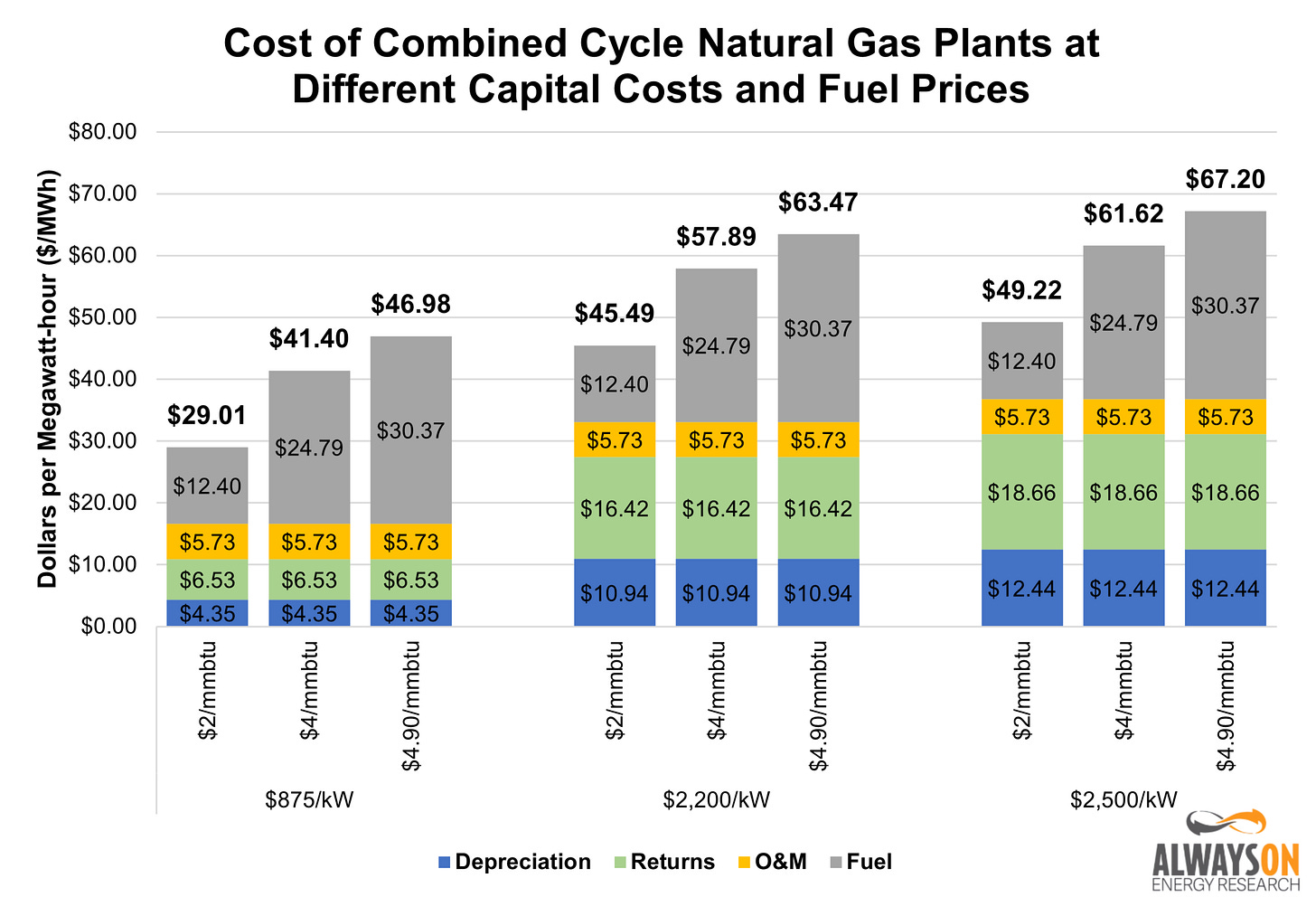

The U.S. Energy Information Administration (EIA) estimates the cost of a new combined cycle (CC) gas turbine to range from $824,000 to $875,000 per megawatt (MW) of installed capacity. However, Utility Dive recently reported that costs have risen to $2.2 million to $2.5 million per MW to build a new natural gas CC plant, meaning gas turbine prices have roughly tripled compared to just a few years ago.

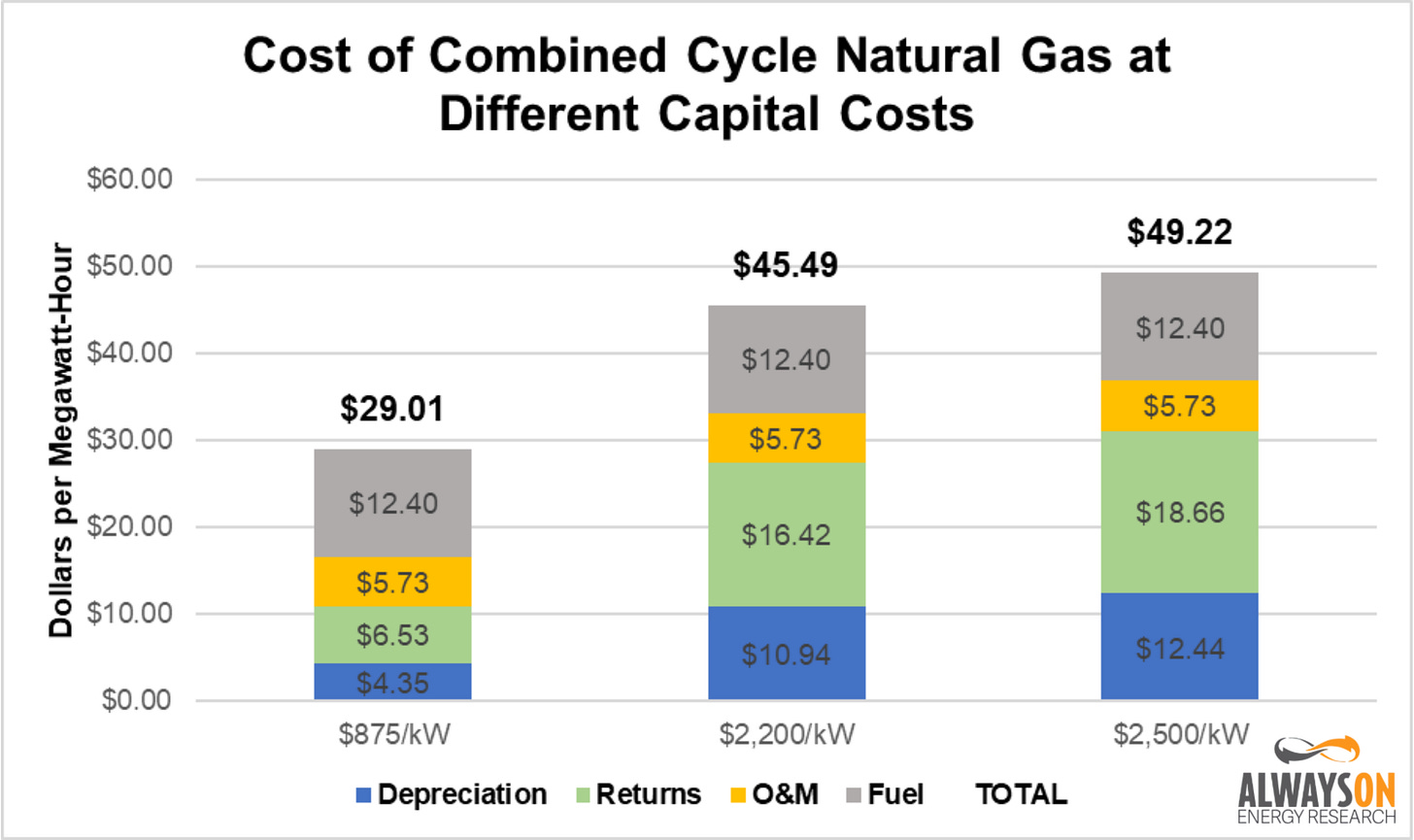

These increasing capital costs have important implications for the Levelized Cost of Electricity (LCOE) of new natural gas plants. The graph below shows the cost of electricity from CC natural gas plants at $875,000 per MW, $2.2 million per MW, and $2.5 million per MW, assuming a fuel price of $2 per million British thermal units (MMBtu).

As we show in the graph, a near tripling of capital costs does not result in a tripling of the LCOEs of the gas plants. The LCOE of the high-end capital cost of $2,500 per kW is $49.22 per MWh, which is a 70 percent increase compared to the low-end estimates of $29.01 for plants that cost $875 per kW.

At the low end of the capital cost spectrum, capital costs and returns—which are based on the rate of return earned by utilities on their capital expenditures— constitute just over a third of the total cost of electricity from these facilities. At the high end of the spectrum, this share rises to 63 percent of total costs, assuming the low fuel prices of $2 per MMBtu.

At the low end of the cost spectrum, new natural gas CC plants are already competitive, if not lower cost than existing coal and nuclear plants. As we detailed in a previous post, the existing coal plants in MISO operated at an average cost of $37.45 per MWh, and existing nuclear plants generated power for $28.38 per MWh. However, at $2,200 per kW of capital costs, new gas is less attractive than existing assets.

CT Gas Costs

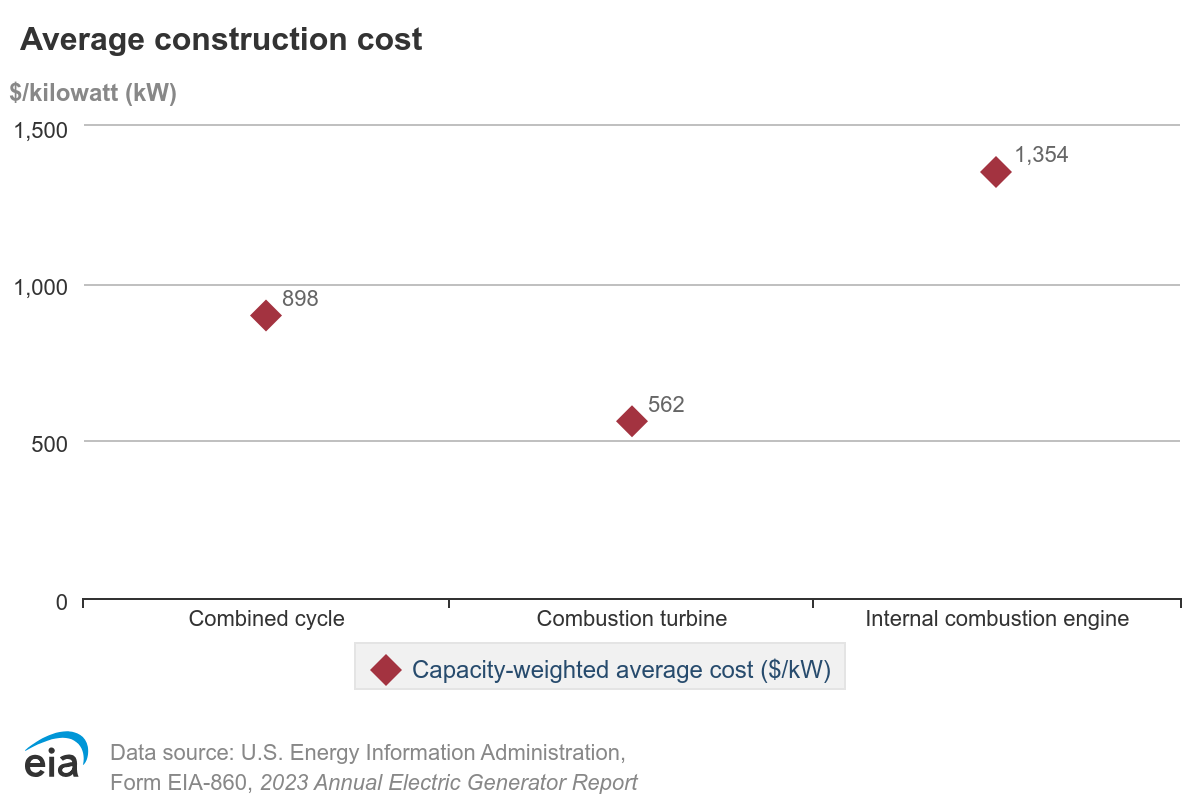

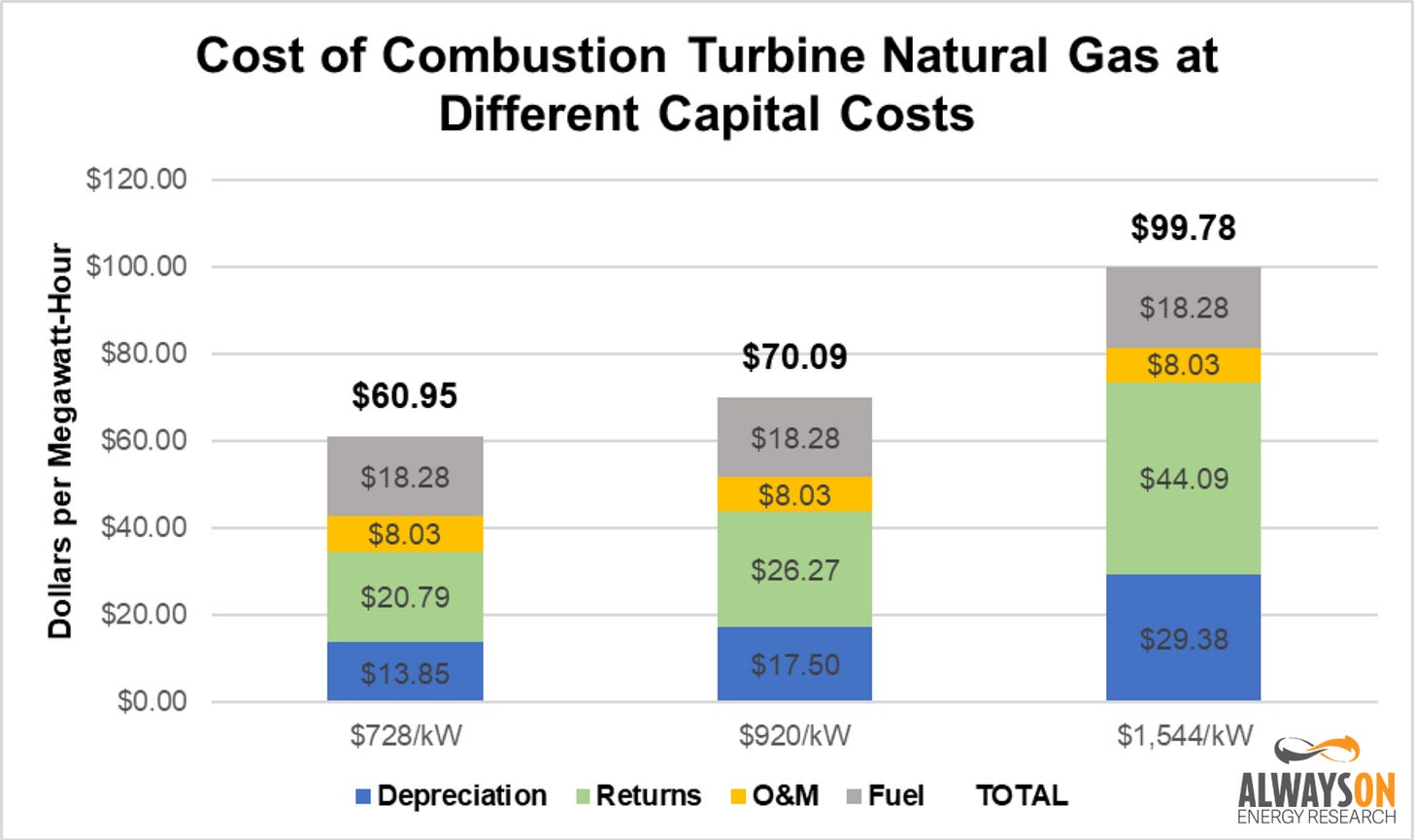

Combustion turbine (CT) natural gas plants, also known as simple-cycle plants, are also experiencing rising costs. According to EIA data, the average cost of a CT gas plant placed into service in 2023 was $562,000 per MW of installed capacity.

A recent study by Grid Lab and conversations with our friends in the utility business suggest that CT gas plants placed into service in 2025 will have capital costs ranging from $728 per MW of capacity to $1,544, a stunning increase in prices in just the last two years.

The figure below shows the cost of generation at the 2023 prices, and the cost at $728,000 per MW, $920,000 per MW (also from the Grid Lab data), and $1,544,000, assuming a $2 per MMBtu fuel cost and EIA estimates for plant heat rates.

Here, it’s worth noting how important the capacity factor assumption is for CT plants. CT plants are often used for peaking or load following situations, and as a result, they almost always have lower capacity factors than CC gas plants, which are more equipped to operate as baseload gas. Our analysis used a 76 percent capacity factor for CC plants and a 20 percent for CT plants.

Fuel costs are more prominent for these plants because CT gas plants are less fuel-efficient than CC plants, as signified by their higher heat rates, and as a result, fuel costs constitute 56 percent of the $32.33 per MWh LCOE of the low-end capital cost scenario and about 43 percent of the total LCOE in the high-end capital cost scenario.

Natty Prices Up, Too

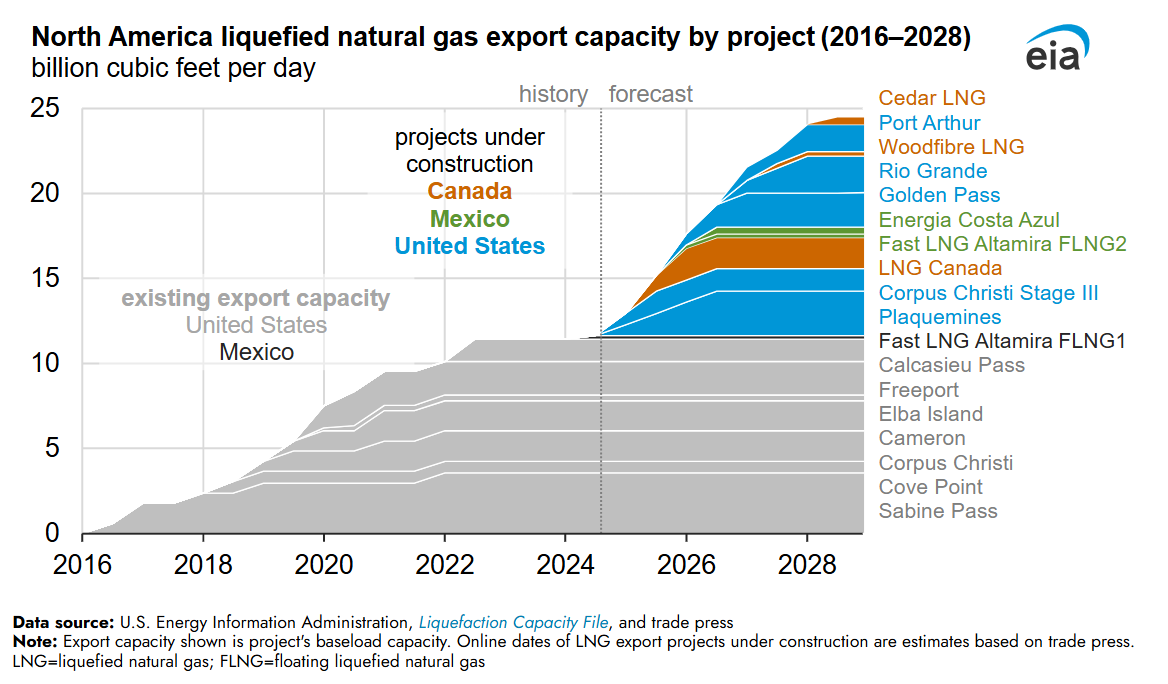

Market forces are creating upward pressure on natural gas fuel prices are also rising just as turbine prices peak. The U.S. Energy Information Administration expects North American —including three Canadian projects—liquefied natural gas (LNG) export capacity to double by 2028.

If all of these facilities come online and operate at full capacity, the daily export of LNG would equal 20.6 percent of current daily gas production. Add in rising power demand for data centers, and natural gas prices will see upward momentum if drillers do not backfill this supply to contain prices.

We are not ones to bet against American shale producers, but if gas prices tick higher it will influence the economics of natural gas plants moving forward.

The U.S. EIA Short-Term Energy Outlook estimates natural gas prices will average $4 per MMBtu in 2025, and jump to $4.90 per MMBtu in 2026, up from $2.20 per MMBtu in 2024. The graph below shows the cost of electricity generated at CC natural gas plants at the various fuel prices discussed in this paragraph.

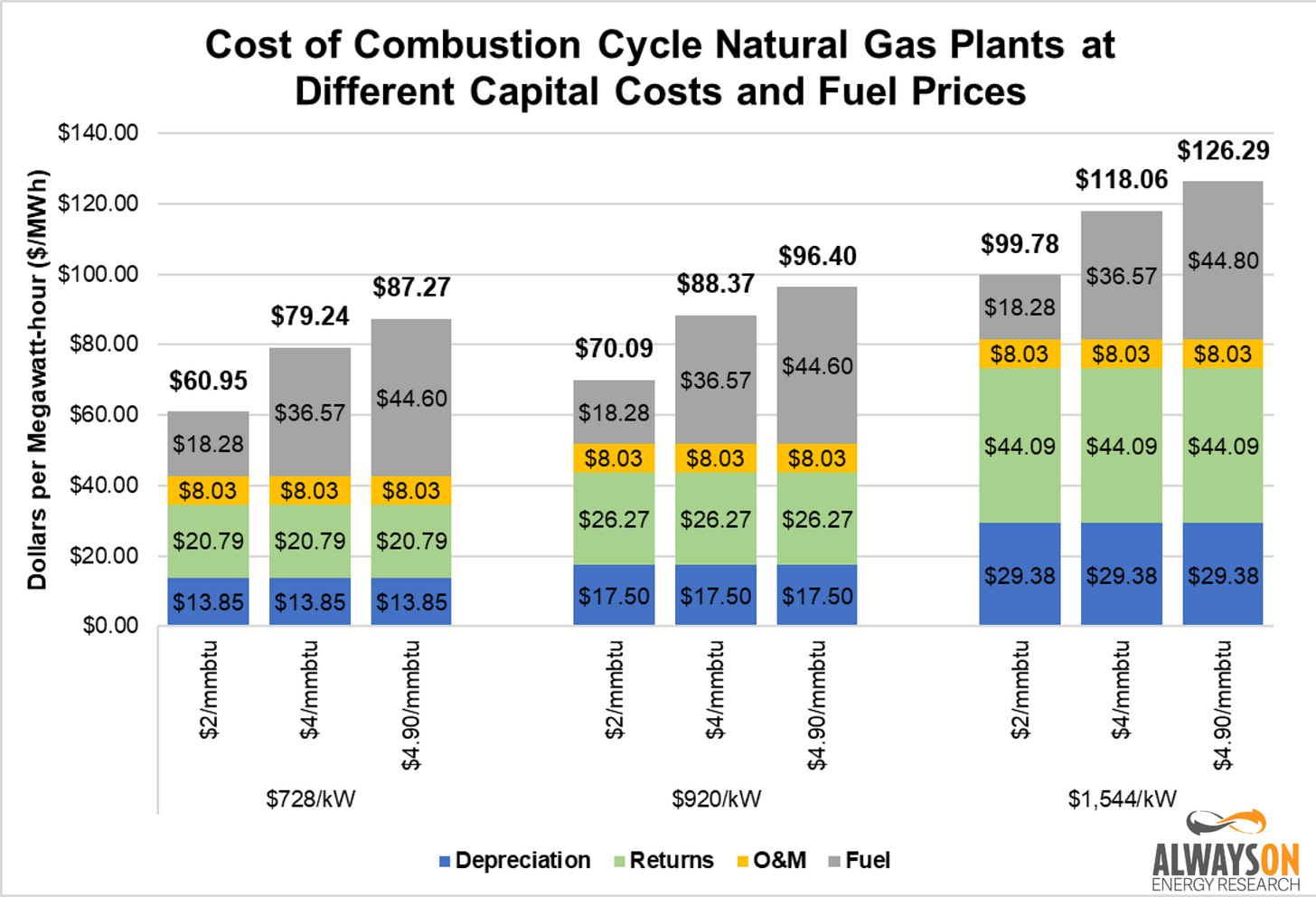

The figure below shows the impact of rising fuel prices on the LCOE of CT natural gas plants.

Higher Gas Prices Also Make Wind and Solar Systems More Expensive

Now for the fun part. Here’s the rub that wind and solar advocates don’t want to admit: when it comes to rising prices for gas turbines and fuel, it makes running their preferred electric grids much more expensive by increasing the cost of backup generation.

And no matter how many states pass “net-zero” and “carbon-free” mandates, wind and solar need backup generation—and if policymakers want regular Americans to be able to afford electricity, this backup generation will need to come in the form of natural gas.

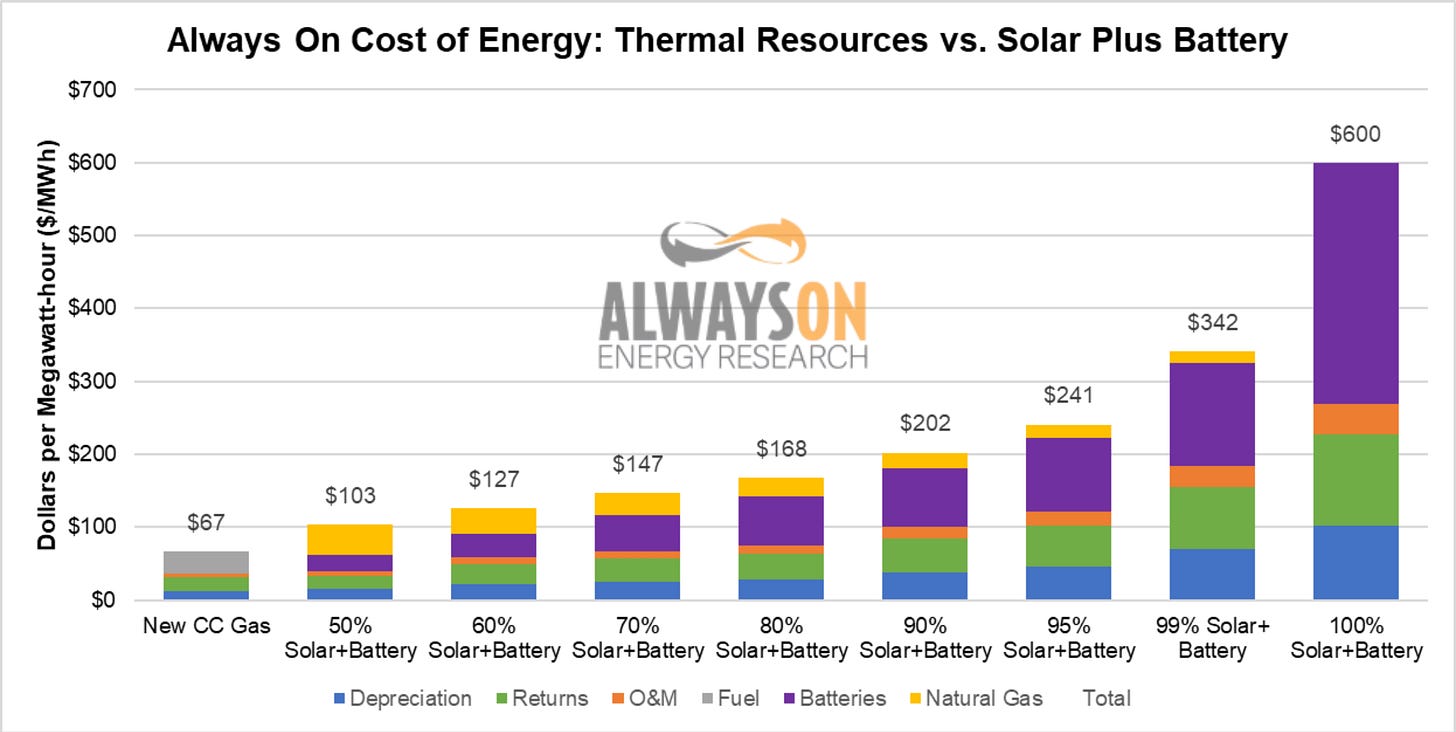

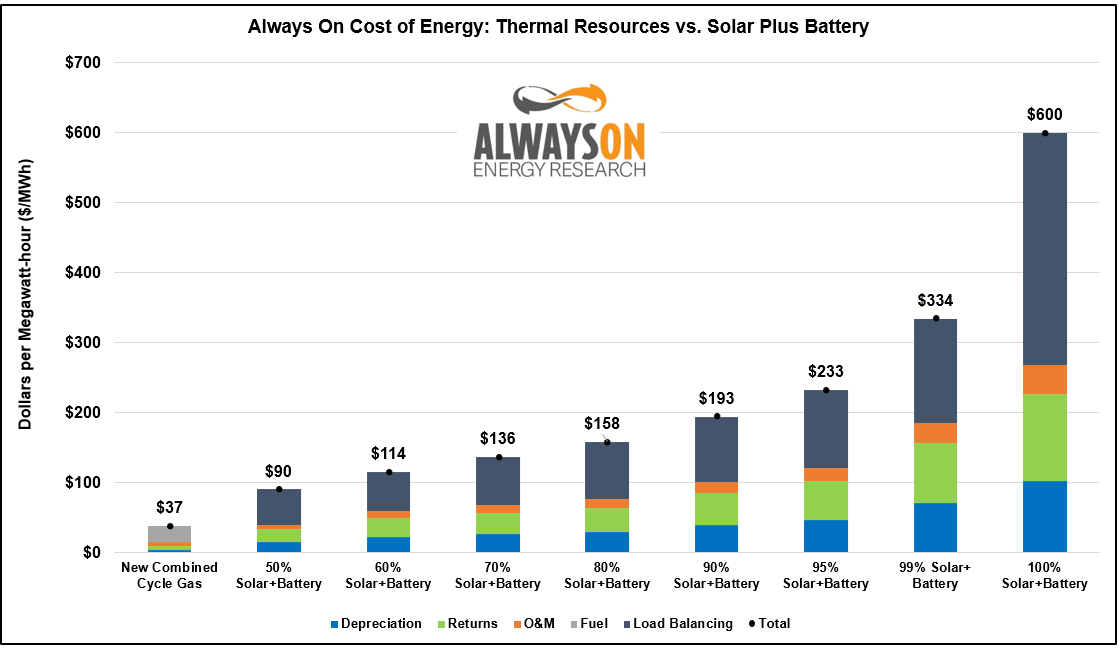

Using the model we built for our article “The Baseload Solar Beatdown,” we adjusted the capital and fuel costs for the backup combustion turbine natural gas plants to demonstrate their impact on the stand-alone cost of wind and solar—along with storage—at varying levels of penetration. As you can see, the price increases have hit all of these portfolios.

Compared to the figures shown in “The Baseload Solar Beatdown,” the 50 percent solar plus battery storage levels are 15 percent higher, using higher capital cost and fuel prices for the natural gas backup generation. Additionally, we presented the cost of combined cycle natural gas at the highest capital cost and fuel price from above.

The graph below shows prices are higher in every other portfolio mix, as well, even though a higher use of solar will require less natural gas for load balancing than the 50 percent scenario.

Outside of this hypothetical situation where a constant demand must be met by new resources, the extent to which rising natural gas costs increase the cost of running a system with wind, solar, and storage will depend on the penetration of the intermittent sources and the amount of dispatchable capacity on the system.

If there is already adequate dispatchable capacity on the system to meet demand, then rising fuel costs for load balancing will affect customer bills, but higher capital costs for natural gas plants won’t because the backup capacity already exists. If more dispatchable capacity is needed to meet peak demand, it will come at a premium price until gas turbine prices come back down—if they ever do.

Conclusion

Electricity costs from natural gas power plants are rising, as the rise in capital costs for new natural gas plants constitutes a 70 percent increase in the LCOE of these plants, and a potential rise in fuel costs could push these prices higher.

But wind and solar advocates should be careful what they wish for, as higher prices for natural gas power plants and fuel make their own preferred generation portfolios, which are reliant upon natural gas for reliability, more expensive.