In this episode of Energy Newsbeat – Conversations in Energy, Stu Turley sits down with Wasif Latif, President of Sarmaya Partners, to explore the “Return to Tangibles” investment thesis. Latif explains why commodities like gold, silver, copper, and platinum are outperforming tech stocks and bonds in today’s market. He breaks down the geopolitical catalysts, surging industrial demand, and the performance of the LENS ETF—designed to capture this tangible asset boom. From silver’s breakout and platinum’s comeback to supply chain rewiring and defense-driven resource demand, this episode is a masterclass on navigating a deglobalizing, resource-constrained world.

Wasif writes in his Substack article:

7% retracement is another instance of the market digesting gains rather than signaling exhaustion. We see this spike in volatility as a healthy reset, not a sign of weakness. It’s how long-term strength shows up and builds momentum.

· Deficits, not just interest rates, are driving liquidity creation. With Social Security, Medicare, and Net Interest absorbing more than half of all U.S. federal outlays, fiscal consolidation seems a politically impossible. This structural imbalance anchors gold’s long-term bid as policymakers rely increasingly on monetary and fiscal accommodation to finance spending.

· Central banks have become systematic gold buyers, treating it as a Tier 1 reserve asset amid rising geopolitical fragmentation and declining trust in fiat discipline. Their price-insensitive accumulation sets a structural floor beneath the market. For investors, the behavioral edge lies in patience, the capacity to stay invested through cyclical volatility in a secular uptrend.

See how energy plays into the return to tangibles.

As always, Wasif, thank you for stopping by! – Stu

Substack: https://sarmayakar.substack.com/

Check out https://sarmayapartners.com/

LinkedIn: https://www.linkedin.com/in/wasiflatif/

Highlights of the Podcast

00:00 – Intro

00:56 – JP Morgan’s $10B Strategic Investments

02:11 – Rise of Geopolitical Investing & Strategic Imperatives

02:28 – Return to Tangibles: The Core Thesis

04:36 – Ringing the Bell: Launch of LENS ETF

05:37 – Silver Breaks Out: Early Stages of Bull Run

09:00 – Precious Metals vs. Tech & Bonds

11:05 – Platinum’s Comeback & EV Reality Check

13:55 – Geopolitics, Military Spending & Commodity Demand

15:30 – “We’re in the Stuff Shovels Pick Up”

17:40 – Oil Lagging—But Not for Long

19:56 – LENS ETF Performance YTD

21:21 – How Samarya Partners Invests Differently

23:50 – Gold vs. S&P500 (Real Returns)

25:17 – Inflation Outlook & Rate Cuts

27:12 – AI, Data Centers & Energy-Driven Inflation

30:18 – Long-Term Trends: Stagflation, Labor vs. Capital

30:20 – How to Reach Wasif Latif

Stuart Turley – Energy News Beat Host [00:00:07] Hello, everybody. Welcome to the Energy Newsbeat Podcast. My name’s Stu Turley, President CEO of the Sandstone Group. Today is a special treat. I’ve got Wassif Latif. He is the head guy over there at Sarmaya Partners, and he has been on the podcast several times. We’ve got finance and investments and ETF to talk about. Guy over there at Samaria Partners and he has been on the podcast several times. We’ve got finance and investments and ETF to talk about today. How are you today, sir?

Wasif Latif – Sarmaya Partners [00:00:38] I’m great, Stu. How are you?

Stuart Turley – Energy News Beat Host [00:00:39] I’ll tell you what, this is an exciting time. Today, JP Morgan announced that they will make direct equity investments up to 10 billion into strategic industries that support the United States economic security. You know, Wallace, I think they must have listened to our last podcast.

Wasif Latif – Sarmaya Partners [00:00:57] It might be, you know, we’ve been talking about this for some time, as you know, Stu, and in going back several years. Our our whole thesis was that we are in a geopolitical world and a higher fiscally dominant world where what’s gonna happen is you’re gonna see more and more countries and power zones and geopolitical zones exerting a lot more government led incentives for businesses to move in the certain direction. And it really boils down to as as we’ve talked about, strategic imperatives, national security imperatives. And as a result of that, y you know, we’re you’re seeing all these investments take place because now we are in that competitive world that we’ve talked about. So it’s not the cooperative world that existed twenty, thirty years ago. It’s more now of a competitive world. And as a result of that, you’re gonna see the same type of capabilities being built across borders. So if China has certain capabilities that we don’t, which we are now recognizing real time, we’re gonna spend a lot of resources and energy driven by government and government policy to get the businesses behind it as well, to make sure that we can then have those resources and those capabilities ourselves and not be reliant on others like China.

Stuart Turley – Energy News Beat Host [00:02:12] Speaking a very professional way of saying China is trying to hoard all of the critical minerals and magnets and everything else that you have talked about on the podcast before as being in a commodities super cycle type thing.

Wasif Latif – Sarmaya Partners [00:02:28] Yeah, so we, you know, our thesis we developed quite a while ago, I would say a few years ago, and we called it the return to tangibles. And I know we’ve talked about it, but basically the return to tangible is that mankind, humankind, the world at large returning to the idea that you know what, these these commodities are actually essential not only for our existence, but our prosperity, and now increasingly so for our security and defense and things of that nature. And so that migration continues to occur. Right now it is about rare earths, but it’s also a lot about the broader commodities as well. They’re gonna be the underpinning of not just some of the geopolitical stuff that’s happening today, but if you go out the next few years, several years, they’ll be the essential ingredients in building out the future as the rest of the world continues to build out its infrastructure as we begin to upgrade our infrastructure, whether it’s the energy grid or it’s just reshoring or onshoring or friendshoring, if you will. All of that’s gonna need a lot of sort of baseline fundamental commodities that are the bedrock of all of these this physical infrastructure. So that’s the stuff we’re in. That way we know, for example, that the world as it goes down this path, the need for copper, for example, will continue to increase. And right now, the amount of copper that’s available that’s being mined, that’s going to be available in terms of supply versus a demand, it looks like there could be some interesting future, an interesting future where copper prices continue to rise in order to meet that demand because the supply is not as robust as we had initially thought. So it’s just the world just gradually coming back to this realization that tangibles or real assets are are really a very, very critical and foundational piece of the world that we live in.

Stuart Turley – Energy News Beat Host [00:04:20] You know, for our podcast listeners, Wassif has been a fantastic resource for the podcast and a friend of the show, but I’m looking at his office. And as he’s sitting there, he’s got a bell picture. I’m looking at that going, that looks like you were ringing a bell. What was that picture about?

Wasif Latif – Sarmaya Partners [00:04:36] Yeah. We’re definitely ringing the bell. My partner Carl and I are ringing the bell for the official bell-ringing ceremony of our ETF that we launched. The ticker is lens, and as you can see on the picture, it’s over there. That’s the ETF that is actually investing in this return to tangible secular theme that we’ve been talking up about for all of this series with you Stu. And it is investing in the equities of these commodities. So companies that are either involved in the exploration, mining, extraction, selling, or facilitating all of this space. And it’s across gold, silver, gold mining stocks, silver mining stocks, copper, uranium, platinum, and let’s not forget oil and gas as well. And so all of that broad commodity space is embedded and invested in our single ETF vehicle that that our investors are are looking at.

Stuart Turley – Energy News Beat Host [00:05:33] Outstanding. I that’s pretty cool. So did you have some slides that you wanted to show on this?

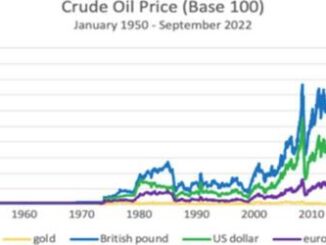

Wasif Latif – Sarmaya Partners [00:05:37] Yeah, sure. So, you know, what’s interesting is the you know, gold has been in the news for quite some time. It continues to make new highs. But last week’s big news, in in our opinion, was what silver did. And so I want to share this first the what the silver price and the history of silver, and then touch a little bit about what has happened to the price of basically precious metals versus the broader market, the equity in the bond market. So I’m gonna share this slide here. Let me know when you see it. Cool. So this is the price of silver pretty much going back to 1960. And as you can see, in in we broke a new all-time high. This is as of last week when it broke 50. Right now, it is almost 52 as we speak on October 13th. And so it has it has definitively broken out of its prior highs. And what is interesting is the last high that it broke through was from 1980. Believe it or not, 45 years later, silver has finally broken out out of its all-time high that was set in 1980. And we think that there’s a lot more left in this rally in silver that in our view has has just begun and is still in the early innings. And the reason is because of the the fundamentals, it more likely more like than some of the the price or the technicals. And the fundamentals are saying two things. Number one, as gold rallies and as gold continues to move up, silver, you know, like it’s gold’s little brother eventually catches up and historically has has done sort of a catch-up move. To gold whenever gold is in a bull market. And so, number one, we’re seeing that catch up. Number two, and by the way, that that catch up is has more legs to go when you do a historical silver to gold ratio. And there’s a lot of folks who pay attention to that. Some folks will say, well, that’s just the ratio really doesn’t mean anything. But for those who care about it, you know, just for silver to get back to sort of the average or the median of that ratio, the the price for silver needs to be a lot higher than where it is, just to get back to that, for example, as it catches up to gold. So that’s number one. Number two, silver is not just a precious metal. Obviously, it has some of that characteristic, but it is also an industrial metal. And as we know, it goes into a lot of industrial uses because it is it is is a great conductor, it’s still relatively cheap and malleable and can go into a lot of things. And that industrial usage is continuing to grow. So, as we talked about, you know, the whole idea of the world needing more and more of everything in terms of infrastructure, industrial capacity and the build out of that, and not to mention the migration towards electrification and whether we we like it or not, in China, for example, they’re gonna continue to build out more solar capabilities. And all of those uses require silver. And so silver also has an industrial use. So when you do the demand and supply analysis on silver for the uses of industrial needs, but also then you attach that to its characteristics as a precious metal. And then finally, when you look at the supply of silver versus that demand that’s there, it it looks like that the supply is still behind the curve and it needs to catch up. And the the interesting thing about commodities is supply and demand will always do what they need to do. Demand ultimately is the driver, and the adjustment mechanism is the price. So if the if the demand continues to move up, the supply isn’t there, guess what’s going to happen? The price will move up to counter for that and be the adjusting period. So all that means is to us that silver is in a bull market and it’s finally beginning to get into high gear after lagging gold. And usually when that happens, it catches up and it moves really rapidly. And we’ve been seeing that. So so far this year, and when I go to the next slide here, so far this year, you know, silver has done really, really well. But here’s the interesting part, and I’m gonna shift gears here a little bit. So far this year, we’ve seen a rebound in equity markets since the April lows. And the markets and the financial media has been talking about it of how strong the equity market is, how strong the S P 500 has been year to date, and the Nasdaq has been year to date. So this chart is showing you a section of how the NASDAQ, the SP 500 and the Bloomberg Act, which is basically a proxy for the broader bond market, and gold have done in the first quarter of this year, the second quarter of this year, the third quarter of this year, and then so far since the beginning of this year till the end of the third quarter. So here’s the interesting part. As much as the equity market is up, and as much as people are talking about the excitement around the equity market, driven by a lot of the tech names and the semiconductor names and whatnot, gold is beating them all. And gold is outperforming both the SP, the Nasdaq 100, and bonds on a year to date basis. And it really is the strength that we saw in the first quarter and then in the third quarter. And here’s the interesting piece that I mentioned on the silver side. So this chart is the same time frame. So first quarter, second quarter, third quarter, and then year to date through the end of the third quarter. But what we’re looking at now is the commodity space. So gold is still there, like it was in the prior chart in yellow. But then we’ve added, we’ve taken out the indices and we’ve added copper, we’ve added oil as represented by WTI. We’ve added platinum and we’ve added silver. And so, you know, you saw in the prior chart that gold is outperforming year to date the equity markets and bonds. So it’s beating stocks and bonds. But look at this chart. Silver and platinum are beating even gold on a year-to-day basis. Why? Because they’re catching up. And I talked through silver in in detail. So that’s where the catch up is occurring. And this is a year-to-date number. If you go back a few years, silver still, in our view, has to do a little bit more of catch up versus gold. But but platinum, as you may know, on a longer-term historical basis, platinum actually trades at a premium to gold. And for the past several years, it’s actually been trading at a discount. And there’s been some you know bearishness around platinum because it goes into catalytic converters for industrial combustion engines. And for the past few years, the idea was that EVs are going to take over and therefore platinum sold off because of that industrial demand pressure. What’s come to light over the past year, as we all know, is that the adoption of EV is nowhere near as what the initial thoughts were. And that’s really because their practical real world experiences are resulting in the world realizing consumers realizing that they’re not as practical. And just just the technology is not there yet to be able to compete on a real world basis on a longer term basis when you grind through the day-to-day, month to month, year to year of running a vehicle. The technology isn’t there yet. Maybe you’ll get there someday. But what that’s done is it’s put a upward pressure on platinum because the realization is, oh wow, we still need industrial internal combustant engines for the time being. And also the halfway point between electrification and ice engines is the hybrid engine. And the hybrid engine also needs platinum. So all of that is to say platinum got into high gear earlier this year, but more so in the second quarter. As you can see, the big jump in platinum came in the second quarter. And that hasn’t let up. And it’s because of, again, both of those reasons. Number one, it is a precious metal that is now trying to get back to its relationship to gold with the premium price. And number two, the industrial use of platinum is coming back into the forefront. And the market is realizing that it was underpriced. And again, the demand versus the supply seems to be a mismatch. And we think that the price will continue to move upward on that.

Stuart Turley – Energy News Beat Host [00:13:55] This is amazing. Just th this chart for our podcast listeners, when you go and listen to this on Spotify or Apple, this is amazing from the standpoint that you take a look at this chart, you’ll want to read the article and look at this chart. But I I’m gonna also throw this in there, Wassip, because of the geopolitical issues going on around the world. The President Trump is basically told the EU, you better arm yourselves because we’re done, you know, doing all of the armament. So the defense contractors around the world, jet engines, turbine components, you mentioned the engines part of it, but also fuel reforming and power systems, thermal batteries and electronics and sensors. This is all military stuff that everybody is now looking at redoing. And this is a huge issue.

Wasif Latif – Sarmaya Partners [00:14:46] Yeah. Yeah, it is. And what’s interesting is you’ve had decades of underinvestment in the let’s say let’s let’s look at the European Union, for example, or NATO, for example. They’ve had decades of underinvestment in their military capabilities and we know that. And now because of the US’s reaction, they are now ramping that up. So Germany has committed to spending a lot of money there, as as other countries have as well. And so what’s that resulted in is this renewed need to spend on this space. And you know, in the short term, there’s some winners and some losers on the companies that are going to be building this stuff for sure. But what you don’t know as technology evolves and as things improve, what’s going to be the bigger winner over the long term? And there are ways to play that. What we would prefer to do is to say, look, we don’t know if Germany’s going to be spending more or China’s going to be spending more or the US is going to be spending more. We just know at the aggregate, there’s going to be more spending in the space. Okay. That means that they’re all gonna need copper, they’re all gonna need platinum, they’re all gonna need silver. And so we, you know, people talk about in this market rally, there’s been this common phrase that everybody uses that we want to be in the picks and shovels. I wanna say, and I usually say is that instead of being in the picks and shovels, we’re in the stuff that those shovels are going to be picking up. That’s what I’d rather be in. And so so investing in this stuff to us is just the most fundamental layer, the most broadest layer of exposure you can get. And if you invest in companies that are exploring for these materials, mining these materials and extracting them and and selling them and then or facilitating that, that’s where the benefit is. Because if you invest in the companies, instead of directly into these commodities, the companies have financial leverage and they have operating leverage. And so because of their operations of bringing this stuff out and selling it, they turn a profit and then they can use that profit to reinvest in the company. And therefore, that is the way, in our opinion, to have a better chance of compounding your returns in in these things as opposed to just buying the commodity directly. I will say that we own gold and silver directly as well in our ETF. But that is because of their precious metals, especially gold, their characteristics of you know being sound money and being a safe haven and ultimately seen as a tier one asset against monetary debasement, which is happening worldwide, especially in the Western developed world. And so as that occurs, that metal itself will do well. But the other commodities we prefer to play through investing in the companies that are facilitating that, because that’s how you can compound your growth and your earnings and your returns. And the last thing I’ll say about this chart is that oil has been lagging this year. We can see that. Now, what is interesting is oil and then by extension, natural gas, when commodity cycles begin, it usually starts with one corner of the market and then it moves to the other corner of the commodity market. And then in the second phase or the full blowout phase is when all of it starts to move up. And we think that the commodity cycle, the return to tangible started in 2021, when the world was coming out of lockdowns and the supply chain shortages and the sudden need to travel and the sudden need for energy just catapulted the price of oil. And since then, so that was the biggest returner of commodities at that time, in those two, in those couple of years, 21 and 22. And since then, oil’s been consolidating while the precious metals and now the broader metal space is beginning to ramp up. We think the next phase is likely that oil also will begin to catch up again. And we’re still in the early innings. We think that we will be in the full-blown phase of this market cycle or this boom in commodities when they all participate. And we think that oil is probably going to do that sometime next year. So that’s why we have a healthy allocation to oil companies and natural gas companies in our portfolio. We just have a higher allocation to precious metals and mining at this point. And at some point, we’ll be looking to reverse that or move that around to allocate more to oil and gas. And that is part of our active management in our portfolio where we actively allocate across these exposures to have the portfolio have the flexibility to move where we think the opportunity is. And we did that three, five years ago, we were much heavily allocated to oil and gas. And about a year, year and a half ago, we reduced that exposure and increased our gold and gold mining exposure because of what we saw coming. And so we think in the next year or so we’re gonna increase our energy exposure as well.

Stuart Turley – Energy News Beat Host [00:19:37] Do you have a time machine in your closet by any chance? Because you’ve been right all along. This is pretty cool. This is very, very forward thinking. And I love the way that your ETF is performing. If I understood that correctly by looking at at things, it’s been doing extremely well, hasn’t it?

Wasif Latif – Sarmaya Partners [00:19:56] Yeah, the performance has been fantastic. It’s through the the third quarter since the launch of the beginning of the year. It’s it’s been a great return. And I think if investors pull it up, again the tickers lens, L E N S, it’s it’s really good. It’s done well. And so as a result, you know, we we of the spaces that we’ve been in. The biggest contributor, as you can imagine, to the portfolio has been our allocation to gold and gold mining stocks. And now now followed by what’s happened lately in the silver and platinum names. And so that continues to be supportive for the portfolio. And we’re very excited about the results that we’ve been able to generate.

Stuart Turley – Energy News Beat Host [00:20:28] This is really an exciting time. And I I applaud, I I absolutely love your charts and your team do do an absolutely phenomenal job with these Wassif. And as we I think you are spot on with the oil. I think that platinum is definitely going to be a huge demand. Hybrids are going to be rolling around. They’re going to be needing more platinum, but the military aspects of it, silver is, I think, still gonna be rolling. And if President Trump can actually pull off an end of the Fed and then go to gold, look out. I don’t know that he can, but there seems like the Treasury has been buying a lot of gold and at least that’s what I’ve been seeing. I could be wrong, but it seems like your plan and your return to tangibles has been spot on.

Wasif Latif – Sarmaya Partners [00:21:21] Yeah, it’s been it’s been really gratifying to see our our views come to fruition and and sort of pan out in the market. I definitely don’t have a crystal ball or a time machine in the closet for sure. But what we do is we we we look at the world from the top down and look at the macro world, not where not necessarily where we want the world to be, but where the world is. And that sort of adjustment of views, what that allows us to do is to think about policymakers. If they had a magic wand, what would they want to do? But the fact that they don’t have a magic wand and they are dealing with constraints. So the whole world, everybody in the world deals with constraints of all kinds. And when you’re dealing with constraints, your choices become narrower. And so all we try to do is we think about what do they want to do, but ultimately what can they do because of the policy constraints. And so as a result of that, what’s the narrower path that we think is going to occur? And so that’s what we try to think about and and then draw a broad sort of brush about where we think the world is going. And then and then based on that, develop an idea, okay, what areas of the market would benefit because of that, whether it’s sectors or countries or regions. And then as a result of that, we look at then those places and say, what are the best ideas in those places and only invest in that. So that’s sort of high level of how we we think about our investment process.

Stuart Turley – Energy News Beat Host [00:22:48] This is such a unique way to look at things, Wassif. It is not nor I I’m gonna say being not normal is a good thing when you’re leading the pack. So

Wasif Latif – Sarmaya Partners [00:22:59] We’re intentionally different. My partner and I, we we’re very seasoned investment professionals. We’ve been around for a long time. And, you know, in an industry where there’s so many copycats and everybody’s trying to create the Me Too portfolio, the next portfolio that that’s another flavor of vanilla. We wanted to do something that is different because to your point, and in order to beat the market over time, in order to beat the competition over time, you do need to be different. Obviously, being right is an essential ingredient. So being different by itself isn’t the, you know, good enough. You have to be different, but you also have to be right in where you are different. And so far, you know, we’ve been we’ve been blessed to be different and we’re very, very thrilled about that. Last thing I want to show, Stu, is this chart, which when I show it, people really sit up and it’s kind of eye-opening. Is over the long term, when you adjust for inflation, gold has beaten the S P 500 and bonds most of the time. And so, you know, this is real returns. In other words, you take the nominal returns that you see, and then you bring them down after adjusting for inflation. So after adjusting for inflation, most of these periods, gold has beaten the SP 500. And I will say this is the SP 500’s total return, which includes dividends and all kinds of income. So this is the best possible scenario for the market. And this is gold ultimately reflecting what it has been for sort of centuries and millennia, a tier one asset that withstands, you know, periods of of long debasement and and holds its value and is the place where investors go to when there is concerns around that.

Stuart Turley – Energy News Beat Host [00:24:37] I’ll tell you, it’s a good thing you don’t have the S P 500 and then a Jim Kramer effect because it would be an extremely negative one. You you always want to do the opposite of what that poor man says, and it would be way down there and it’d skew the whole charts. So that that’s an impressive looking chart, Wassip, but the Jim Kramer would be way down here. I take I listen to that man and I do the exact opposite, and I’ve made a lot of money. So I wouldn’t want to be in that one. The Wassif brand and the Samaria Partners is way cool. I’m very impressed with everything that you got there.

Wasif Latif – Sarmaya Partners [00:25:17] Well, thank you so much. Really appreciate it and it’s great to catch up again and hopefully we can do it again.

Stuart Turley – Energy News Beat Host [00:25:21] So what do you see coming around the corner?

Wasif Latif – Sarmaya Partners [00:25:23] I think this, you know, liquidity in the market is still pretty strong. And the idea that the Fed is now alongside other major central banks of the world are cutting rates. I think that’ll just continue to provide liquidity to the market. But what is interesting, all of that is being done when there are fiscal pressures in all of the developed country budgets. At the same time, inflation truly hasn’t been stomped out. And so in our view, they’re they’re lowering rates when it’s not clear that the economy is completely in need of it. Now, historically they’ve been late, so maybe they’re doing it right this time. We just don’t know. But all of that is to say, because in our view, inflation isn’t completely stomped out. And by the way, we are in the inflationary camp. We think, and we talked about this in the past, we think that inflation when it starts, it really is a one and done. As I say, you know, when you s an inflation spike is like a cockroach, you usually don’t see just one. There’s gotta be there’s gonna be more. And so we think that we think that we’re in another version of the 70s. So so we we entered the, in our view, another period of the late 60s and and we’re somewhere in the 70s, early 70s, maybe late 60s period, where you have an equity market that is continuing to rise and rally in a very concentrated few names with very rich valuations. So that harkens back to not only nineteen ninety nine that a lot of people are comparing it to, but it also to us is similar to what happened in the nineteen seventies or the nineteen seventy-two nifty fifty stocks that you know, those stocks were seen as, you know, rock solid and and ultimately it was inflation and therefore higher rates that did them in. And so we think we think that the next several years are gonna be less about those names and more about commodities, which is where we are.

Stuart Turley – Energy News Beat Host [00:27:12] Let me ask this about inflation and energy, because what we you you mentioned the previous in the eighties, the other inflationary periods. We didn’t have AI or data centers driving up or renewable energy, quote unquote, renewable energy that’s not sustainable without subsidies driving up electrical cost. And Bloomberg, I just wrote an article, I think a week ago or a week before, where back east they’ve had a 230% increase in electricity prices. And that when a homeowner is having that kind of inflation, it affects the entire consumer household budget.

Wasif Latif – Sarmaya Partners [00:27:54] Yes. And and I live in the North East and I can tell you firsthand that that that is an experience how sorry about bringing it.

Stuart Turley – Energy News Beat Host [00:27:59] Sorry about bringing that painful memory up.

Wasif Latif – Sarmaya Partners [00:28:01] You know, each location and county is different. So might might not be as bad as some of the others, but but it’s definitely happening. You know, that to me is another indication of inflation. You know, we we’ve had a a grid that hasn’t been updated in decades. And as a result of that, the the sudden jump in the need for energy, which by the way, to us it it it’s very similar to the idea that we would never have enough cable and fiber optic in the world to run the internet. And and you know, in the in the 90s and the 2000s, early 2000s, that was the big rage. And ultimately it was an overbuilding capex cycle. So we think the data centers are an overbuilding capex cycle number one. But while that’s going on, their energy need is definitely going to be there, and that’s inflationary because that is eating into your inflationary basket of what you’re paying paying. That I we don’t know how much of that gets captured in the actual CPI and the inflationary basket, but it is inflationary and it’s gonna impact consumption. And so we that’s why we keep on coming back to the idea that we might be closer to the 70s than we realize, because the 70s weren’t just inflation, it was stagflation because you had slow economic growth and at the same time prices were going up because of exogenous reasons. Back then it was the oil price shock, it was the inflation shock of going off of the gold standard. And now for different reasons, we’re getting inflation in an in a period where we actually might begin to see a softening of the economy. As we know so far, the economy is a K-shaped economy where a smaller percentage of the population is actually doing the majority of the consumption. Absent that we are actually in a pretty weak economic environment. And so, you know, it wouldn’t surprise us if we see more and more of the 70s repeating. So, in terms of the big picture, I think the next the next big move probably is going to be that just like you saw in the 70s, the inflation, the stagflation will feed into the economic divide, and that will feed into a greater labor power versus capital. We think that’s probably gonna be the next big sort of mega mega trend that takes place over the next five to ten years.

Stuart Turley – Energy News Beat Host [00:30:19] Well, how do people get a hold of you?

Wasif Latif – Sarmaya Partners [00:30:20] Well, our website is a great place, Sir MayaPartners dot com. If you don’t want to look at the ETF, it’s Sir Maya ETF dot com. I’m on LinkedIn and I’m on Substack under my name. Those would be the best