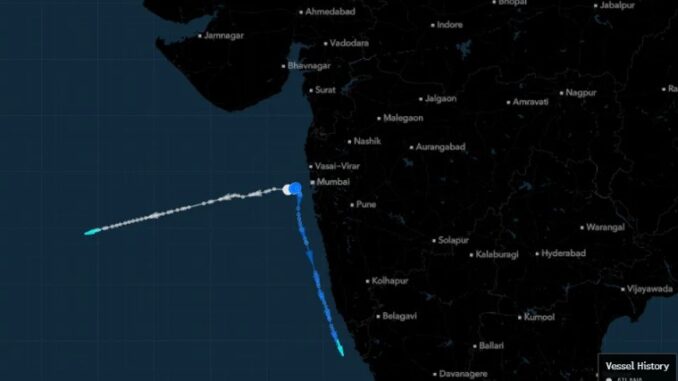

In a striking display of resilience amid tightening global sanctions, a Russian “dark fleet” tanker recently conducted a ship-to-ship oil transfer off the coast of Mumbai, ultimately delivering its cargo to Indian shores. This maneuver, highlighted in a recent Bloomberg report, underscores the ongoing challenges in enforcing Western sanctions on Russian energy exports.

As trade relations strain under geopolitical pressures, such activities reveal how sanctions often fall short of their intended goals, allowing Russian oil to continue flowing to key markets like India.

The Dark Fleet’s Clever Evasion Tactics

The “dark fleet” refers to a shadowy network of aging tankers, often operating without Western insurance or under opaque ownership, used by Russia to bypass sanctions imposed after its invasion of Ukraine. In this instance, the tanker in question executed a rare ship-to-ship transfer—a method where oil is moved from one vessel to another at sea to obscure origins and avoid detection—off Mumbai’s bustling coastline. Following the transfer, the oil proceeded to Indian ports, ensuring delivery despite heightened scrutiny.

This event comes at a time when the Russian-Indian oil trade is under strain. Western nations, led by the United States, have ramped up sanctions targeting Russia’s energy sector, including secondary sanctions on entities facilitating such trades. Yet, these measures have not fully stemmed the tide. Russia’s use of non-Western currencies, alternative shipping routes, and the dark fleet has kept exports robust, with seaborne crude shipments often exceeding pre-war levels in certain months.

Do you live in New York, New Jersey, or California? Then Taxes May Be an Issue and you can invest with tax advantaged solutions

Sanctions: A Blunt Instrument That Misses the Mark

Critics, including voices from energy analysis platforms like Energy News Beat, argue that sanctions on Russian oil haven’t achieved their desired effect.

Instead of crippling Russia’s economy, they’ve inadvertently boosted alternative trade networks. Russian oil, sold at steep discounts, finds eager buyers in Asia and beyond, while the dark fleet—estimated to number over 600 vessels—operates largely unchecked in international waters.

For instance, ship-to-ship transfers like the one off Mumbai allow cargoes to be relabeled or blended, making it harder for enforcers to track. This circumvention not only sustains Russia’s war chest but also highlights the limitations of sanctions in a globalized energy market. As Energy News Beat has pointed out in various analyses, these policies often hurt Western allies more than the target, driving up global energy prices and fostering resentment.

India’s Stance: Rhetoric vs. Reality

India’s government has faced intense scrutiny over its Russian oil purchases. In October 2025, U.S. President Donald Trump claimed that Indian Prime Minister Narendra Modi had assured him India would cease buying Russian oil as part of broader trade negotiations.

However, Indian officials quickly cast doubt on this assertion, stating they were “not aware” of any such commitment and emphasizing that discussions were ongoing.

Despite these claims, India has shown signs of recalibrating. Major refiner Reliance Industries, Russia’s top Indian buyer, announced it would review contracts to align with government guidelines following new U.S. sanctions.

Sources indicate a potential sharp cut in imports, driven by the threat of secondary sanctions that could impact Indian firms’ access to global markets.

Yet, India has not outright banned Russian oil, prioritizing energy security and affordable supplies for its growing economy. Official statements from the Ministry of External Affairs in August 2025 reiterated that India imports based on national interests, even as it faces pressure from the West.

This nuanced position reflects India’s balancing act: maintaining ties with Russia while navigating U.S. demands. As one analyst noted, a full halt could disrupt supplies, but partial reductions might pave the way for stronger U.S.-India trade ties.

Who’s Still Buying Russian Oil?

If India is scaling back, who fills the void? Data from 2025 shows China as the undisputed top buyer, accounting for about 40% of Russian fossil fuel exports in August alone.

India follows closely, with Turkey in third, collectively snapping up around 95% of Russia’s seaborne crude.

Other notable importers include Brazil (12% of oil products) and even some EU holdouts like Belgium and France for LNG, despite broader bans.

Chinese state firms have temporarily suspended some purchases due to sanctions, but overall volumes remain high, with Russia redirecting flows eastward.

This shift began post-2022 invasion, turning Asia into Russia’s energy lifeline and underscoring how sanctions have reshaped global trade patterns rather than halting them.

The Broader Fallout: Is the US Dollar Paying the Price?

At the heart of these sanctions is the “weaponization” of the U.S. dollar—using control over the global financial system to enforce penalties. While effective in the short term, experts warn this strategy is accelerating de-dollarization, eroding the dollar’s dominance as the world’s reserve currency.

Nations like Russia, China, and BRICS members are increasingly settling trades in local currencies or alternatives like the yuan, reducing reliance on the dollar.

This push stems from fears of arbitrary exclusion from dollar-based systems, as seen with SWIFT bans on Russian banks. Over time, such moves could weaken the dollar’s value, increase volatility, and diminish U.S. leverage in global affairs.

As one report puts it, the dollar’s status provides low-cost power, but overuse risks “financial instability” worldwide.

In conclusion, the Mumbai transfer is more than an isolated incident—it’s a symptom of a flawed sanctions regime that’s failing to isolate Russia while potentially harming the very currency it’s built upon. For energy markets, this means continued volatility, but also opportunities for those adaptable enough to navigate the shadows. Stay tuned to Energy News Beat for more insights on how global energy dynamics are evolving in real time.

Be the first to comment