As an energy-rich nation with the fourth-largest proven oil reserves in the world, Canada paradoxically continues to import billions of dollars’ worth of crude oil annually. This irony was recently highlighted in a viral X post by MP Bob Zimmer (@bobzimmermp), who delivered a speech at the BC Natural Resources Forum, decrying the absurdity of importing vast quantities of oil from abroad while imposing strict regulations on domestic production. In the video, Zimmer revealed staggering figures: Canada imports nearly 232 million barrels of oil each year—about 50% of what it exports—and has spent over $600 billion USD ($830 billion CAD) on foreign oil imports since 1988. He pointed out daily import volumes, including 381,000 barrels per day (bpd) from the U.S., 70,000 bpd from Saudi Arabia, 63,000 bpd from Nigeria, 50,800 bpd from Iraq, and 32,000 bpd from Norway. These imports come with no production caps or carbon taxes applied, unlike Canada’s own industry.

This article explores the scale of Canada’s oil imports, their sources, and how restrictive energy policies have undermined the country’s economic potential in the oil and gas sector.

JAW-DROPPING

You won’t believe the amount of oil and the dollars we have spent to import oil from other countries, with no caps or carbon taxes.

Meanwhile, Canada has the 4th largest oil reserves in the world and we develop them w the best standards and best people in the… pic.twitter.com/JKWWaLOmJM

— Bob Zimmer (@bobzimmermp) January 22, 2026

The Scale of Canada’s Oil Imports

Despite being a top global oil producer—ranking fourth in production at about 4.9 million bpd in 2023—Canada imported approximately 0.5 million bpd of crude oil in 2024, totaling around 232 million barrels annually. The financial toll is immense: In 2024 alone, crude oil imports totaled C$19.1 billion (approximately $13.8 billion USD), making it the sixth-most imported product in the country.

Over the longer term, as Zimmer noted, cumulative imports since 1988 exceed $600 billion USD.

Historical trends show fluctuations but a persistent reliance on imports. For instance:2024: C$19.1 billion

2023: C$16 billion (in USD equivalents)

2022-2023 Growth: Varied by source, with Ecuador showing the fastest increase (+C$527 million).

These imports are driven by regional needs, particularly in Eastern Canada, where refineries are configured for lighter crude from abroad, and infrastructure limitations prevent easy access to Western Canadian heavy oil.

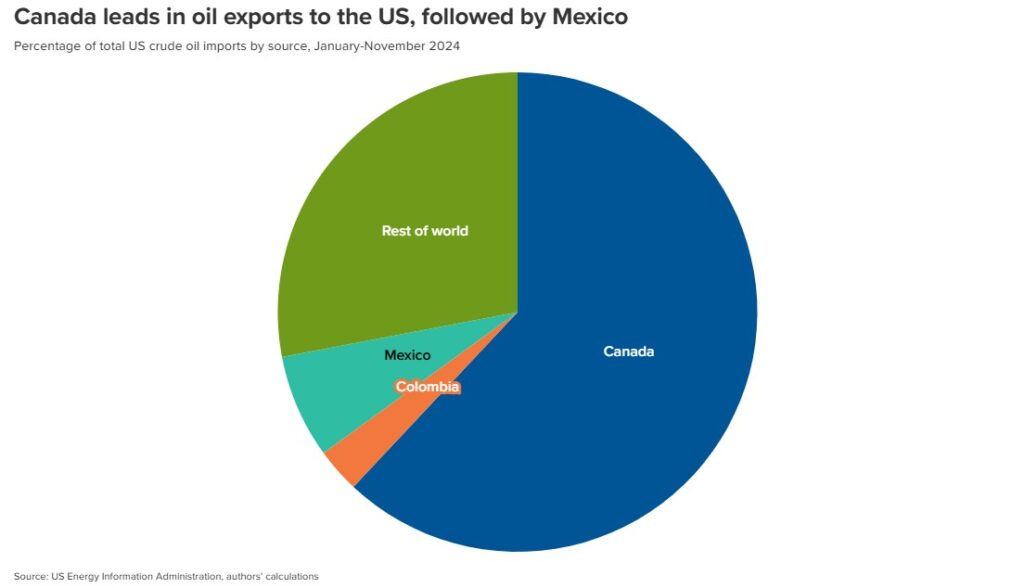

To visualize the breakdown:

Breakdown by Source Countries

The majority of imports come from a handful of countries, with the United States dominating due to proximity and pipeline integration. Here’s a detailed table based on 2024 data (values in billion CAD):

|

Country

|

Value (Billion CAD)

|

Percentage of Total Imports

|

|---|---|---|

|

United States

|

13.9

|

72.8%

|

|

Nigeria

|

2.19

|

11.5%

|

|

Saudi Arabia

|

2.01

|

10.5%

|

|

Ecuador

|

0.728

|

3.8%

|

|

Cote d’Ivoire

|

0.151

|

0.8%

|

|

Others

|

0.121

|

0.6%

|

Source: Observatory of Economic Complexity.

This distribution highlights Canada’s heavy dependence on U.S. supplies (74.6% by volume in 2024, valued at $14.2 billion USD), which account for about 0.4 million bpd.

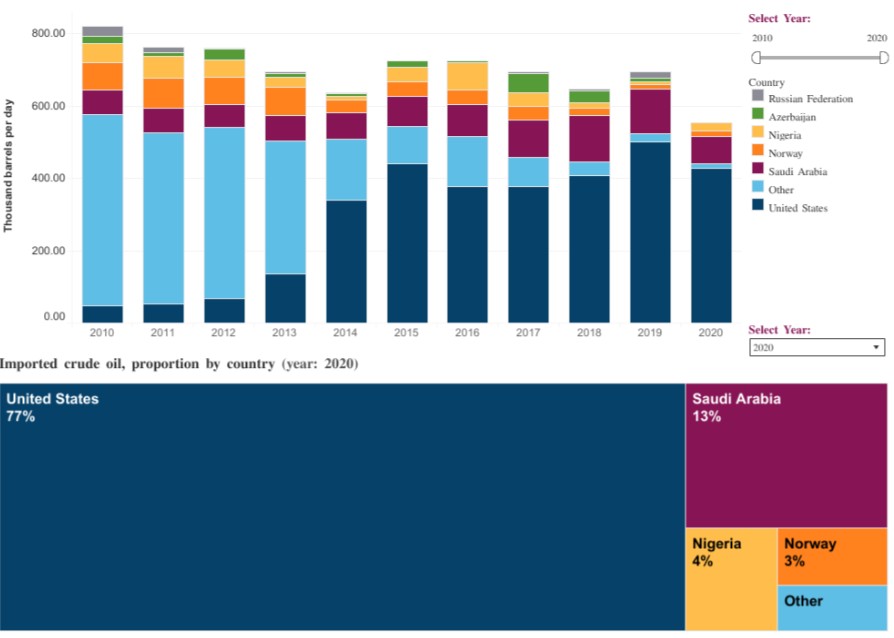

However, significant volumes also flow from OPEC nations like Nigeria and Saudi Arabia, often produced under less stringent environmental standards than Canada’s.For a graphical representation of import trends:

How Energy Policies Have Hurt Canada’s Economy

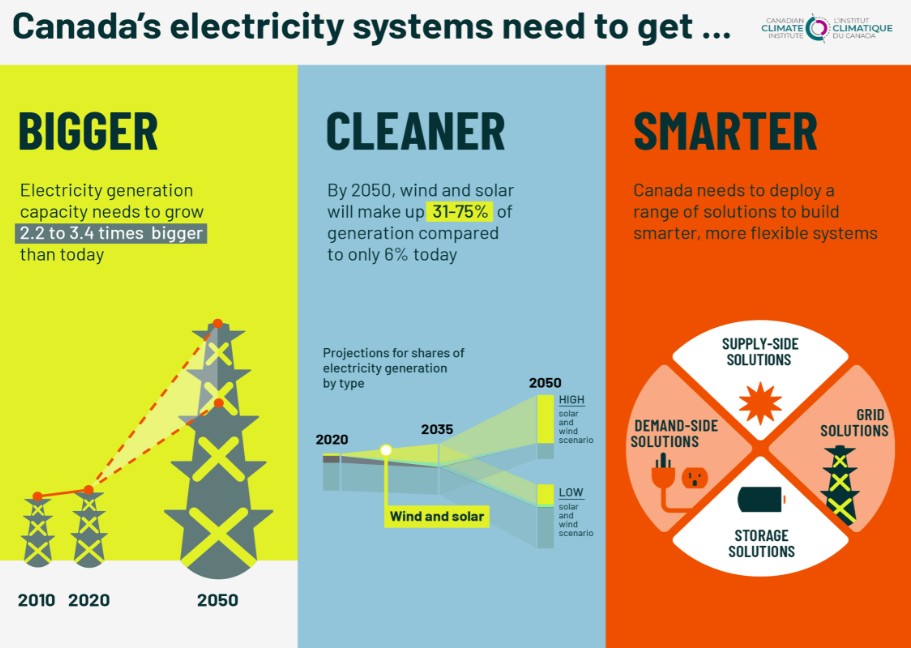

Canada’s energy policies, including emissions caps, carbon taxes, shipping bans, and regulatory delays, have stifled domestic production and driven investment southward to the U.S. These measures, aimed at reducing greenhouse gas emissions, have inadvertently weakened the sector that contributes significantly to the national economy—accounting for 7.7% of GDP ($208.8 billion) and supporting 446,600 jobs in 2023.

Key impacts include:

Job Losses and Investment Flight: The proposed oil and gas emissions cap is projected to kill 54,000 jobs and strip $20 billion from the economy.

Over the past decade, policies like the tanker ban on B.C.’s north coast and delays in pipeline approvals (e.g., the canceled Energy East project) have pushed hundreds of billions in investments to the U.S., where regulations are more favorable.

Economic Vulnerability: Under a rapid energy transition, up to 30% of Canadian oil and gas value could be at risk, with provincial revenues potentially dropping over 80% in the 2030s.

This leaves provinces like Alberta economically exposed as global demand shifts, while Canada continues importing from countries without similar constraints.

Missed Opportunities: Despite vast reserves, policies have hindered market access. For example, the Trans Mountain Expansion has increased exports, but overall, restrictive rules have led to discounted sales to the U.S. and reliance on foreign imports. Critics, including former Bank of Canada Governor Mark Carney, have been accused of prioritizing net-zero goals over economic growth, potentially mirroring the U.K.’s “nihilistic” approach that increased import dependence.

A recent national poll underscores public support for oil and gas as key to Canada’s economy and future energy policy, with a super majority favoring development.

However, policies like the carbon tax and production caps have raised costs, contributing to inflation and reduced competitiveness.

Visualizing the economic toll:

Conclusion: Time for a Policy Rethink?

Canada’s oil imports underscore a self-inflicted paradox: A resource-rich nation spending billions abroad while hamstringing its own industry. As Zimmer’s speech emphasized, these imports—from regimes often lacking environmental rigor—come without the burdens placed on Canadian producers. Reforming energy policies to prioritize domestic development, infrastructure, and market access could unlock economic growth, reduce imports, and enhance energy security. With global demand persisting, Canada has an opportunity to lead responsibly—balancing environmental goals with prosperity.

Turley’s Law is very alive and well in Canada. As a podcast guest once put it, “The more money spent on Wind, Solar, and Hydrogen will result in more fossil fuels being used and fiscal collapse.” It appears this aligns with Canadian leaders and their policies. We are seeing a realignment of trading blocs, and Canada is aligning with China, the UK, and the EU. This is a doomed block destined for a fiscal collapse.

For more insights, follow @STUARTTURLEY16, and check out the Energy News Beat Channel.

Be the first to comment