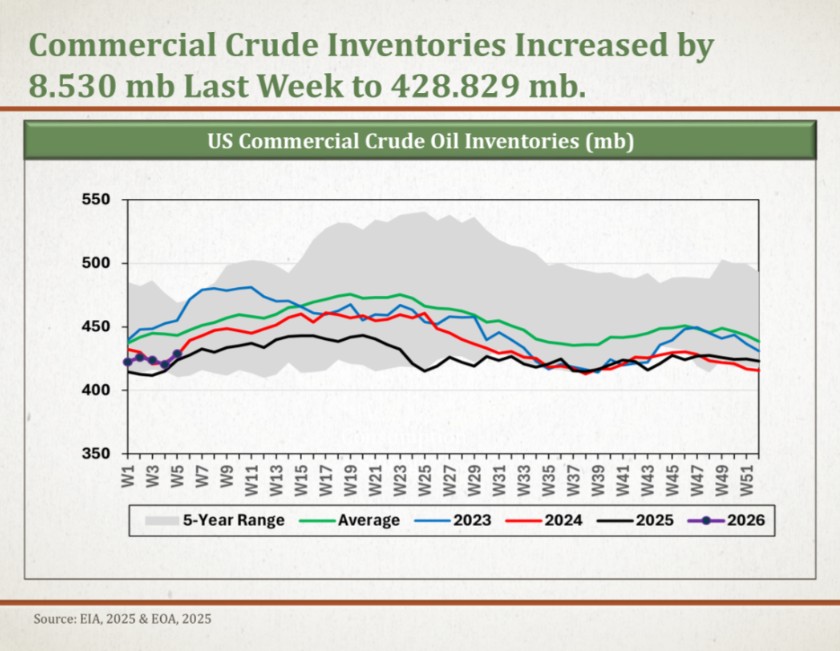

The latest Weekly Petroleum Status Report from the U.S. Energy Information Administration (EIA), released on February 19, 2026, reveals a significant drawdown in U.S. crude oil inventories for the week ending February 13, 2026. Commercial crude oil stocks fell by 9.0 million barrels to 419.8 million barrels, a stark reversal from the previous week’s build of 8.5 million barrels.

ir.eia.gov

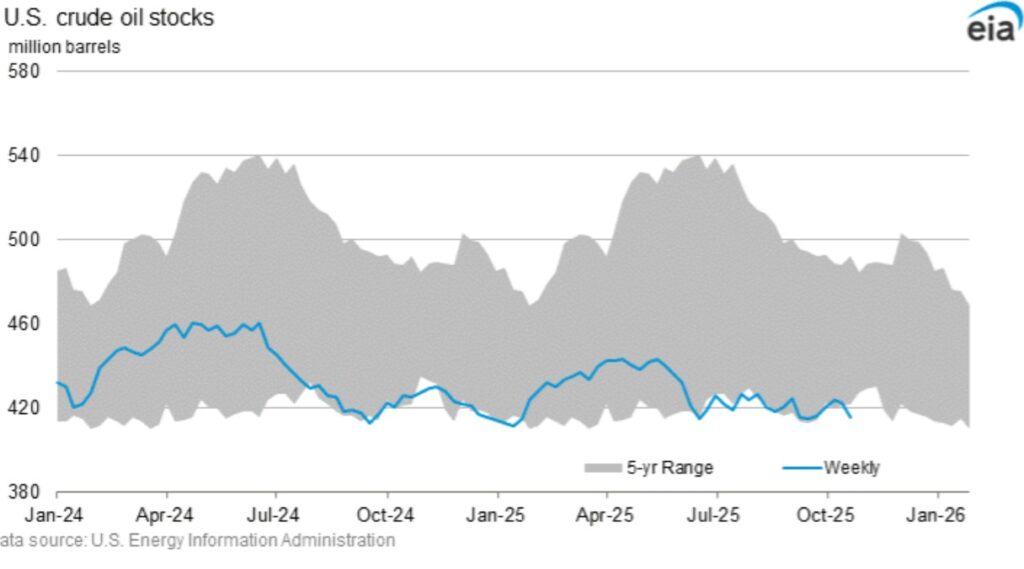

This level is approximately 5% below the five-year average for this time of year, signaling tighter supply conditions amid rising demand.Key Highlights from the EIA ReportU.S. refineries ramped up operations, with crude oil inputs averaging 16.1 million barrels per day (b/d)—an increase of 77,000 b/d from the prior week. Refinery utilization rates climbed to 91.0%, reflecting improved processing capacity.

ir.eia.gov

Crude oil imports, however, declined by 281,000 b/d to 6.5 million b/d, contributing to the inventory draw.On the demand side, total products supplied—a proxy for petroleum consumption—averaged 21.2 million b/d over the past four weeks, marking a 4.1% increase compared to the same period last year.

ir.eia.gov

This uptick indicates strengthening economic activity and higher fuel needs. Breaking it down:Motor gasoline demand averaged 8.5 million b/d, up 1.5% year-over-year.

Distillate fuel (including diesel) demand averaged 4.4 million b/d, up 2.5% year-over-year.

Product inventories also saw drawdowns, with gasoline stocks decreasing by 3.2 million barrels and distillate stocks dropping by 4.6 million barrels.

ir.eia.gov

These reductions further underscore the demand surge, particularly as seasonal maintenance periods typically lead to builds.To visualize the recent trends in U.S. crude oil inventories, here’s a chart showing historical levels and seasonal comparisons:

This EIA chart illustrates how current stocks are tracking below the five-year range, highlighting the recent drawdown.

What This Means for Investors

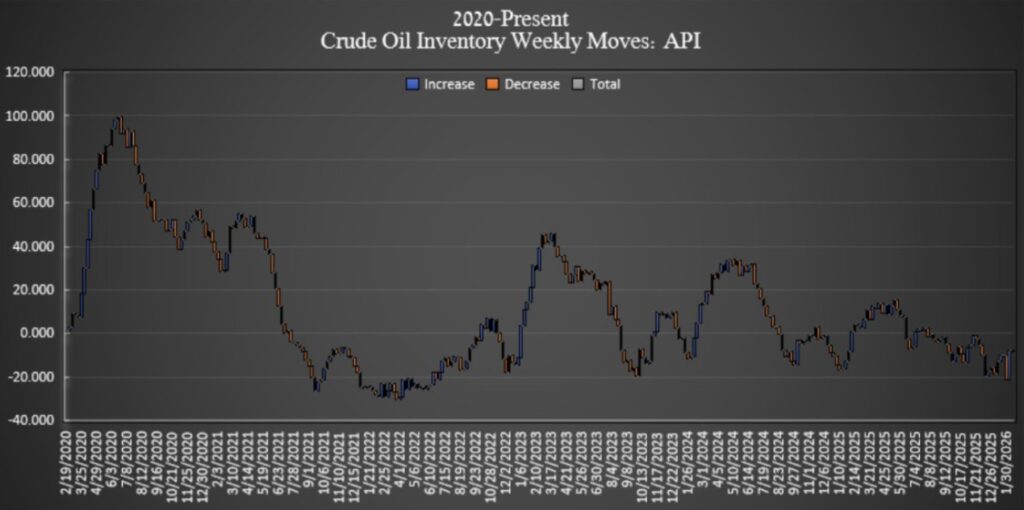

For investors in the energy sector, this report is largely bullish. The unexpected 9 million-barrel draw—against market forecasts of a 1.7 million-barrel build—suggests supply is tightening faster than anticipated.

investing.com

Combined with rising demand, this could exert upward pressure on crude oil prices. West Texas Intermediate (WTI) futures have already shown volatility, and persistent draws might support prices in the near term, benefiting upstream producers and oil majors like ExxonMobil or Chevron.

However, investors should temper optimism with a broader context. The EIA’s Short-Term Energy Outlook forecasts global oil inventory builds averaging 3.1 million b/d in 2026, potentially leading to lower prices later in the year due to increased production from non-OPEC+ countries.

eia.gov

Geopolitical tensions, such as U.S.-Iran relations, could amplify price swings, but the current data points to short-term opportunities in energy equities and futures.

Here’s a look at weekly inventory changes over recent years, which shows the magnitude of the latest draw in context:

Implications for Consumers

Consumers may feel the pinch at the pump if this trend continues. Higher demand and lower inventories often translate to elevated gasoline and diesel prices, especially as we approach the spring driving season. With gasoline demand already up 1.5% year-over-year, retail prices could rise by 5-10 cents per gallon in the coming weeks, depending on regional factors.

ir.eia.gov

On a positive note, robust demand reflects a healthy economy, potentially offsetting some cost increases through wage growth or economic stability. Distillate users, such as trucking and heating sectors, might see more pronounced effects given the 2.5% demand rise and steeper inventory draw.

For a seasonal perspective on inventory builds and draws, consider this comparative chart:

In summary, the EIA’s latest data paints a picture of a dynamic U.S. oil market where demand is outpacing supply adjustments, leading to inventory draws. While investors might capitalize on near-term price support, consumers should brace for potential fuel cost hikes. Stay tuned to Energy News Beat for ongoing analysis of these trends.

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Be the first to comment