Energy News Beat Publishers Note: A couple of thoughts. First; Why does one of the leading countries in green energy need so much natural gas? Second; You would think that Europe would have learned from the last time Russia held them hostage over natural gas supplies. Third; A competitive market would solve the political problem without the United States involvement.

A natural gas pipeline being built under the Baltic Sea from Russia to the German coast is shaking up geopolitics. Nord Stream 2, as it’s called, fuels worries in the U.S. and other countries that the link could give the Kremlin new leverage over Germany and other NATO allies. Pipe construction, halted in 2019, resumed in December 2020, yet U.S. sanctions still threaten to pull the brakes on the project backed by the Russia’s Gazprom PJSC.

1. What is Nord Stream 2?

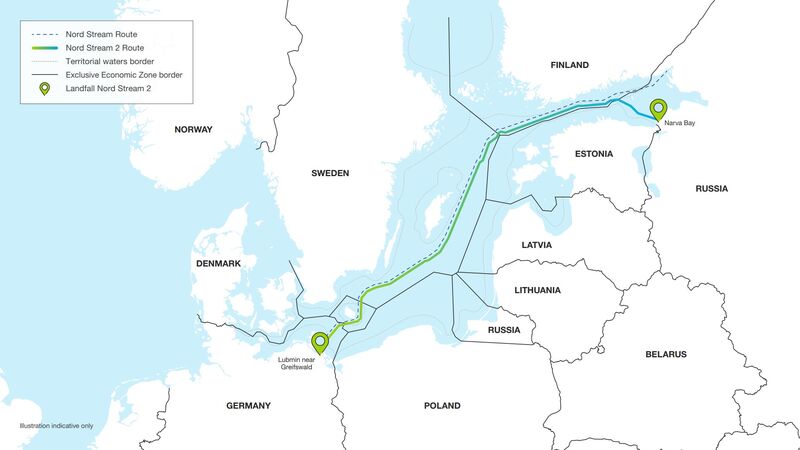

It’s a 1,230-kilometer (764-mile) gas pipeline that will double the capacity of the existing undersea route from Russian fields to Europe — the original Nord Stream — which opened in 2011. Gazprom owns the project operator, with Royal Dutch Shell Plc and four other investors contributing half of the 9.5 billion-euro ($11.6 billion) cost. Initially expected to come online by the end of 2019, the link has been delayed by U.S. sanctions that forced Swiss contractor Allseas Group SA to withdraw its pipelaying vessels when all but 160 kilometers of the link was in place. When Nord Stream 2 started construction again, Russian vessels were deployed to lay 2.6 kilometers in Germany’s exclusive economic zone. In January 2021 work resumed on the Danish section.

The Nord Stream 2 undersea link to Germany.

2. Why is it important?

The pipeline will help Germany secure a relatively low-cost supply of gas amid falling European production. It’s also part of Gazprom’s decades-long effort to diversify its export options to Europe as the region moves away from nuclear and coal. Before the first Nord Stream opened, Russia was sending about two-thirds of its gas exports to Europe through pipelines in Ukraine. Their troubled relations since the Soviet Union collapsed left Gazprom exposed to disruptions: A pricing dispute halted gas flows through Ukraine for 13 days in 2009. Since then, relations between the two countries have worsened, culminating in the Ukrainian popular revolt that kicked out the country’s pro-Russian president and led to Russia seizing the Crimean Peninsula.

3. Who’s opposed to Nord Stream 2?

Chancellor Angela Merkel has come under pressure from German lawmakers and the opposition to back away from the project as the poisoning of Russian opposition politician Alexey Navalny in August 2020 heightened tensions. While Germany condemned the decision to detain Navalny in mid-January after he returned to Moscow, Merkel’s administration stands by Nord Stream 2, according to her press office. Navalny was jailed for about 2 1/2 years. The Baltic pipe has also been opposed by Ukraine, Poland and Slovakia — countries between Russia and Germany that collect transit fees on gas flowing through their territories. Those concerns were partially alleviated after Gazprom reached a deal to continue gas transits via Ukraine through at least 2024.

4. Why is the U.S. involved?

Former President Donald Trump, backed by members of the U.S. Congress, claimed during his term in office that Nord Stream 2 would make Europe overly dependent on Russian energy supplies, and said that Germany in particular would become “a captive to Russia.” It’s also clear that the U.S. has been keen to increase its own sales to Europe of what it calls “freedom gas.” In June, a bipartisan group of senators proposed expanding the sanctions against Nord Stream 2 to target insurers, certifiers and other companies working on the project. The restrictions, included in the nation’s 2021 defense act, came into force at the start of 2021.

5. What’s happening under Biden?

The administration of President Joe Biden confirmed sanctions on the Fortuna pipelaying vessel that is set to build at least one line of the link, as well as on its alleged owner, Russia-based KVT-RUS. The move was initially announced by the U.S. State Department on Jan. 19, the day before Trump left office. A report sent to Congress on Feb. 19 listed 18 entities that were exempt from sanctions because they’re unwinding their work on Nord Stream 2. Notably absent were any German or other European entities. Germany wants to make a deal with the U.S. to complete the project and a potential proposal would include a regulatory mechanism that could limit Russia’s ability to manipulate the energy market.

6. What do the obstacles mean for Nord Stream 2?

The project operator expects one of the twin Nord Stream 2 lines to be largely completed by July, according to the construction schedule. Pressure testing, cleaning and filling the line with buffer gas may take another six to seven weeks, based on the schedule for building the original Nord Stream. Yet U.S. sanctions targeting Nord Stream 2 insurers and certifiers may delay the launch of the link. Amid risks of restrictions, Norway-based certification provider Det Norske Veritas AS has pulled out of the project. In addition, Swiss-based Zurich Insurance Group AG and Germany’s Munich Re have decided to stop covering Nord Stream 2 construction risks. As there’s no restriction on the nationality of insurers and certifiers for the project, Gazprom may look for them in Russia.

7. Is Europe really captive to Russian gas?

The European gas market has become more competitive as liquefied natural gas, or LNG, vies to replace declining local production from the North Sea and the Netherlands. Gazprom estimates that in 2020 its share of the European market was around 33%. Its domestic rival, Novatek PJSC, is also expanding LNG sales in Europe. But not all countries are equally dependent on Russian imports. Gazprom remains the traditional key supplier for Finland, Latvia, Belarus and the Balkan countries, but western Europe gets gas from sources including Norway, Qatar, African nations and Trinidad. More nations, such as Germany, are seeking to build LNG import terminals to take shipments from around the world. Croatia in January started using a new import facility.

8. Will the U.S. sell more gas to Europe?

The U.S. supplies tanker-borne gas to Europe, but it must be chilled into a liquid form and shipped at great cost. Russia transports gas mostly through the world’s largest network of pipelines that have been in place for decades. Over the summer of 2020, transatlantic LNG shipments became less economic, although they subsequently regained ground. Freezing temperatures in Asia at the start of 2021 pulled cargoes to the higher-priced markets from Japan to South Korea, leaving Europe largely short of LNG. While U.S. suppliers are focused on long-term prospects, and have had some success securing deals with Poland, they have also had setbacks from Ireland to France on environmental grounds. The International Energy Agency expects the U.S. to become the world’s biggest LNG seller in 2025.