David Ramsden Wood, his friends call him “DRW”. .Subscribe now to the #hottakeoftheday

Bubbles are defined by taking risks that aren’t justified by the rewards, and even though you know that, you buy anyway. In November, I shook my head as the Democrats won the Presidency, and mark to market capital gains seemed likely. No, no, I was told. It’s a split congress. And the market rallied alongside the vaccine excitement.

When I openly asked later in the month “is it just me or does it look like the Democrats win the senate run offs too…” They did, but the market went up, VIX went down, and even with the excitement in the Capitol, consensus was, “Hail, stimulus. Hail devaluing the dollar…” How about oil and gas and the Saudis? “Up, up and away!!”

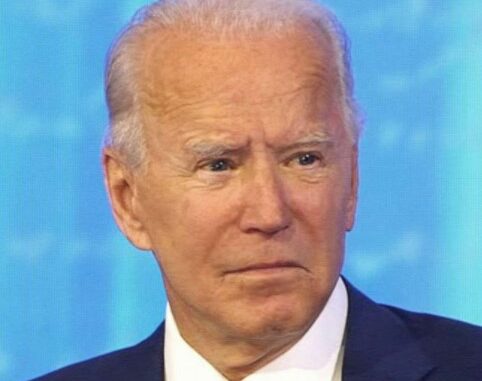

Yesterday, we saw the Biden administration pass an executive order that effectively puts a 60 day pause on the delegation of authority that helped facilitate an already atrocious process to get Federal permit (9+ months at best). Added to that, it halts right of ways and amendments. Somehow surprised, the market freaked out and traded guys like EOG down 8%. Call me a contrarian, but now is not the time to panic. That comes later.

For now, any company with half a brain, accelerated their permit activities in the last year and have oodles of Fed permits (though right of ways for temporary surface lines for frac’ing will make management ask some hard questions). With the reduced pace of activity, companies are flush with permits and short of capital so if anything, this makes companies slow down, which is the only thing that could have stood in the way of the Saudis controlling the market and pushing prices much higher. So let’s talk about prices.

I don’t care how good your management team is. This industry is about timing and price. Timing is luck and price is a response to supply. With “net zero” on the mind, US companies need to pivot their focus from operational excellence (irrelevant) to supply withholding. Every 1 mmbo/d of supply we don’t produce, we get $4/bbl in revenue.

We can’t win the public relations fight. CAN NOT. Had the Capitol police opened fire on the rioters in DC January 6th before they walked the halls of Congress, there would have been an uproar from the people. Similarly, we can’t pre warn the public about the failures of future energy reliability. It has to happen first. In DC, only when the riot happened and it was January 7th was it acceptable to bring the national guard, fence everything and threaten immeasurable force.

And so it is with fossil fuels. Solar and wind aren’t reliable enough to be the answer. Technology and slave labor will limit battery potential. And the electric grid in this country is bad. Really bad. But no one cares. All we can do is help Saudi get the price of oil to $65/bbl because nothing solves political sentiment more than gasoline prices marginalizing poor people when its $6/gallon.

Net net, today’s action by the Biden administration was a shot across the bow to make his supporters happy. Our only response is to let prices rise to a point that is painful for consumers and they, not us, yell at President Biden. And to do that, we need to do nothing.

All year.

by David Ramsden Wood, his friends call him “DRW” ..Subscribe now