Aclara Resources (TSX: ARA) shares shot up to a near 52-week high on Wednesday after the rare earth elements (REE) developer announced an investment agreement with Chilean conglomerate CAP SA, which operates iron ore mines in northern Chile, very close to Aclara’s Penco module project.

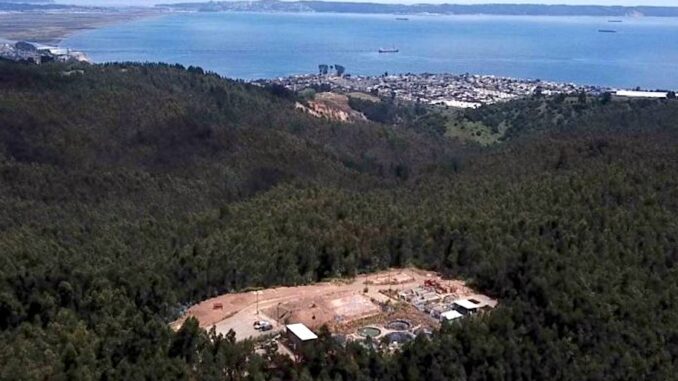

The Penco module covers a 6 sq. km. area hosting an ionic clay deposit rich in heavy rare earths, with measured and indicated resources totalling 27.5 million tonnes grading 2,292 parts per million total rare earth oxides (TREO), for 62,900 tonnes of contained TREO.

Under the investment agreement, CAP will make a strategic investment in REE Uno, Aclara’s Chilean subsidiary which owns the Penco module as well as all its mining concessions in the country, in exchange for a 20% equity participation in the REE unit.

This initial capital, according to Aclara’s calculations, gives REE Uno a pre-money valuation of $116.5 million. It will be paid in three tranches: $9.7 million upon closing, $12.5 million in January 2024 and the remaining $6.9 million in January 2026.

The initial capital injection from CAP will support the ongoing development of the Penco module throughout its permitting, community relations and feasibility study phases. It will also allow the company to reallocate its current cash reserves towards advancing its other project: the Carina module in Brazil.

Drawing upon CAP’s experience in environmental permitting from multiple mining projects in Chile, Aclara anticipates strengthened support for the forthcoming Penco environmental impact assessment (EIA) permit application.

CAP’s involvement includes a thorough review and constructive contributions to the application preparation, as well as accompanying Aclara throughout the review and approval process by Chilean environmental agencies, the TSX-listed miner said.

CAP also has an option to invest an additional $50 million in REE Uno for an additional 20% equity interest once the requisite environmental permit is secured for the Penco module. This second investment represents a pre-money valuation of REE Uno of $150 million.

The option for additional investment post-receipt of the environmental permit is intended to cover a significant part of the equity portion associated with the construction of the Penco module. This provision mitigates financing risks linked to the module’s construction, Aclara said.

The Chilean group can also invest up to 19.9% in Aclara itself by participating in any private placement or public offerings that Aclara may make over the next threes years. This includes a residual top-up right to maintain its pro rata voting right in the REE miner.

The companies will also form of a 50/50 joint venture to develop metals and alloys for the rare earths permanent magnet industry. CAP will invest $3 million in exchange for its 50% of the shares of the newly established joint venture company.

The establishment of a metals and alloys company represents the initial phase of Aclara’s strategic vision to vertically integrate its rare earths concentrate production towards the manufacturing of permanent magnets.

This move aims to offer a geopolitically independent alternative supply of permanent magnets to the market, Aclara said, adding that the new company will harness CAP’s expertise in metal refining and ferro-alloyed special steels, synergizing with its thorough understanding of the rare earths and permanent magnet industry.

The transaction reflects the valuation of Aclara at the time of the company’s initial public offering in late 2021 after it spun off from Hochschild Mining, and is indicative of the belief both parties have in establishing Aclara as a leading producer of clean rare earths.

The pre-money valuation of the initial investment plus the 50% interest in the new JV company represent a total value of $119.5 million, which reflects Aclara’s pre-money valuation at the IPO.

“We are thrilled to partner with CAP to develop our Penco module and strategy in Chile, as well as joining efforts to start developing Aclara’s capabilities in the vertical integration of the rare earths and permanent magnets industry,” Aclara chairman Eduardo Hochschild said in a news release.

“This alliance with Aclara represents a historic milestone for Grupo CAP, marking the first step in our strategy to become leaders in the production of essential materials for decarbonization and energy transition,” Juan Enrique Rassmuss, chairman of CAP, added.

Shares of Aclara Resources surged 30.1% to C$0.51 as of 11:30 a.m. ET, for a market capitalization of C$83.8 million ($62.2 million). The stock traded between C$0.36 and C$0.60 over the past 52 weeks.