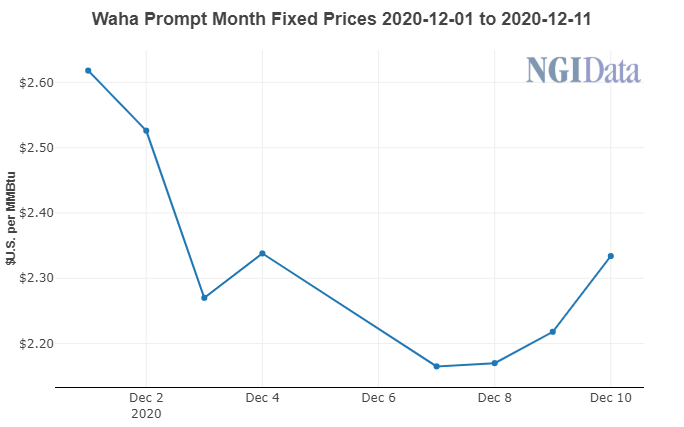

Weather dominated natural gas forward price action for a third consecutive week, sending prices through the winter lower despite record export demand and cuts to production, according to NGI’s Forward Look. However, losses were less severe than the prior two weeks, and prices stabilized a bit for the summer 2021 strip (April-October) and beyond, with small gains seen at several U.S. market hubs.

After a chilly October, winter weather has failed to materialize in a meaningful way, with only brief periods here and there of truly cold weather. November was the fourth warmest on record, and December could land in the top 10 warmest months amid a sea of red across weather maps.

Nymex futures plunged on Dec. 7, with the January contract dropping to a $2.381 intraday low before going on to settle at $2.406. The entire strip got clobbered, with not a single contact across the curve sporting a $3 handle.

While action the next day appeared far more subdued on the surface, with only modest changes day/day, the flip in a key price spread told a far different story. The March/April spread — commonly known as the widowmaker in the gas market — flipped negative, indicating that traders expect supplies to be sufficient for the winter.

EBW Analytics Group said DTN-Frontier’s weather forecast had erased 153 Bcf of gas demand for December, with market reaction “equally swift.” Earlier in the month, however, the potential for a sharp turn colder, amplified by structural demand changes amid a widespread stay-at-home population, still could have presented a meaningful threat to winter supply adequacy.

Instead, the warmer turn in the weather forecast “effectively ends any realistic winter supply adequacy concerns” and suggests “the market no longer needs to price in near-term gas at a premium,” EBW said.