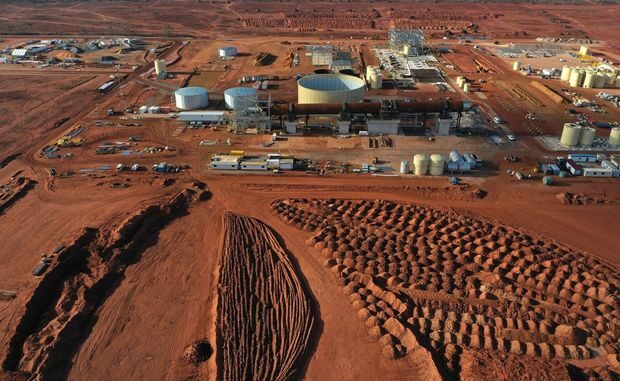

ADELAIDE, Australia—Two years ago,

talked up its plan for a $300 million lithium mine to help power the world’s energy transition.

Today the cost of the Kathleen Valley project in the red dirt of the Australian Outback is estimated at more than $600 million.

Liontown, which is a takeover target of Charlotte, N.C.-based chemical company

“It is very challenging,” said Tony Ottaviano, chief executive of Liontown, which has agreed to supply lithium to buyers including automakers

Inflationary bubbles haven’t popped as readily in mining as in some industries. Cost blowouts on new projects have become a theme, and running existing operations has also grown more costly as labor markets remain tight while energy prices resume climbing.

Analysts warn these forces could push commodity prices—including for metals essential to the energy transition—higher for longer, and complicate central banks’ efforts to contain inflation in the years to come. If manufacturers can’t absorb potential price gains, households could end up paying more for metals-intensive products such as electric cars and air conditioners.

“I think you are seeing capital costs to build new projects permanently get adjusted,” said Graham Kerr, chief executive of South32 , a $10 billion miner of commodities ranging from coal to silver.

In July, Rio Tinto said it now expects to spend $335 million on a small plant at its Rincon lithium project in Argentina that carried an original budget of $140 million.

Liontown Chief Executive Tony Ottaviano says building the Kathleen Valley project amid a labor shortage in Australia ‘is very challenging.’ PHOTO: BRENT LEWIN/BLOOMBERG NEWS

On Monday, Australia’s Allkem —which has agreed to merge with Philadelphia-based Livent —raised development-cost estimates for lithium projects in Argentina and Canada and said they would also likely cost more to run. One project’s cost came in 38% higher than a March 2022 estimate.

In some cases, higher costs partly reflect the increasing size of a project. But executives say the biggest engine for budget overruns is inflation.

How miners deal with cost pressures has implications for customers including automakers and construction companies. Commodity prices typically have a theoretical floor that reflects mining costs, as operations risk closure when they become unprofitable.

Since the start of June, prices of coal used in steelmaking are up as much as 45% while iron-ore prices have risen by more than 10%. Oil prices are bearing down on $100 a barrel, raising the cost of operating miners’ typically large fleets of diesel-powered trucks.

Higher commodity prices tend to stoke inflation and choke off growth in countries that rely on imports, economists at the Bank for International Settlements cautioned in a report this year.

“The cost of mining is only a small part of the overall cost of commodity prices, but it all adds up,” said Shane Oliver, Sydney-based chief economist at AMP Capital. “Particularly when increased military spending and decarbonization are increasing the demand for metals at a time when supply is constrained by years of low investment in new mines.”

Record amounts of metals such as copper and lithium will be needed for an energy transition that consulting firm Wood Mackenzie this month estimated will cost $1.9 trillion annually to limit global warming to 2.5 degrees Celsius above preindustrial levels. Limiting it to 1.5 degrees would cost $2.7 trillion a year, mostly in metals-intensive clean-energy infrastructure, the U.K.-based firm said.

BHP Group, the world’s largest miner by market value, said last month that the cost of producing commodities is now higher than before the pandemic. In the 12 months through June alone, BHP’s output costs rose by roughly 9%.

“This implies that price support is also expected to be higher than in previous cycles,” BHP said of commodity markets.