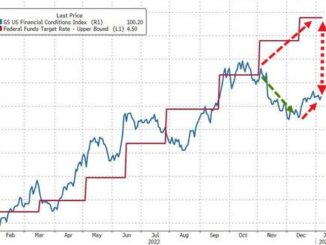

The Federal Reserve has been unwavering in its goal of getting inflation back to its 2% target. With terminal rates now expected to reach as high as 5.6%, real estate stocks have been taking a beating. IBD’s property REIT group currently ranks 157th out of 197 Industries. One dividend stock stands out though.

How To Invest

What Is CAN SLIM? If You Want To Find Winning Stocks, Better Know It

IBD Live: Learn And Analyze Growth Stocks With The Pros

MarketSmith’s Tools Can Help The Individual Investor

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

The post Best Dividend Stocks: Consider Rolling The Dice On This Top Las Vegas REIT appeared first on Investor’s Business Daily.

Dividend Stock Vici Stands Out

While this sector should be avoided, the top-rated stock in the group, Vici Properties (VICI), remains a standout dividend stock worth considering.

Vici Properties is a real estate investment trust specializing in gaming and resort properties. While holdings stretch across North America, Vici Properties’ most significant assets are on the Las Vegas Strip. Its sites include famous names such as Caesars Palace, MGM Grand and Venetian Resorts.

Vici Cashes In As Consumer Discretionary Spending Runs Hot

Even as fears of a global recession grow, consumer discretionary spending has continued to run hot. And dividend stock Vici Properties has seen impressive results.

Total revenue for 2022 came in at $769.9 million — over double a year prior. While most of this increase was due to acquisitions of several key properties, organic growth was also impressive, and investors took notice.

Shares of dividend stock Vici generated the highest — and only positive — shareholder return of all S&P 500 REITs in 2022.

In addition to growth, strong results have led to increasing dividends for shareholders. Since its inception five years ago, Vici Properties has increased distributions every year.

A current dividend yield of 4.6% is well above the 1.6% average of the S&P 500. While not confirmed, reports indicate investors can expect a next quarterly dividend of 39 cents with an ex-dividend date of around March 22.

Dividend Stock Forming New Base

For conservative investors, there are certainly better stocks than Vici Properties. A debt rating of BBB- by S&P Global is still investment grade, though it signifies some risk.

Nevertheless, exposure to dividend stock Vici will pay off with growth and yield if consumer discretionary spending remains relatively resilient in the face of rising interest rates.

Shares of Vici Properties fell below the 50-day moving average the past week but are forming a flat base. A buy point has been identified at 35.17, based on its MarketSmith chart. The stock is now testing the 200-day line.

YOU MAY ALSO LIKE: