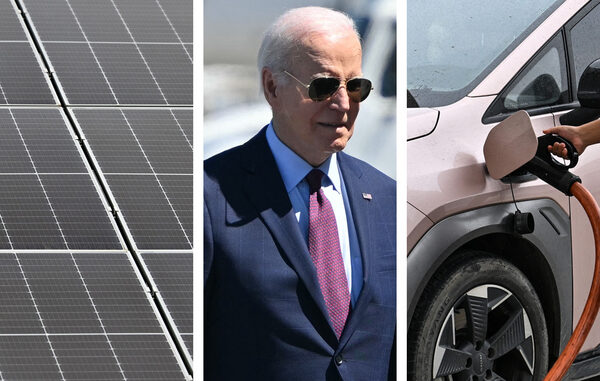

The Biden administration moved Tuesday to block China’s access to the American market for clean energy technology by doubling duties on solar cells and effectively quadrupling the price of electric vehicles from China.

The actions reflect a bipartisan consensus that U.S. industries need protection against a flood of inexpensive Chinese imports. In recent days, both President Joe Biden and former President Donald Trump, the presumptive Republican presidential nominee, have jousted over who would erect the stiffest barriers to China.

The new tariffs affect not just EVs and solar panels but also parts of their supply chain along with semiconductors, shipping cranes and medical supplies.

Duties will triple this year on EV batteries and other battery parts, to 25 percent. The same 25 percent rate will be imposed on some steel and aluminum products. A 25 percent duty will also go into force this year for a host of critical minerals essential to battery production, including cobalt, manganese and zinc; the same tariff rate will be put on natural graphite and permanent magnets in 2026.

The new trade rules tighten the ongoing tension between nurturing the country’s young clean-energy industries and deploying clean energy quickly and cheaply to combat climate change.

“China’s using the same playbook it has before to power its own growth at the expense of others by continuing to invest despite excess Chinese capacity and flooding global markets with exports that are underpriced due to unfair practices,” said Lael Brainard, the director of Biden’s National Economic Council, on a call with reporters Monday to announce the new tariffs.

“China’s simply too big to play by its own rules,” she added.

Brainard said Biden’s trade barriers are more targeted than a Trump proposal to impose a 10 percent tariff on all imports. She said that approach “would raise costs by $1,500 per year on each American family.”

But at a campaign rally Saturday in New Jersey, Trump promised to go even further.

Biden “says he’s going to put a 100 percent tariff on all Chinese electric vehicles. Isn’t that nice,” Trump said, before adding, “I will put a 200 percent tax on every car that comes in.”

EV ‘stay of execution’

The new duties mean that any EV imported from China will now nearly quadruple in price — a new reality that experts say could provide needed shelter for U.S. automakers in the short term but could harm them in the long term.

The actual duty is 102.5 percent, since the 100 percent duty is added onto a 2.5 percent tariff on all imported passenger cars.

The duties come as China has surpassed Japan as the world’s largest automotive exporter. A growing portion of that is electric vehicles, as China now makes more EVs than Chinese drivers can buy and is sending the excess abroad. According to the White House, China’s exports of EVs grew 70 percent between 2022 and 2023.

The fact that U.S. presidential candidates are one-upping each other to protect American EVs from Chinese competition is a striking flip of fortunes for the auto industry.

Fifteen years ago, “nobody took the Chinese auto industry very seriously because the cars weren’t very good,” said Sam Abuelsamid, an auto analyst for the corporate advisory firm Guidehouse Insights.

But last month, visitors to the Beijing Auto Show were wowed by Chinese cars — and especially their EVs — for their styling, quality, technological sophistication and low prices.

For example, the Seagull, an electric sedan made by the Chinese EV and battery-maker BYD, retails for as little as $12,000. That is less than half the price of the cheapest American EVs, such as the Nissan Leaf, with a base price of $28,000.

The big concern with the Chinese [automakers] is that they’re going to be able to come in and sell EVs at a much lower price point than American producers can,” Abuelsamid said. “That will make it very hard to compete.”

The U.S. auto industry has been a staunch supporter of higher tariffs.

“The speed, scale and nature of China’s global automotive expansion presents a challenge,” said John Bozzella, the CEO of the Alliance for Automotive Innovation, the chief trade organization for U.S. automakers, in a statement before the tariffs were announced. “The overall competitiveness of the auto industry in the U.S. will be harmed if heavily subsidized Chinese vehicles can be sold at below-market prices to U.S. consumers.”

The only Chinese automakers currently selling Chinese-made EVs in the U.S. right now are Volvo and Polestar, both of which are subsidiaries of Geely Automobile Holdings. Both companies plan to manufacture EVs domestically. No other Chinese automakers have announced such plans.

Karl Brauer, an auto analyst for the car-sales website iSeeCars.com, said the tariffs could create a sort of “stay of execution” for U.S. automakers. But he added it isn’t a long-term remedy if they plan to compete in Europe and in China — the world’s two other biggest auto markets that are also pivoting to EVs.

“It will help ensure that the U.S. market is protected, but it also creates a little fishbowl that we exist in,” Brauer said. “If we can’t compete with the Chinese here, how will we compete with them in China and in Europe?”

Calming China’s swell

The plan announced Tuesday is the culmination of the Office of the U.S. Trade Representative’s legally required review of tariffs the Trump administration imposed starting in 2018.

Trump instituted 25 percent tariffs on $300 billion of Chinese products, including finished electric vehicles and lithium-ion battery cells, critical EV components like electrical control boards and electric motors, and some critical minerals.

Those duties seemed steep at the time, but policymakers now find them insufficient as China’s huge factory base has continued to pump out clean energy products at ever-lower prices.

Those cheap goods, supported by decades of generous subsidies by the Chinese government, have risen to the forefront of geopolitical tensions between the U.S. and China.

They were a key point in talks between Treasury Secretary Janet Yellen and Chinese officials when she visited Guangzhou and Beijing last month.

“When the global market is flooded by artificially cheap Chinese products, the viability of American and other foreign firms is put into question.” Yellen said.

A study last year by the U.S. International Trade Commission determined that the Trump-era tariffs were coming up short. For example, the report noted that duties on finished batteries — lower than those for battery-cell components — were “insufficient to slow shipments.” It noted that Chinese imports of lithium-ion batteries had “skyrocketed.”

All of that is the backdrop to the new, higher tariffs that the White House announced Tuesday. They add tariffs to an additional $18 billion of imports.

“China’s forced technology transfers and intellectual property theft have contributed to its control of 70, 80, and even 90 percent of global production for the critical inputs necessary for our technologies, infrastructure, energy, and health care — creating unacceptable risks to America’s supply chains and economic security,” the White House said in a statement.

The new tariffs come amid the Biden administration’s other moves to freeze China out of the American electric vehicle supply chain.

The Inflation Reduction Act, for example, tied a $7,500 tax credit for electric vehicles to requirements that batteries be made and assembled in the U.S. or in friendly countries. Earlier this month, the Treasury Department finalized rules for that incentive that attempted to both boost EV adoption and curb China’s dominance of the supply chain.

The new trade rules lie on the same continuum.

“Regardless of who’s in the White House right now, there’s a lot of political will to put the U.S. on a better footing when it comes to manufacturing EVs,” said Nick Nigro, the founder of Atlas Public Policy, an EV data and policy shop. “This is just the next step.”

Critical mineral timelines

The upped tariffs on critical minerals mark a delicate balancing act for the administration as it attempts to juice domestic EV production and adoption, even as the industry faces China’s dominance in processing materials like graphite needed to make that happen.

Despite ongoing pressure from graphite producers in the U.S. and Canada to impose tariffs on the mineral — a key ingredient in EV batteries — the White House said a 25 percent tariff for natural graphite and permanent magnets won’t take effect until 2026.

The 25 percent duty will kick in this year, however, for other crucial EV battery metals like manganese, cobalt and zinc, as well as materials like uranium, said Angela Perez, a spokesperson for the Office of the U.S. Trade Representative.

Perez did not immediately respond when asked what tariff would be imposed on synthetic graphite, also used in EV batteries.

Abigail Hunter, executive director of SAFE’s Center for Critical Minerals Strategy, said the administration’s approach makes sense. The delay on graphite tariffs, she said, gives domestic producers time to build capacity and is “a thoughtful timeline that syncs with other policies and long-term goals.”

“Trade policies for mineral supply chains are ideally measured, incremental and comprehensive — making hard decisions with long-term resiliency in mind,” said Hunter.

When asked about the phased-in approach to some tariffs, a senior administration official told reporters on a call Monday that some duties were pushed back to create a transition period for EV batteries as domestic production comes online.

Protecting solar

The administration also is doubling existing tariffs on Chinese solar cells from 25 percent to 50 percent.

The increase “will protect against China’s policy-driven overcapacity that depresses prices and inhibits the development of solar capacity outside of China,” a White House fact sheet said.

Brainard of the National Economic Council said that China has enough anticipated solar manufacturing capacity to meet more than double the global demand in the near term.

The increased fees on Chinese solar cells likely won’t slow U.S. solar deployments or manufacturing, said Pol Lezcano, a senior solar analyst at BloombergNEF, in a statement before the White House announcement.

“The U.S. already barred almost entirely the use of solar cells and modules made in China in 2012 with prohibitive antidumping and countervailing duties, which rerouted U.S. solar supply chains to Southeast Asia,” Lezcano said.

Chinese solar cells represented less than 1 percent of total U.S. solar cell imports in the first half of 2023, according to data from the National Renewable Energy Laboratory.

But U.S. solar manufacturers allege that unfair domestic and Chinese government subsidies to manufacturers in four Southeast Asian nations are enabling cheap solar exports. More than 80 percent of U.S. solar panel imports come from Vietnam, Cambodia, Thailand and Malaysia.

A coalition of seven leading U.S. solar manufacturers asked the Commerce Department last month to expand tariffs on solar imports from those nations. A tariff moratorium on the four countries is due to expire in early June, after which a 14 percent duty will be collected on solar panels.

The tariff issue has long divided the solar industry. American solar manufacturers say levies are necessary to ensure products made in the U.S. are competitive. Developers argue that tariffs slow solar deployment, raising electricity prices and hindering progress on decarbonizing the grid.