By Wolf Richter for WOLF STREET.

Express Inc, once a high-flying fashion retailer for the younger crowd with 542 stores in the US, and with three brands – Express, UpWest, and Bonobos – finally filed for pre-packaged Chapter 11 bankruptcy today.

Since its heyday in 2016, the company has already closed 114 stores. The store count had peaked in the fiscal year ended January 2017 at 656 stores. Now it will close another 95 Express stores and all its 12 UpWest stores, bringing the store count to about 435 stores.

Mall landlords have a lot at stake, they’re the biggest creditors: In its last quarterly 10-Q filing with the SEC, Express reported lease liabilities of $625 million – far larger than its outright debt of $271 million. Lease liabilities made up nearly half of its total liabilities of $1.32 billion.

So… a consortium, including the two largest mall landlords – Simon Property Group and Brookfield in whose malls many of the surviving stores are – have worked out a “non-binding” deal with Express and its debt-holders to buy the brands, the surviving 435 stores, and the retail operations out of bankruptcy.

The consortium is led by WHP Global, an investment company founded in 2019, which has bought numerous retail brands and fashion labels that had been liquidated in bankruptcy court.

For Simon Property and Brookfield, it’s another desperate effort to keep stores at their malls open to keep their malls alive. Among the other brands and stores they’d bought out of bankruptcy was J.C. Penney, which anchors many of their malls. As goes the anchor, so goes the mall.

There’s DIP financing: Express said it has received a commitment for $35 million in new money in form of a “senior secured super-priority priming first lien debtor-in-possession [DIP] asset-based loan.” In addition, it worked out a deal with its existing lenders to convert various debts into $162 million of DIP financing, which includes $10 million that are part of the $35 million of new money.

The sale of the brands and stores, and the DIP financing deals, which were negotiated before the bankruptcy filing, make this a prepackaged Chapter 11 filing, with all negotiated elements subject to court approval.

And the pandemic-era government money keeps flowing. In the bankruptcy announcement, Express said: “Additionally, on April 15, 2024, the Company received $49 million in cash from the Internal Revenue Service related to the CARES Act.” The CARES Act was of course the $2.2 trillion stimulus bill that included, among many other measures, the PPP loan program; it was passed in March 2020, and it keeps on giving. The $49 million is now cited as money that will help fund Express during the bankruptcy proceedings.

Express said in the bankruptcy announcement that:

Its retail stores are open with their usual hours.

Its ecommerce sites Express.com, Bonobos.com, and UpWest.com, along with all brand apps, “are accepting orders.”

All of its brands “are fulfilling orders and processing returns, merchandise return policies remain unchanged, and gift cards and store credits are currently being redeemed in-store.”

“Bonobos is continuing to serve its premium wholesale customers.”

“Customer benefits related to the EXPRESS Insider program are expected to remain the same.”

Bonobos has a tumultuous history. Express Inc together with WHP Global, the above-mentioned leader of the consortium, bought Bonobos in April 2023, when it was already clear that Express would head sooner or later into bankruptcy court.

Bonobos was founded in 2007 as an online-only company that designs and sells menswear. In 2012, it launched “Guideshop” in partnership with Nordstrom with physical locations at department stores. For your amusement, we’ve have included a chart below of sales at brick-and-mortar department stores.

In 2017, Walmart acquired Bonobos for $310 million. The brand’s merchandise would be sold on Jet.com which Walmart had acquired for $3.3 billion in 2016. But then Walmart moved all its ecommerce business to Walmart.com, now the second largest ecommerce retailer in the US, with huge growth rates year after year. In 2020, Walmart began winding down Jet.com. In April 2023, it sold Bonobos to Express and WHP Global for $75 million.

Express got the operating assets and liabilities for $25 million and WHP Global got the brand rights for $50 million. Express agreed to license the brand rights and pay royalty fees to WHP Global.

Desperate and calculating landlords faced with ecommerce. Simon Property and Brookfield have already defaulted on the debts of a bunch of their malls, and let the properties go back to the lenders, including through foreclosure — “jingle mail” is a standard procedure in CRE — and the lenders had to take the big losses.

The malls Simon Property walked away from to let lenders take the losses include the 1.2-million-square-foot Town Center at Cobb in Georgia, the 1.1-million-square-foot Montgomery Mall in North Wales, Pennsylvania, and the 1-million-square-foot Independence Center in a suburb of Kansas City, Missouri, which generated what was then (2019) the largest loss ever by a retail CMBS loan.

So this is just one more chapter in what we have come to call since 2016 the Brick-and-Mortar Meltdown that has melted down mall retailers from Sears on down. It wasn’t brought about by the softening of consumer demand, or similar BS that ignorant reporters manage to stick into the headlines to get clicks – consumers are spending more than ever as incomes and population have surged. It was brought about by ecommerce that has turned into a structural shift in how consumers shop.

Much of classic mall retailing moved to online sites, not just Amazon, but also the ecommerce sites of the largest retailers, such as Walmart, Macy’s, Target, and even the online sites of the Express brands, and to smaller sites, and now to super-cheap Chinese sites that ship direct from China.

Here is the fate of department stores – those few chains that are still alive today. They anchored the malls, which is why Simon Property and Brookfield are so desperate in keeping the big retailers in their malls open:

Express is catering to 20-30-year-olds, and those in that age group now grew up with ecommerce and just take it for granted, and many of them cannot figure out why on earth anyone would want to waste their time going to a mall. They buy this stuff on their smartphones and on their laptops at work.

The big exception to the brick-and-mortar meltdown are strip malls anchored by grocery stores. There are some categories of brick-and-mortar retailers that have been spared the brunt of the attack by ecommerce, including: auto dealers (though that is now changing too) but they own their own properties; gasoline stations (though that is now changing too as EVs are gaining market share); and grocery stores (though online sales are making headway as well, including by online-only specialty food retailers, such as Weee).

These three categories combined – auto dealers, gas stations, and grocery stores – account for 44% of total retail trade. The rest of the retailers are getting whittled down by ecommerce. What’s growing at Walmart are its grocery sales, and what’s booming are its ecommerce sales (+17% in its latest quarter), and what is declining, as it said, are its sales in the rest of the aisles.

Strip malls anchored by grocery stores, with the other tenants being largely restaurants and services providers (hair and nail salons, healthcare operations, etc.) that cannot be replaced by ecommerce are doing well. It’s the big malls and their stores that have come under brutal attack from ecommerce.

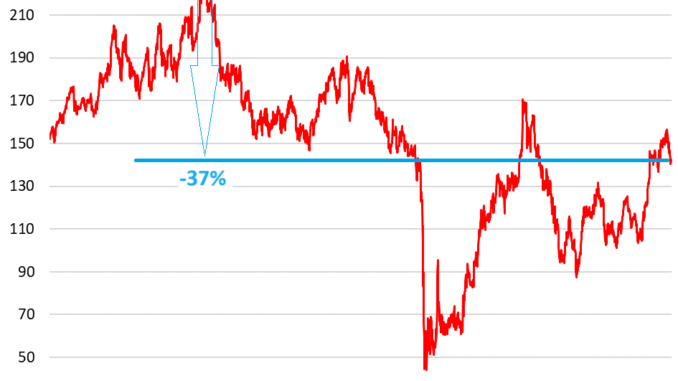

Express Inc’s shares [EXPR] have long been in our pantheon of Imploded Stocks. The company went public via IPO in 2010. The shares initially soared, reached their all-time high in March 2012, and then zigzagged lower. By August 2023, they’d been reduced to a penny stock, when the company announced a 1-for-20 reverse stock split, where each 20 shares became 1 share, and the stock prices multiplied by 20, to keep the shares from getting delisted for a while longer.

Adjusted for the 1-for-20 reverse-stock-split, the IPO price of $17 amounted to $340, and the all-time high in March 2012 amounted to $523.

“The Company expects that its stockholders could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 process,” the company said in its press release today, upon which shares first plunged 50% to 35 cents, and then jumped by 177% to 97 cents, then re-plunged to close at 83 cents, up by 18% for the day, and down by 99.8% from their all-time high in 2012.

Note the hilarious meme-stock action from late 2020 through the first half of 2021 that briefly produced gains of 650% and more, followed by a near total wipeout of those that didn’t get out in time.

Take the Survey at https://survey.energynewsbeat.com/

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack