Exxon Mobil Corp. plans to invest billions of dollars in low-carbon segments like carbon capture, biofuels and hydrogen. But the U.S. supermajor is also evaluating opportunities in lithium production, Exxon CEO Darren Woods said.

As the U.S. oil and gas supermajor plans to invest $17 billion into low-carbon initiatives in the coming years, Exxon has reportedly been making a quick—and quiet—entrance into the lithium space.

Exxon acquired drilling rights for over 100,000 gross acres in southern Arkansas from which it plans to produce lithium, a key mineral used in electric vehicle batteries, The Wall Street Journal reported in May.

This summer, an Exxon subsidiary, Saltwerx LLC, signed a memorandum of understanding (MOU) with services company Tetra Technologies Inc. to develop about 6,138 acres in Arkansas’ Smackover formation for potential lithium brine production, Reuters reported.

Exxon declined to comment on the company’s activities in the lithium space to date.

Exxon continues to focus its low-carbon efforts on the so-called “molecule side of the equation” of the energy transition, Woods said on a June 28 second-quarter earnings call with analysts.

In contrast to the electron side of the transition—developing wind, solar or battery storage projects—Exxon sees growing opportunity in carbon capture, utilization and storage (CCUS), low-carbon hydrogen and fuels made from renewable feedstocks.

Lithium production from brine water is an extension of Exxon’s current upstream capabilities, Woods said.

“It requires a good understanding of the subsurface, it requires a good understanding of reservoir management, it requires drilling and injections,” Woods said on the call. “I think the below-surface things are very much in-line with the skills and capabilities that we’ve built out over the decades in our upstream business.”

Woods also noted that processing brine water to extract the lithium is similar to operations Exxon already performs at its refineries and chemical plants.

With global lithium demand forecast to double over the next five years, Exxon can leverage its scale and existing advantages to bring lithium to market “at a much lower cost,” Woods said.

“And I think importantly, with much less environmental impact versus, say, [than] the open mining that they’re doing in other parts of the world,” he said.

However, Exxon is still early in evaluating its opportunities in lithium, Woods said.

RELATED: Exxon Mobil, Chevron Profits Slump, but Permian Itch Persists

Carbon capture

While Exxon is still in the early innings on lithium, the company is making major investments into carbon capture and sequestration.

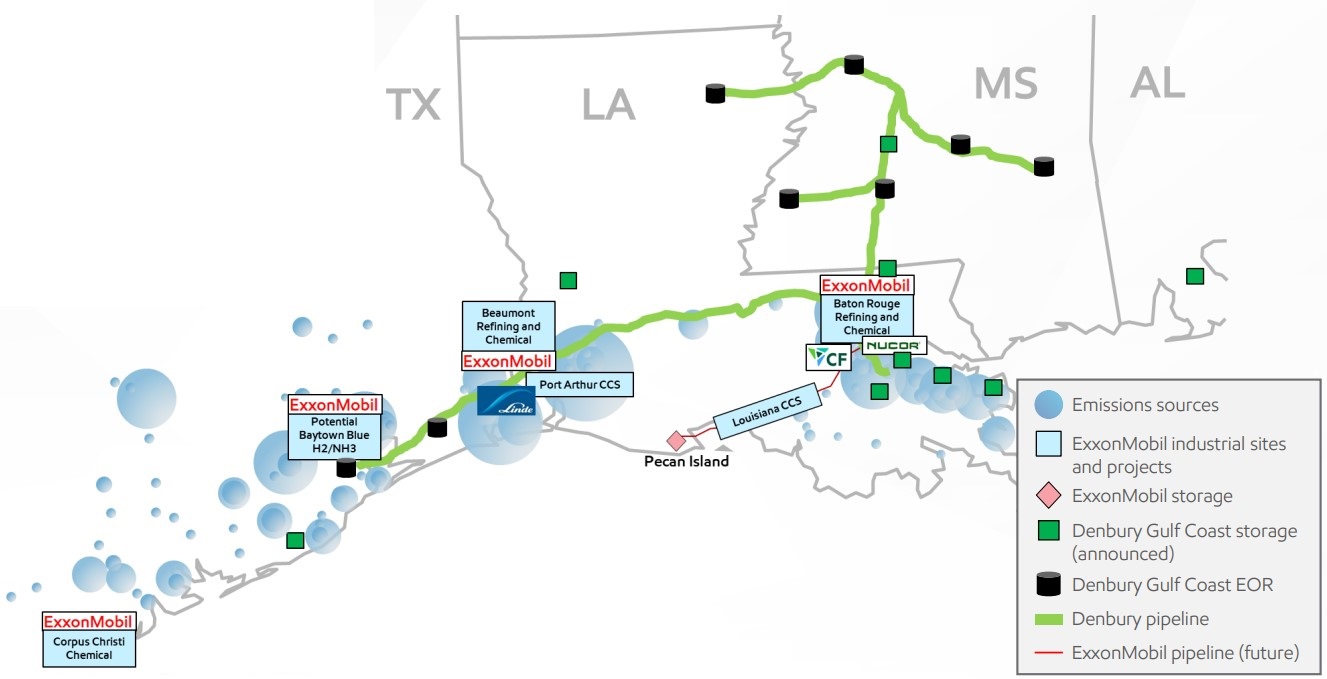

Exxon’s $4.9 billion bid to acquire Denbury Inc., announced earlier this month, will deliver a key component to the company’s emerging CCUS business: the nation’s largest network of CO2 pipelines and access to 10 onshore sites for permanent CO2 sequestration.

Plano, Texas-based Denbury uses its 1,300-mile CO2 pipeline network, somewhat paradoxically, as part of a process to produce barrels of oil. The company’s core business is EOR, where CO2 is injected under pressure into oil-bearing reservoirs to maximize oil recovery from a field.

EOR is Denbury’s core business today and has facilitated the development of the company’s existing infrastructure, Woods said. But Denbury’s EOR production wasn’t a key driver for Exxon’s multibillion-dollar acquisition.

“If you think about the broader opportunity, it’s really around carbon capture storage, sequestration and keeping the carbon under the ground,” Woods said. “That’s the longer term play for us.”

But as Exxon works through regulatory and permitting constraints to start permanently sequestering CO2 in subsurface formations, Denbury’s EOR business gives the supermajor options to choose from.

Exxon has already secured several major CO2 offtake agreements with third-party customers, like industrial gas company Linde, steelmaker Nucor and fertilizer maker CF Industries. Exxon’s offtake arrangement with Linde—a deal to transport and store up to 2.2 million metric tons of CO2 per year from Linde’s blue hydrogen production plant in Beaumont, Texas—is slated to begin in 2025.

If Exxon doesn’t have its ducks lined up on the sequestration side when it starts capturing CO2 from third-party customers, EOR gives the company an option to facilitate the offtake agreements and not fall off schedule, Woods said.

Adding Denbury’s EOR assets is expected to provide Exxon immediate cash flow of around $600 million annually.

Exxon and fellow supermajor Chevron Corp. both reported a drop in second-quarter earnings as the companies faced volatile natural gas and refining markets.

Exxon booked earnings of $7.88 billion during the second quarter, down 31% from $11.43 billion last quarter. Chevron’s second-quarter haul of $6.01 billion was down 8% from the California-based company’s first quarter earnings of $6.57 billion.

Both companies said that lower upstream realizations and declines in refining margins negatively impacted profitability for the quarter.