In a resilient performance amid fluctuating oil prices, Chevron Corporation (NYSE: CVX) reported third-quarter 2025 earnings that surpassed Wall Street expectations, bolstered significantly by the recent integration of Hess Corporation’s assets. The acquisition, completed in July 2025, has already begun paying dividends through enhanced production volumes, particularly from high-yield fields in Guyana.

This marks a pivotal moment for Chevron, as it navigates a complex energy landscape marked by geopolitical tensions and shifting demand dynamics.

Earnings Summary:

Record Production Drives ResultsChevron’s Q3 2025 results, released on October 31, showcased adjusted earnings of $3.6 billion, or $1.85 per diluted share, handily beating the consensus estimate of around $1.66 per share—a surprise of approximately 11.45%.

Reported earnings came in at $3.5 billion, or $1.82 per share, down from $4.5 billion in the same quarter last year, primarily due to lower crude oil realizations and one-time costs associated with the Hess deal.

Revenues and other operating income totaled $49.7 billion, slightly below the prior year’s $50.7 billion, reflecting softer commodity prices. Sales and other operating revenues specifically stood at $48.2 billion.

Despite the top-line dip, the company’s operational strength shone through in production metrics. Worldwide net oil-equivalent production hit a record 4.1 million barrels of oil equivalent per day (BOE/d), a 21% increase from 3.4 million BOE/d in Q3 2024.

The Hess acquisition contributed roughly 495,000 BOE/d to this surge, with key boosts from Guyana’s prolific Stabroek Block. U.S. production alone reached a record 2.0 million BOE/d, up 27%, driven by Permian Basin growth and Hess assets in the Bakken. Internationally, output climbed to 2.0 million BOE/d, supported by Hess’s Guyana operations and expansions in Kazakhstan.

Segment-wise, upstream earnings fell 28% to $3.3 billion, hampered by Brent crude averaging around $63 per barrel internationally (down from $70.59) and U.S. liquids realizations at $48.12 per barrel.

However, downstream profits more than doubled to $1.1 billion, benefiting from higher refined product margins and lower operating expenses. Cash flow from operations was $9.4 billion, with adjusted free cash flow jumping over 50% to $7.0 billion, enabling $6.0 billion in shareholder returns—including $3.4 billion in dividends and $2.6 billion in buybacks.

The Hess integration added complexities, including a net loss of $235 million from severance and transaction costs, but legacy Hess operations delivered positive earnings, underscoring the deal’s strategic value.

Chevron highlighted progress in unlocking synergies, such as divesting non-core assets and streamlining structures.

Forward-Looking Statements:

Optimism Amid CautionLooking ahead, Chevron provided guidance emphasizing sustained growth and financial discipline. For full-year 2025 (excluding Hess initially but now integrated), organic capital expenditures are targeted at around $15 billion, with affiliate capex at $2 billion.

Production guidance for legacy Chevron stands at 3,400 to 3,465 thousand BOE/d, a 6-8% increase excluding asset sales, while Hess’s second-half 2025 contribution is expected at 450-500 thousand BOE/d.Sensitivities highlight the company’s exposure to price swings: a $1 change in Brent crude impacts after-tax earnings by approximately $550 million, with Henry Hub natural gas at $670 million.

Affiliate dividends are projected at $5 billion at $70 per barrel Brent, and the company aims for structural cost reductions through efficiencies and divestments.For Q4 2025 and into 2026, Chevron anticipates accelerating growth, particularly from Guyana expansions and Permian optimizations, while maintaining buybacks in the $2.5-3 billion range quarterly.

Management expressed confidence in achieving synergies from the Hess deal, targeting lower carbon intensity and growth in new energies. However, cautions abound regarding risks like OPEC+ quotas, geopolitical disruptions (e.g., Middle East conflicts), and regulatory changes.

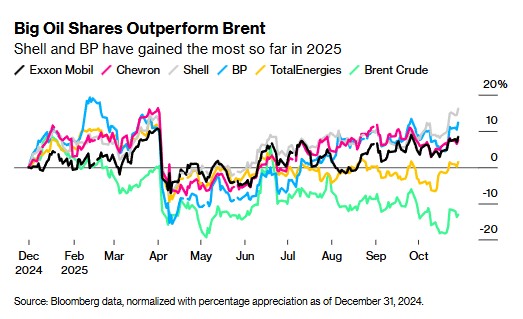

Overall, the outlook focuses on resilient cash flows and shareholder returns, with a target net debt ratio around 15% and a commitment to a $1.71 per share quarterly dividend.What Investors Should Watch in the Oil MarketsAs Chevron’s results illustrate, the oil sector remains volatile, with 2025 shaping up as a year of divergent narratives.

Investors eyeing energy stocks like CVX should monitor several key factors:

Supply-Demand Balance: Global oil demand is expected to rise modestly, driven by emerging markets, but trade tensions and economic slowdowns could curb growth.

Watch OPEC+ production decisions—any extensions of cuts could support prices, while non-OPEC supply (e.g., U.S. shale at record levels) might lead to oversupply.

Price Forecasts: Analysts predict Brent crude averaging $70-80 per barrel in 2025, but supply-demand dynamics could push it lower if inventories build.

Elevated prices may persist due to constrained supply and geopolitical risks, though over-supply scenarios loom.

Geopolitical Risks: Escalations in the Middle East, Russia-Ukraine conflict, or U.S.-China trade policies could spike volatility. Disruptions in key chokepoints like the Strait of Hormuz remain a wildcard.

Economic and Policy Shifts: Track global GDP growth, particularly in China, and inflation trends influencing central bank policies. Energy transition efforts, including EV adoption and renewables, could pressure long-term oil demand, but near-term reliance on hydrocarbons persists.

Investor Sentiment and Alternatives: Oil investor sentiment impacts inflation and market dynamics—positive outlooks could boost stocks, but watch for shifts toward sustainable investments.

For Chevron specifically, the Hess integration’s success will be crucial; synergies could enhance ROCE (currently 7.6%) and support dividend growth. With a forward P/E around 12 and a 4.5% yield, CVX offers value for patient investors, but hedging against price drops is advisable.In summary, Chevron’s Q3 beat underscores its strengthened position post-Hess, setting a positive tone for 2026. Yet, broader market uncertainties demand vigilance—stay tuned to Energy News Beat for updates on these evolving trends.

Got Questions on investing in oil and gas?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack