In a dramatic escalation of the ongoing trade tensions between the United States and China, Beijing has imposed new port fees on U.S.-linked vessels, sending shockwaves through the global oil tanker market.

This retaliatory move comes in response to U.S. charges on Chinese-owned or operated ships, further complicating an already volatile energy trade landscape. As a result, oil tanker rates have surged to multi-year highs, with experts warning of prolonged disruptions to global crude flows.

The feud intensified when the U.S. Trade Representative targeted Chinese vessels with fees, prompting China to announce a tiered port fee system effective October 14.

The fees begin at $56 per ton and are slated to rise annually, reaching up to $157 per ton by April 2028.

Notably, ships built in China are exempt, giving Beijing a strategic edge in this maritime standoff. This policy affects approximately 13% of the global crude tanker fleet, creating a scramble among shipowners and charterers to restructure operations—such as reducing U.S. ownership stakes below 25% or opting for mid-voyage ship-to-ship transfers to evade the charges.

The immediate fallout has been a sharp rise in tanker rates, particularly for very large crude carriers (VLCCs) on key routes like the Middle East-to-China corridor.

Spot rates for these massive vessels, capable of hauling up to 2 million barrels of oil, jumped to $100,000 per day in September—the highest in nearly three years—before stabilizing at elevated levels amid the chaos.

Traders estimate that a U.S.-linked VLCC could face surcharges as high as $15 million per voyage when docking in Chinese ports, rendering many operations uneconomical.

This uncertainty has led to delayed cargoes, idled ships off Chinese coasts, and the emergence of a two-tier market: one where compliant vessels command premium rates, and another where owners avoid China altogether.

Broader geopolitical pressures are amplifying these effects. U.S. sanctions on Chinese crude import terminals, such as the Rizhao Shihua Crude Oil Terminal co-owned by Sinopec, have forced supertankers to divert from key ports.

Additionally, Washington’s push on buyers of Russian oil to curb imports is reshaping global trade patterns, adding to the “vortexes” of disruption in the energy sector.

As Anoop Singh, global head of shipping research at Oil Brokerage Ltd., noted, “It’s not just the dearth of China-compliant ships, it’s also uncertainty of what is a China-compliant ship that’s driving up freight costs in the near term.”

Countries Impacted by the Escalation

This port trade war is not isolated to the U.S. and China; its ripples extend to several nations reliant on stable energy trade routes. Below is an overview of the key countries affected, based on direct and indirect consequences:

United States: As the instigator of fees on Chinese vessels, the U.S. now faces retaliatory charges that inflate costs for American-owned or operated tankers.

This could add millions in expenses per voyage, straining U.S. energy exporters and contributing to higher global freight rates. Broader U.S. sanctions on Chinese ports and pressure on Russian oil buyers further entangle American interests in international energy markets.

China: Directly hit by U.S. sanctions on its import terminals, China is experiencing disruptions to crude inflows, with ships idling or diverting from blacklisted ports like Rizhao.

The retaliatory fees aim to counter these measures but have sparked internal market turmoil, elevating import costs and potentially slowing economic growth amid already high tanker rates.

Russia: Indirectly affected through U.S. efforts to pressure global buyers into reducing Russian crude imports.

If successful, this could diminish Russia’s export revenues and force rerouting of its oil, exacerbating tanker shortages and rate hikes worldwide.

India: As a major importer of Russian crude, India faces indirect pressure from the U.S. to scale back these purchases.

This could lead to higher energy costs for India, shifts toward alternative suppliers, and increased reliance on pricier tanker routes, impacting its economy and contributing to global oil price volatility.

The Chinese commerce ministry has signaled a firm stance, stating, “China’s position is consistent. If there’s a fight, we’ll fight to the end; if there’s a talk, the door is open.”

However, they criticized the U.S. approach: “The US cannot demand talks while simultaneously imposing new restrictive measures with threats and intimidation.”

As this trade war unfolds, the energy sector braces for sustained volatility. With OPEC+ increasing crude supply and longer-haul routes already straining the market, these port fees could push tanker rates even higher, ultimately passing costs onto consumers worldwide.

Stakeholders in the industry will be watching closely for any signs of de-escalation or further retaliatory actions.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

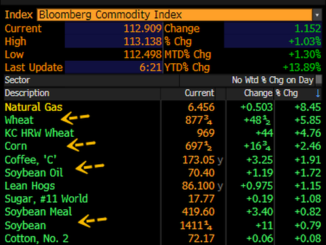

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack